What might the Organisation for Economic Co-operation Development’s estimated 460 million tons of plastic produced in 2019 look like in reality?

With the average adult human weighing 62kg – and there being nearly 8 billion of us in 2019 – it appears that global plastic output roughly matched all of humanity's combined weight in that year alone.

And with up to two thirds of those plastic items designed to be used just once, that's a huge volume of waste.

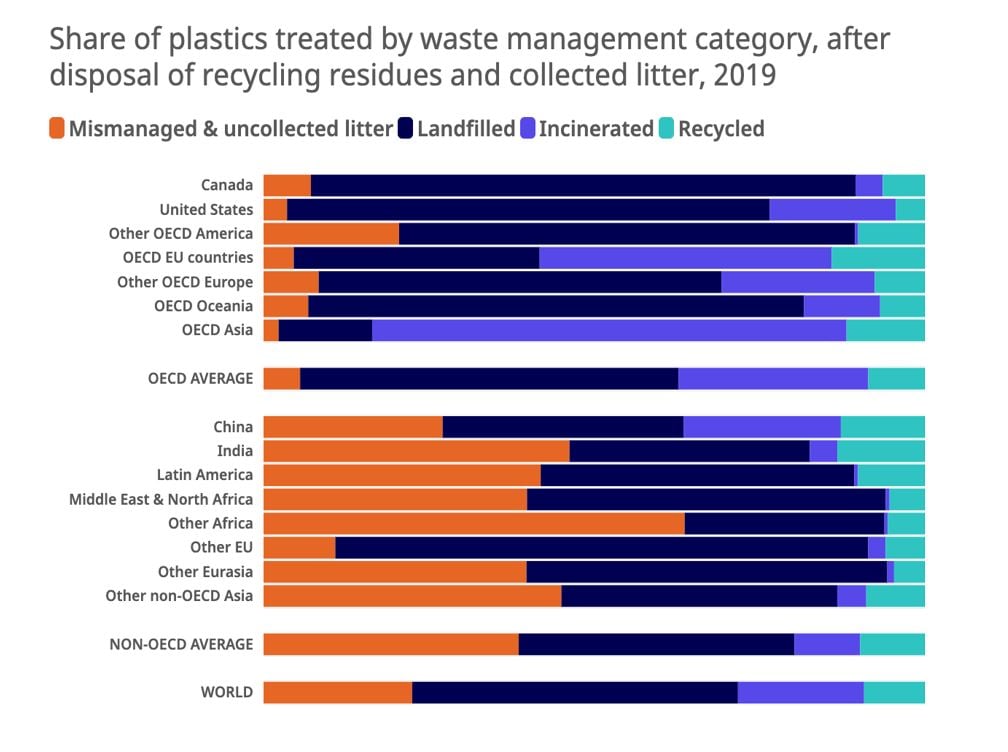

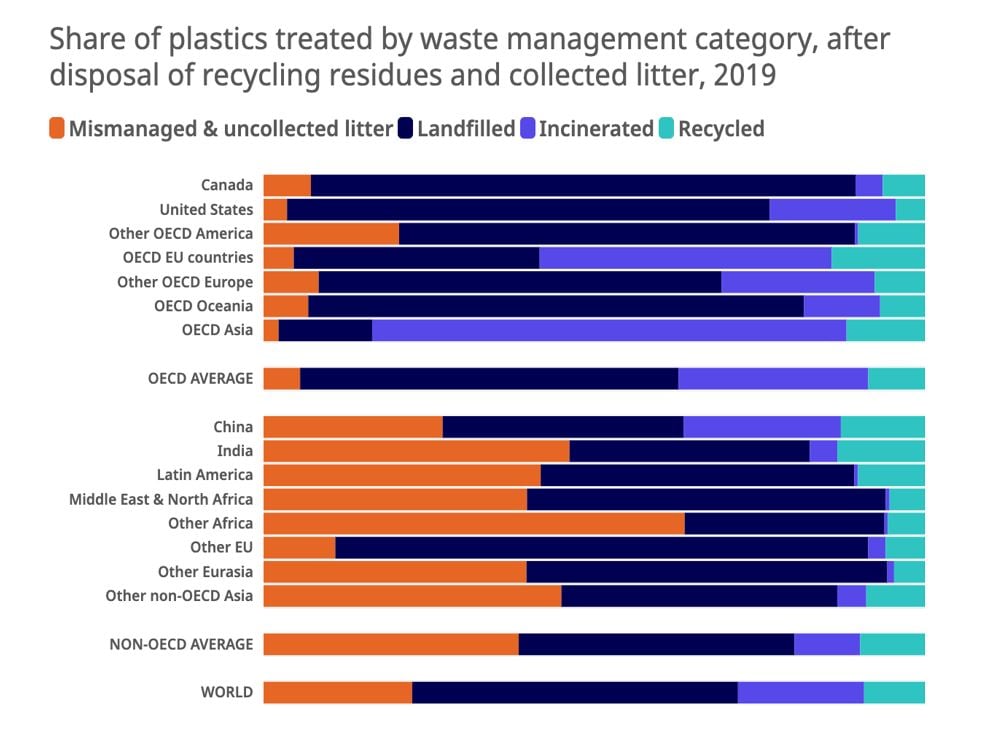

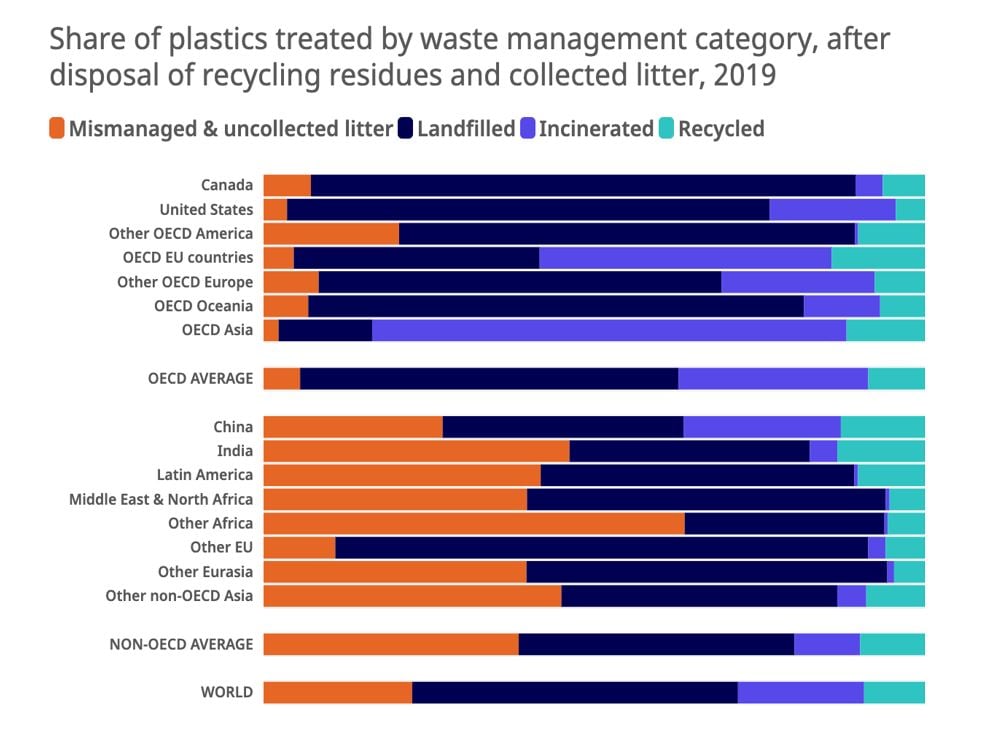

Referencing 2020, the Organisation for Economic Co-operation Development’s latest annual Global Plastics Outlook reports around 40% of global plastic waste as packaging. It further says that overall, just 9% of plastic waste is recycled. And, although 15% is collected for recycling, 40% of that is disposed of as residues. Almost a fifth is incinerated, half is sent to landfill with the remainder destined for uncontrolled dumpsites or burning in open pits. Our natural world – the oceans and open landscapes – become blighted by some of it too.

Single-use plastics & Covid

Not only did Covid-19 PPE needs significantly increase single-use plastic (SUP), but concerns around sanitation also delayed SUP bans mooted beforehand. India, Portugal, Senegal, multiple US states and some Australian states and territories postponed action. However, many have reinitiated their SUP ban policies. In the Australian Commonwealth for example, ministers last year identified eight SUP products for phase-out by 2025 (sooner in some cases) under its National Waste Policy Action Plan.

And from December 2022, Canada is prohibiting the manufacture of a number of SUP products including checkout bags – of which the country currently consumes around 5 billion a year. SUP cutlery, foodservice ware (made from, or containing, hard-to-recycle plastic), ring carriers stir sticks also fall under the ban – with sale of these items within Canada illegal after 2023, and export prohibited after 2025. SUP straws – of which the country uses 16 million daily – also come under the new regulations, though with exceptions, including use for medical or accessibility purposes.

'Demand for recycled plastics is expected to increase as consumer packaged goods companies and packaging producers go after recycled content goals'

Accelerating circular supply chains for plastics, Closed Loop Partners

Meanwhile in the US, President Biden’s Executive Order 14507 calls for federal agencies to minimise waste and support markets for recycled products. The country’s Department of the Interior plans to phase out SUPs on its land and facilities by 2032. It is now seeking re-usable, recyclable and/or compostable alternatives for use in the country’s national parks with materials including paper, bioplastics and composites suggested. These materials are among those explored in a free to download e-Book avialable via our recent blog post World Bio Markets 2022 – Barcelona: Team Tecnon OrbiChem takeaway.

Producer responsibility

Californian legislature enacted in June 2022 requires plastic producers to fund recycling – shifting the cost of recycling collection and infrastructure from the taxpayer to the packaging manufacturers. The state ‘s Plastic Pollution Prevention and Packaging Producer Responsibility Act (SB 54) also requires all single-use packaging – including paper and metals - to be recyclable or compostable by 2032. Within ten years, the amount of plastic allowed in packaging must be reduced by a quarter, it says, targeting items such as containers for personal care products, food packaging, takeaway cups and bubble wrap. How a producer meets the requirement is up to them. The solution could involve scaling packaging size down, making their product reusable or the use of recycled or biomaterials such as those explored in our blog post Paper-Polymer-Plastic: A new 'Rock Paper Scissors' game for the packaging sector.

To mitigate plastic pollution's effects on the environment and human health - primarily in low-income communities – plastic manufacturers are mandated to pay $5bn into a fund between 2027 and 2037 as part of the act. Known as producer-responsibility laws, similar policies are employed in Maine, Oregon and Colorado.

India initiated bans on 19 identified SUPs – including earbuds, polystyrene plates, stirrers and packaging films – from July 2022 as part of a multi-phase plan. The country generates 10-15 million tpa of plastic waste, according to the United Nations, with only an estimated quarter of that recycled. Plastic bags, however, were temporarily exempted with the government requesting manufacturers and importers raise thickness and promote reuse. Forced closures were threatened for non-compliance, with enforcement the responsibility of individual states and city municipal bodies

France’s Circular Economy and Fight Against Waste Law meanwhile bans SUP packaging on 30 fruits and vegetables this year, requiring labelling to be compostable too. SUP packaged around 37% of this type of fresh produce before the ban was implemented, although with items at high risk of damage as loose items exempt until at least 2023, it will not entirely disappear. Wrapping for newspapers and advertising mailings however, and tea sachets, can no longer be made out of non-biodegradable plastic. In another French decree - the 3R Strategy – is a call for a 20% reduction in SUPs by 2025 however, it is not subject to any specific monitoring or enforcement provisions. Industry stakeholders believe stronger mechanisms will be needed to enhance recycling, upcycling and reuse in supply chains.

There may be no stronger mechanism than the circular economy’s potential to increase bottom lines... Recovery Loop chemicals hold great potential and, according to Closed Loop Partners report, addressable US/Canada-based markets are worth $120bn. That’s a subject we explored in our blog post Chemical recycling: Towards a circular economy.

'There is currently no EU law in place applying to biobased, biodegradable and compostable plastics in a comprehensive manner'

European Union Commission guidance note

EU plastics [un]defined...

According to the European Union’s Single-Use Plastics Directive - implemented in 2021 – an SUP is a product made ‘wholly or partly from plastic and that is not conceived, designed or placed on the market to accomplish, within its life span, multiple trips or rotations by being returned to a producer for refill or re-used for the same purpose for which it was conceived’.

The directive bans a number of items including earbuds, cutlery, polystyrene containers and oxo-degradable products. Appropriate waste management labelling on products such as wet wipes and sanitary items was also covered.

Indeed, as the body states ‘...there is currently no EU law in place applying to biobased, biodegradable and compostable plastics in a comprehensive manner’. The EU directive and therefore, it does not differentiate them from conventional plastics. To clarify its position, in its guidance, the Commission notes: ‘There are currently no widely agreed technical standards available to certify that a specific plastic product is properly biodegradable in the marine environment in a short timeframe and without causing harm to the environment.

‘As the industry is a fast-developing area, the review of the Directive in 2027 will include an assessment of the scientific and technical progress concerning criteria or a standard for biodegradability in the marine environment applicable to SUP products.

‘In the context of the EU’s new Circular Economy Action Plan, the Commission plans to develop this year a policy framework on the use of biodegradable or compostable plastics based on an assessment of the applications where such use can be beneficial to the environment and of the criteria for such applications,’ the guidance states.

Italian legislators took a more flexible approach to the definition of plastic and exempted some biodegradable and compostable materials from the ban. For example, where the EU directive considers plastic-coated or lined paper and cardboard a plastic product and therefore subject to its regulation and restrictions, the Italian interpretation exempts them.

It is true that the crossover between biobased, biodegradable and compostable materials is complex, a blog post we published earlier this year – Plastic packaging material that is both sustainable and biodegrades – explores the subject.

Source: OECD Global Plastics Outlook

EU mandates producer responsibility

From July 2024, the EU's collection targets and design requirements for plastic bottles will apply too. Its mandates on extended producer responsibility (EPR) schemes – which must be implemented by the end of 2024 – will force producers to pay for the collection, transport and treatment, clean-up litter and awareness-raising measures.

And since the EU Commission also requires producers to calculate and report reductions in their consumption of SUP food containers and beverage cups from this year, the region is keen to uphold its hard-line stance on plastic pollution.