4 min read

Caustic Soda Endures 'Cost & Freight' Premium, but for How Long?

ResourceWise

:

Aug 9, 2023 4:36:55 PM

Chemical tanker availability is thought to be elevating the cost of caustic soda transportation this year, with little relief envisaged in the near-term.

Tecnon OrbiChem’s Poland-based consultant Jaroslaw Cienkosz indicates that sellers may encounter higher than expected rates for transporting the chemical going forward. It is happening as Reuters reports that freight markets are ‘stuck in the doldrums’. Not so for caustic soda, the key chemical appears to be bucking that trend.

Cienkosz monitors caustic soda and other key raw materials for the construction, textiles and the automotive segment globally.

The alumina industry uses caustic soda in massive quantities to process bauxite ore. Caustic soda is also integral to textile manufacturing processes and the pulp and paper sector, in which it is used to break the lignin bonds of wood being processed into pulp for papermaking. Changes in supply chain costs for caustic soda therefore impact these downstream markets.

It was a major caustic soda market participant that indicated to Cienkosz that the Cost and Freight (CFR) component of logistics contract pricing formulas had increased.

In CFR trade deals, the seller is responsible for the delivery of the goods to a ship and for the loading the goods onto the ship. They also cover the cost of freight to the goods’ destination. Increases in CFR translate to rising selling prices as producers seek to claw back the extra cost from the buyer.

Given the current economic downturn, lower volumes of raw materials and products are being shipped Cienkosz explained. 'Theoretically, deep-sea freight rates decrease under those market conditions as freight companies compete for custom.

‘But – according to brokers – it is not the case and chemical companies negotiating rates are finding prices rising, not dropping.’

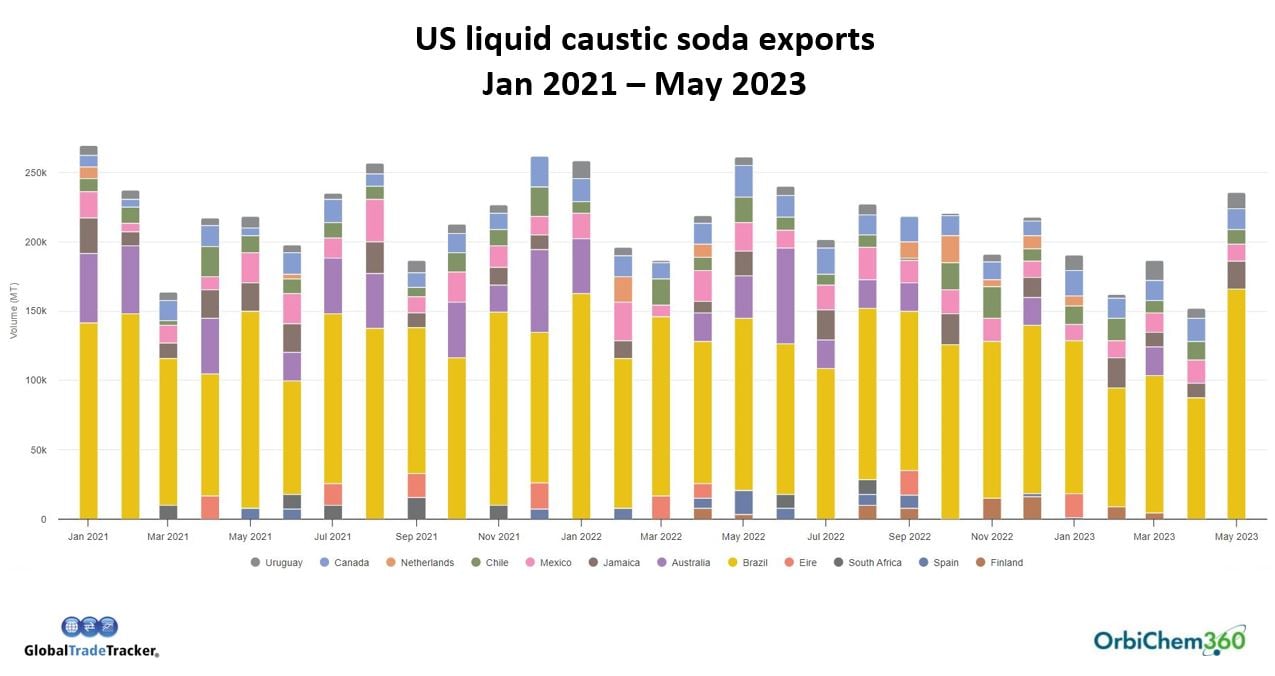

The graph above shows that US exports of caustic soda are in decline. Liquid caustic soda exports were around 20% lower between January and May of this year than they were during the first five months of 2022 and the corresponding period in 2021.

Furthermore, as noted in the eBook Caustic soda trade in global markets: Mid-year review 2023 regional market vectors for the chemical intermediate saw an exceptional change of direction in 2023. Not only were US caustic soda exports to South America were in decline, some trade fundamentals within the Americas had reversed. Cheaper offers were increasingly being made to US purchasers by South American producers, instead of the other way round.

And, following announcements of the closures of two large American paper mills in North and South Carolina, structural caustic soda demand in the region is expected to reduce by up to 100 ktpa. Meanwhile, Finnish forest industry company UPM is poised to start-up its new pulp plant in Uruguay, South America.

With a nameplate capacity of 2.1 million tonne of eucalyptus pulp per year, UPM's US$ 3.5 billion dollar investment included a deep sea-port terminal 20 miles away. Factors likely to have ramifications for pulp and paper, caustic soda and freight sector market participants locally and internationally.

Caustic soda's unique transportation needs

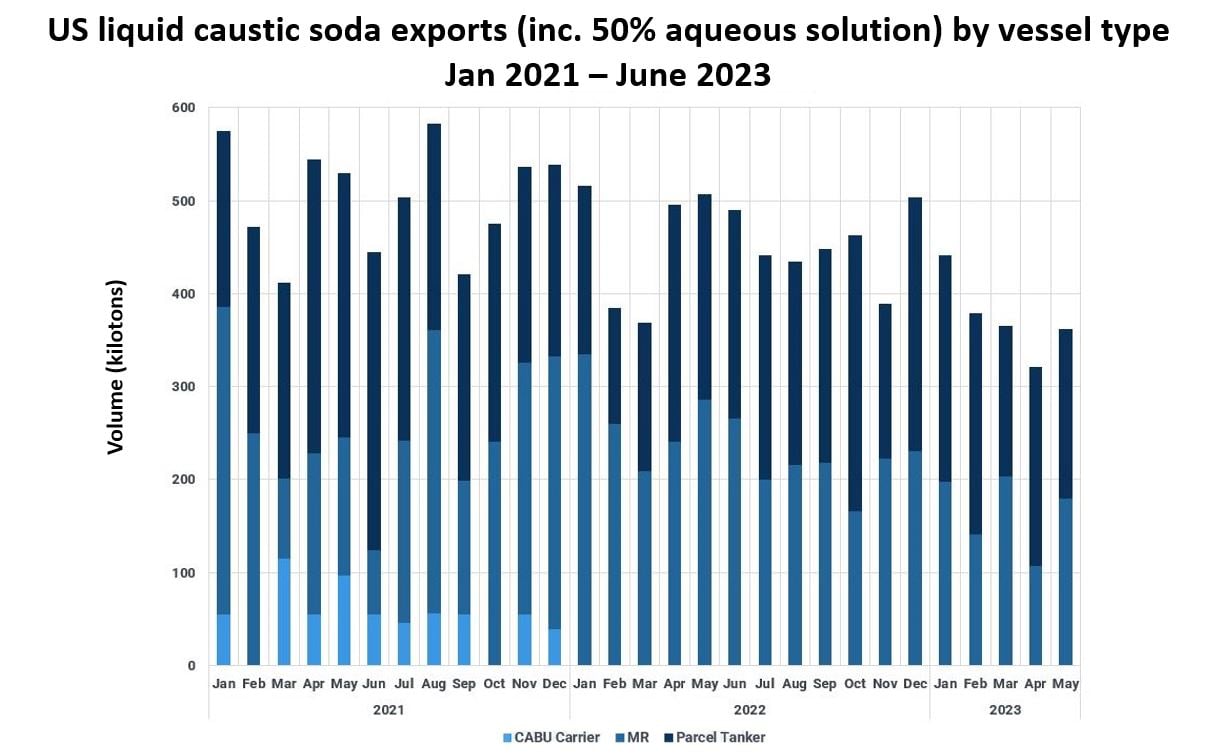

Partly, this is due to particular requirements when transporting caustic soda, although other trends and economic factors are likely to impact seaborne cargo prices too. While a range of container ships are equipped to carry (sometimes many thousands of) 20-feet (TEU) and/or 40-feet (FEU) equivalent containers, liquid caustic soda shipping requires one of three vessel types.

CABU – from the term CAustic BUlk – carriers demonstrate a maximum 72,500 dwt (dead weight tonnage – including cargoes, passengers, crew and provisions). These vessels carry liquid caustic soda cargoes at a total parcel weight between 50 and 60 kiloton per voyage. On the return journey, they carry dry bulk cargoes such as alumina.

Medium range (MR) tankers – designed for bulk volumes on long-range journeys – have a maximum capacity of 40 kiloton caustic soda parcels per voyage.

Lastly, parcel tankers can carry five to 20 kiloton parcels of caustic soda per voyage. Economies of scale therefore will often render CABU carriers the preferred method for transporting larger volumes of liquid caustic soda around the world. The graph below shows that CABU carrier use trailed off for US exports as 2021 came to a close, as the US buyer that received alumina from the return journey closed operations.

Source: Kpler

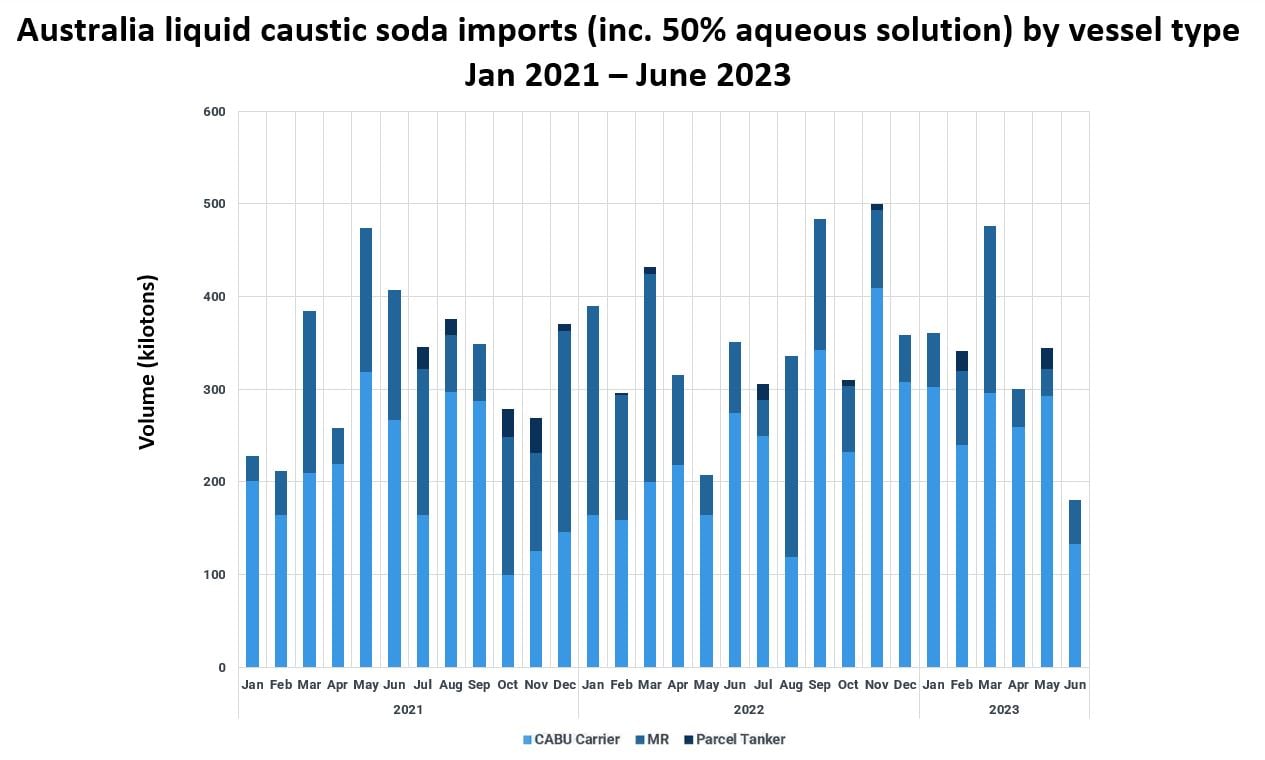

However, the next graph shows that CABU use on caustic soda trade routes to Australia peaked at over 400 kilotons in November 2022. In fact, the majority of imported caustic soda arrived into the country on CABU vessels as opposed to MR tankers and parcel vessels. Due to strong demand for caustic soda in Australia and Asian alumina demand to facilitate the return journey.

Source: Kpler

Source: Kpler

Both graphs above were provided by Senthuran Raviraj (pictured below). Formerly a Tecnon OrbiChem market research consultant, now a senior analyst at Brussels-based cargo tracking and analytics provider Kpler.

At the 26th World Chlor-Alkali Conference in Singapore earlier this year, Raviraj outlined some reasons for the clean tanker market becoming increasingly tight to mid-2023.

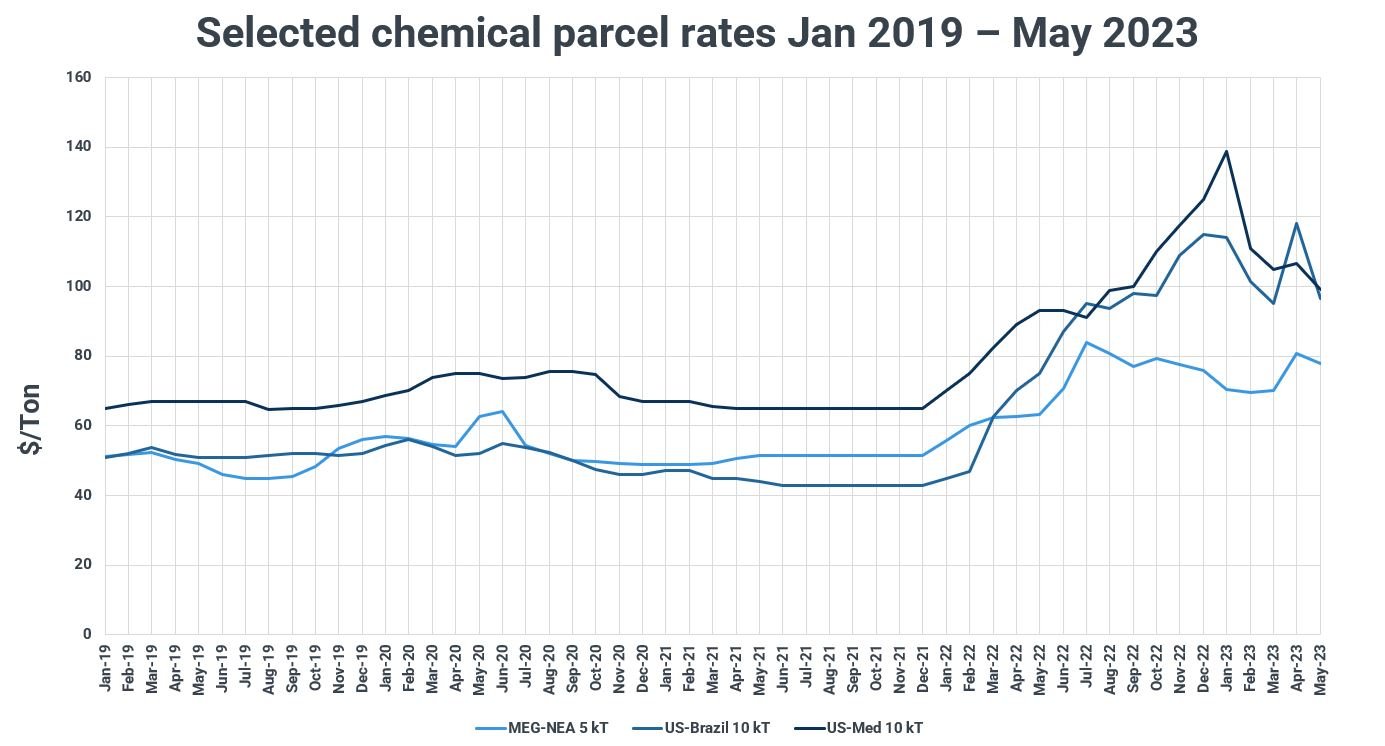

Kpler calculations – based on datasets from Singaporean shipbroker Eastport Maritime – Raviraj said, showed chemical parcel rates elevating this year.

...This year, the EU-import ban (on Russian goods) has maintained rates, even as Chinese exports have tailed off. This has led to a shift in demand to the West, with vessels moving to follow the market needs...

Senthuran Raviraj, senior analyst Kpler

In his presentation Insight into the shipping industry & its effects on the caustic soda market, Raviraj said disruption related to Russia's invasion of Ukraine had partly driven clean tanker rate rises.

'But there was also an increase in export volumes, fuelled by the recovery in oil demand. In Q4, a late batch of export quotas from China added fuel to the fire, pushing rates even higher.

It is thought that European sanctions on Russian oil products have increased demand for Middle Eastern and US oil products from these countries. Meanwhile, Russian oil products have had to look further afield to send their cargoes. The knock-on effect of that is an increase in tonne-miles and a heightened demand for tankers.

'This year, the EU-import ban (on Russian goods) has maintained rates, even as Chinese exports have tailed off. This has led to a shift in demand to the West, with vessels moving to follow the market needs,' says Raviraj.

An annual event, the World Chlor-Alkali Conference is jointly organised by Tecnon OrbiChem and I•C•I•S.

Shipbuilding goldrush

Raviraj says that chemical tanker availability will remain tight till early 2026 when the recent wave in ordering will be launched. For context, orders for tankers take around three years to be built depending on the orderbook of the shipyard.

The last few years saw record lows for chemical tanker earnings, which in turn caused a lack of investment into the fleet.

This caused vessel growth in the chemical tanker fleet to be low and is expected to only grow by 2% yoy in 2023. Last year was marked by exceedingly low tanker scrapping rates as older vessels were kept in service to capitalise on the surge rates and new demand. With fleet availability remaining tight for the foreseeable future, scrapping should remain low until new environmental regulations in the shipping industry come into action.

Norwegian shipowner Klaveness Combination Carriers will bring three new CABU vessels into service in 2026. The Jiangsu New Yangzi Shipbuilding Co vessels will include wind propulsion technology. The newbuilds will augment the firm's eight specialised CABU – and further eight CleanBU – combination carriers.