The chlor-alkali market faced a tumultuous year in 2022 and was rocked by Russia's invasion of Ukraine. This led to skyrocketing oil and gas prices just as the market was beginning to stabilise from the pandemic.

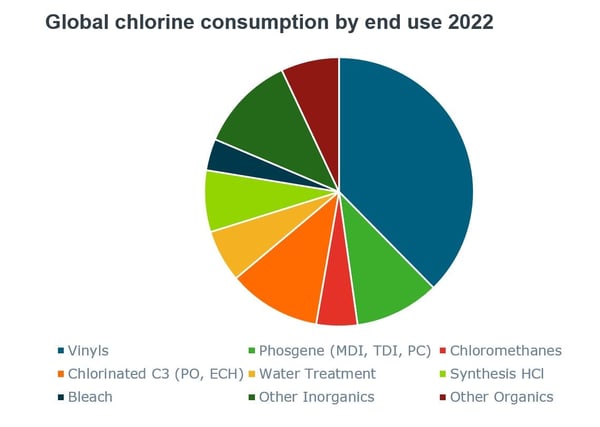

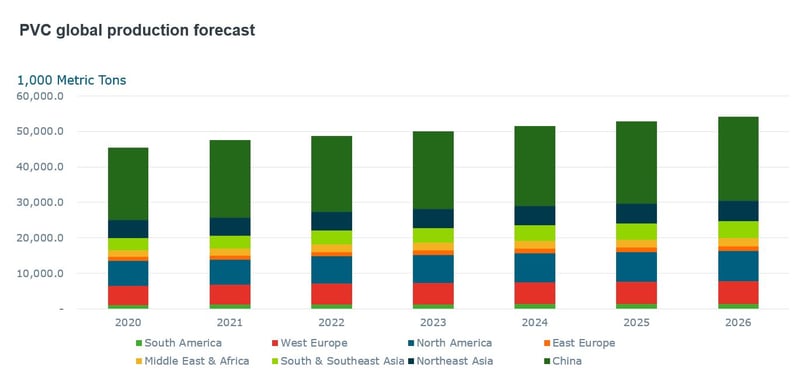

PVC demand showed great strength early in 2022, with high consumption across Europe and the US. With interest rates low, housing and construction sectors thrived in the first half of the year.

By H2 however - as inflation continued to rise - banks increased interest rates to combat it. The move turned building sectors globally as mortgages became less affordable and investment waned.

While the construction sector's seasonality tends to decrease PVC consumption towards the end of the calendar year, the demand destruction witnessed in 2022 went beyond this. The resulting reduction in chlor-alkali operating rates, particularly in Europe, resulted in an incredibly tight caustic soda market.

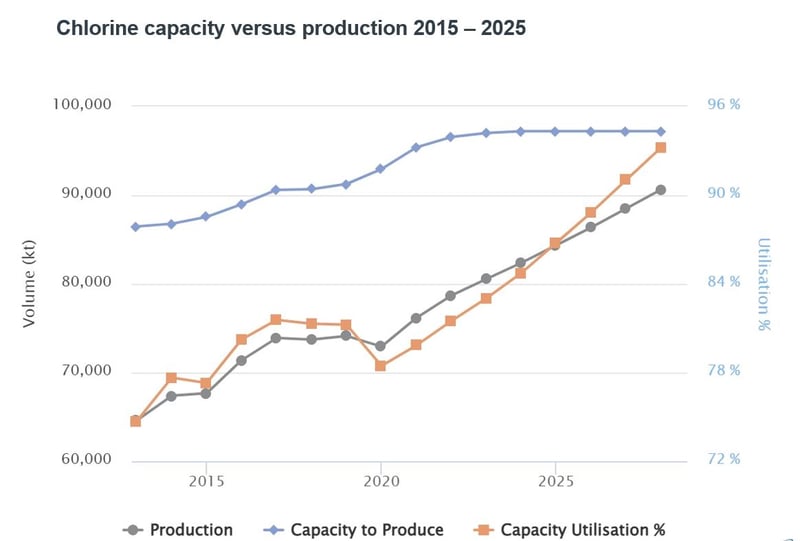

Source: Tecnon OrbiChem

Demand destruction in 2022

Aside from the supply issues and demand destruction observed in the chlor-alkali and derivatives markets, a major topic of concern throughout 2022 and into 2023 has been energy costs. Electricity and natural gas prices skyrocketed in Europe as a result of the conflict in Ukraine. As chlor-alkali production is very energy intensive, the cost of production increased drastically, forcing producers to hike up prices for chlor-alkali products.

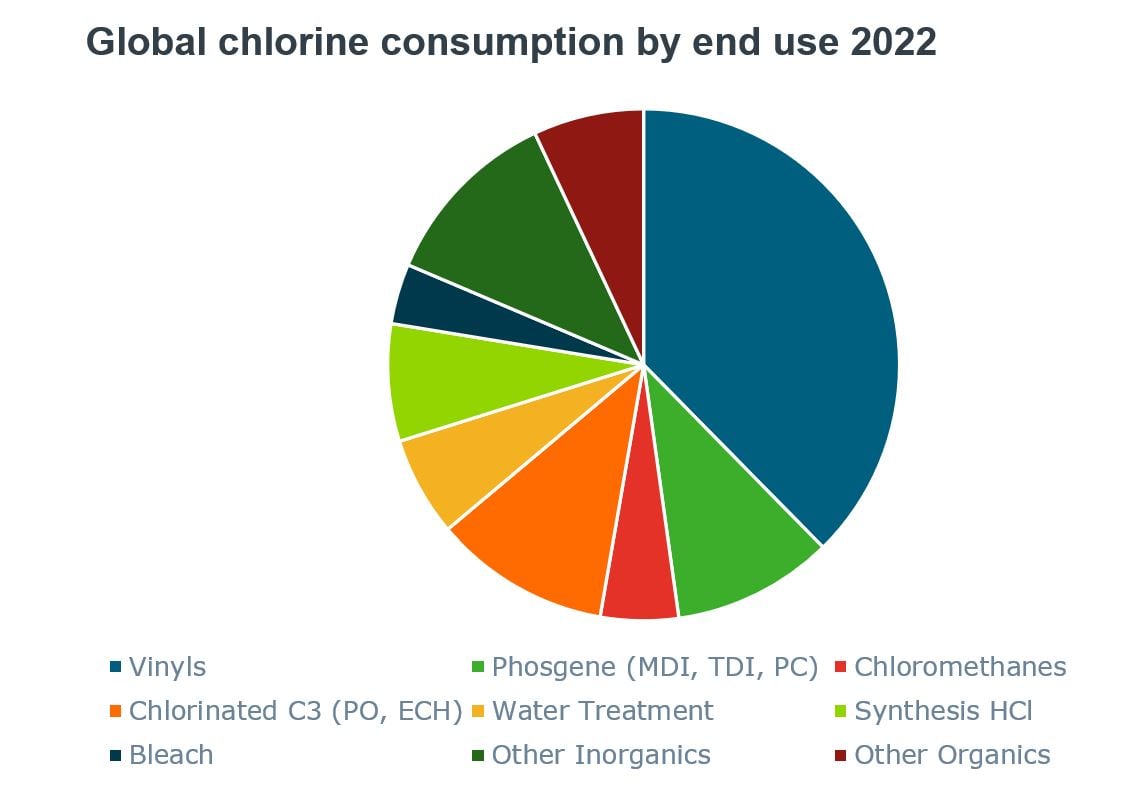

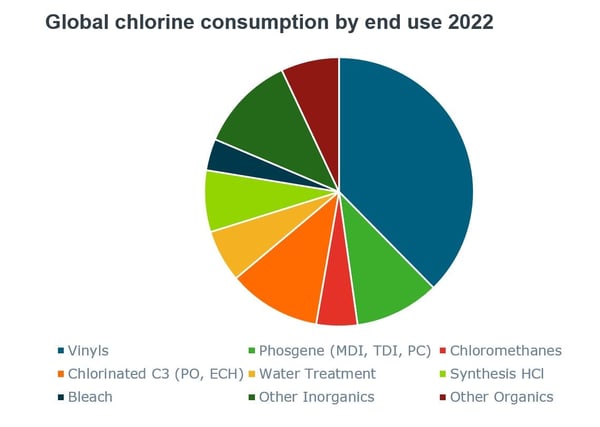

As the year entered its second half and PVC demand started to fall, there was a reduction in operating rates of chlor-alkali plants, as the main outlet for chlorine is PVC. At the same time, the caustic soda supply was very tight and producers increased prices accordingly. At the end of 2022, caustic soda prices were at historical highs in Europe.

Source: Tecnon OrbiChem

Looking forward

So far in 2023, the energy scenario has improved greatly due to a warmer-than-expected winter helping energy prices come down. European caustic soda prices remain high despite weakening demand and reduced pressure from high production costs.

The main challenge facing producers in Q1 will be the decline in caustic soda demand as the weak economy takes its toll on the caustic soda market. It is usually the case that the chlorine side of the ECU is more immediately affected by changes in the economy, while the caustic soda market tends to see a delay of a couple of months.

The softer demand for caustic soda is caused by high prices and a slowdown in the economy. The reduction in caustic soda demand has helped to balance the chlor-alkali market amid the reduced operating rates of European producers in late 2022 and early 2023. Read our blog post Caustic soda, the chemical industry's next global shortage?

When will Europe's chlor-alkali output increase?

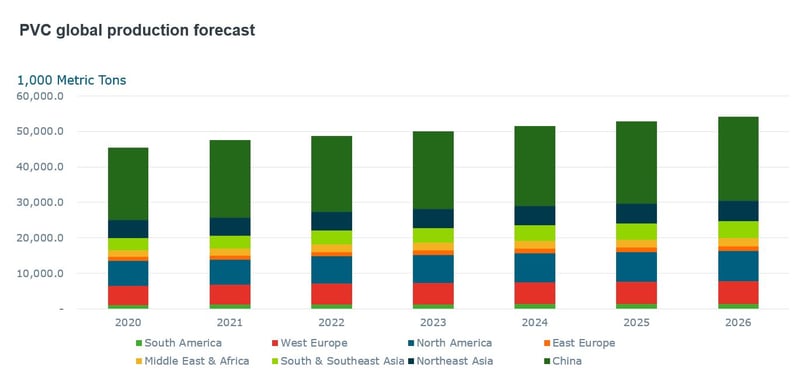

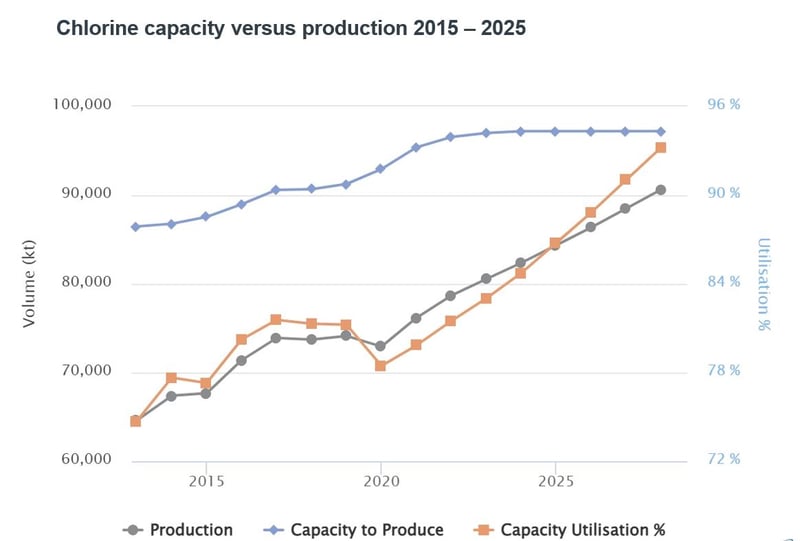

It remains unclear when European producers are likely to increase operating rates, and it depends on several factors including recession fear. Forecasts by the International Monetary Fund predict a 'subpar' growth trajectory globally for 2023. The less-than-positive outlook could be an indicator of a softer chlor-alkali market, particularly in Q1 and Q2. This may keep operating rates low.

Another major factor contributing to the low operating rates is energy cost. Now that energy costs have come down following a warm winter in Europe, the European export markets are becoming more competitive with a rise in export offers for caustic soda out of Europe already being reported in 2023. PVC exports have also become feasible as energy costs come down. Despite this, there has not yet been an increase in operating rates. Reducing energy costs will support increased operating rates.

Source: Tecnon OrbiChem

Caustic soda demand decreases

Caustic soda demand has been weakening to the point where it is roughly in line with chlorine demand in Europe. As the PVC market begins to show signs of picking up, caustic soda demand continues to decline. Because of this, there is some concern that producers may decide to keep operating rates at the current low levels or even lower them further for those that are not currently running at technical minimums.

If this happens as the PVC and chlorine derivatives begin to pick up as they usually do in Q2 due to the seasonality of the construction market, we may begin to see PVC becoming short again. This is not so much a concern in the US where the caustic soda market is a little stronger and economic forecasts are better.

Tecnon OrbiChem’s price forecasting service ChemForesight is launching a PVC version. Pricing is forecast for the next 18 months and assessed using three crude oil scenarios to allow the user to judge the effect of deviations from the base predictions. Feedstock and energy costs are indexed to the Brent crude oil price, with adjustments for non-petroleum sources (mainly natural gas and coal).

An outline of what a ChemForesight subscription offers is included in a previous blog post Supply chain visibility: Price forecasts aid procurement & planning.

The Tecnon OrbiChem & ICIS World Chlor-Alkali Conference is back for the first time in four years. Now in its 26th year, the conference will be held on the 15-16 June at Intercontinental Hotel in Singapore.