6 min read

How a US Gulf Coast Snow Flurry Roused Quiet Markets

Jane Denny

:

Jan 29, 2024 3:09:01 PM

Jane Denny

:

Jan 29, 2024 3:09:01 PM

Not enough years have passed for the Texas Big Freeze shockwaves to have fully exited the chemicals sector consciousness just yet. So severe was its global impact, it must remain a fresh—albeit unwanted—memory in market participants' minds.

It was mid-February 2021 that an extreme US Gulf Coast temperature drop triggered production disruptions and cross-subsector trade gridlock. And that intense fallout affected global supply chains for months on end.

Petrochemical facilities and oil refineries shut down en masse. Industrial gas providers closed their doors, as did storage facilities. Transportation links, along with critical infrastructure, were also negatively impacted.

So, as freezing temperatures began to grip the US Gulf Coast earlier this month, memories of that tumultuous time could not help but re-emerge worldwide. True, there were outages at some local plants and production rate cuts at others. How did chemical markets react?

Methanol Market Activity Follows Force Majeure

The founder of ResourceWise’s newly acquired company, Chemical Intelligence, George West, said the cold snap triggered “a flurry of spot deals” in the methanol chemicals subsector.

The methanol market will be subject to planned maintenance in Q1 but the market's near future hinges on whether there are any lingering issues once they attempt to restart.

—George West, Director, Chemical Intelligence, ResourceWise

This came with no official announcements of rate cuts emerging, just strong whispers of curtailments among industry participants.

“Although two plants are expected down for planned maintenance this quarter, availability before the recent curtailments appeared relatively healthy. Moving forward much depends upon whether there are any lingering issues once they attempt to restart.

“Although two plants are expected down for planned maintenance this quarter, availability before the recent curtailments appeared relatively healthy. Moving forward much depends upon whether there are any lingering issues once they attempt to restart.

“Downstream demand among large consumers is still seasonally slow, although winter-related consumption surged," West adds.

West provided more detail on this ongoing issue—including the then-latest spot and contract price deals—in the early January edition of The Methanol Report. The report— which focuses on North American markets—has been issued bimonthly since the 1990s.

Glycols Under Pressure

Meanwhile, Chemical Intelligence's 22 January glycols-focused report highlighted another key market. The Glycol and Derivatives Report referenced "precautionary shutdowns and mechanical issues" impacting mono ethylene glycol (MEG) output at some Texas and Louisiana-based plants.

For DEG market participants, West's insight is that damage rumors were circulating among his sources. This "could impact regional production," he warned.

Additionally, the latest edition of the glycol-focused report points to the possibility of a problem with Indorama's propylene oxide and propylene glycol output. West says there were unconfirmed reports of damage at its Port Neches plant post-freeze.

Crackers Kick Off 2024 in Closure Mode

Meanwhile, Tecnon OrbiChem's lead chemicals business manager, William Bann, reported that some US-based crackers closed during January due to the cold snap.

With ethylene production curtailed to a degree already this year, potential buyers will have less choice for products – including vital antifreeze products. Food packaging, film, bottles, and pipes are also key downstream consumers of the platform's chemical ethylene.

Texas-based petrochemical and refining hubs—Houston, Corpus Christi, and Beaumont—are accustomed to extreme weather, such as hurricanes and tropical storms.

Following a period in which forecast graphs appeared rather flat, that certainly isn’t the case as we move towards the end of the new year’s first trading month.

—William Bann, Lead Business Manager, Chemicals, ResourceWise

In fact, hurricane season protocols are well-established. However, adds Bann, “faced with prolonged spells of freezing temperatures, the industry isn’t so well equipped”.

“As one petrochemical industry participant told me back in 2021, ‘big plants don’t react well to cold weather’. Market participants will be pinning their hopes on more robust procedures for restart than those seen in 2021.

“As one petrochemical industry participant told me back in 2021, ‘big plants don’t react well to cold weather’. Market participants will be pinning their hopes on more robust procedures for restart than those seen in 2021.

“What is true is that while forecast graphs have appeared rather flat for some time now, that certainly isn’t the case as we move towards the end of the new year’s first trading month,” Bann adds.

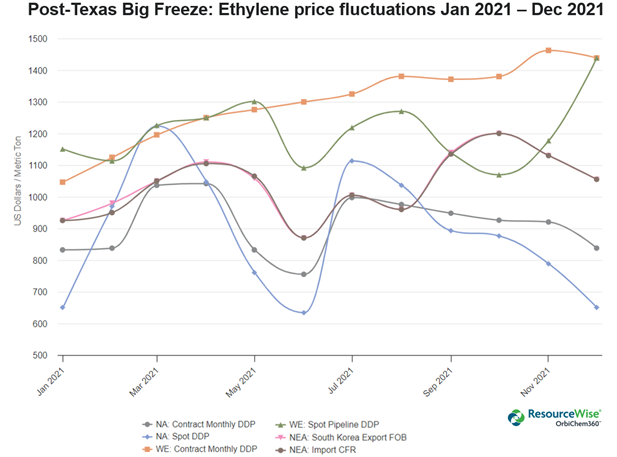

When the Big Freeze gripped the US Gulf Coast in 2021, ethylene production rates dipped below a third of optimum capacity. This resulted in volatile markets and cost increases across the subsector, as shown in the OrbiChem360 graphic below.

Source: Tecnon OrbiChem

What Obstacles to Plant Production During and After the Big Freeze?

When Texas temperatures dropped below zero degrees Fahrenheit in early 2021, plant pipes burst, and pump systems were damaged. Facility infrastructure was unable to function in such an extreme environment.

Compounding the problems was the need to conserve electricity nationally as vast swathes of the US plunged into darkness. This led to oil refineries being asked to bring down units, limiting the flow of platform chemicals and intermediate feedstocks into the value chain.

When plant operators locked their teams into restart mode, they found a lack of utilities for systems prevented the realization of their aims. Potable water—used for heating and cooling, chemical reactions, rinsing, and making solutions—proved scarce. Similarly, the lack of steam—for pressure and power, especially for heating applications—was cited as a restart obstacle.

How Do Global Markets Change When Cold Snaps Happen?

As the world slowly began to wake up to the global pandemic and lockdown its citizens in 2020—unlike the doldrum markets seen today—demand for goods showed no signs of waning. And that high demand continued in 2021.

So, as stockpiled feedstocks and raw materials ran dry, buyers were entering ever-tightening markets in a relative frenzy. Consequently, prices rose quickly.

Butyl acrylate was among the first sectors to exhibit post-deep freeze impact. Used in end products such as paint, coatings, adhesives, and sealants, it is vital to construction, automotive, textile, pulp, and paper. Due to the limited availability of oxo-alcohols, the production of butyl acrylate and 2-EHA stalled. In fact, the cost of butyl acrylate imports to Europe reached a pinnacle of over $4,500/ton in the aftermath—nearly six times its cost in cost in domestic Chinese markets at the time.

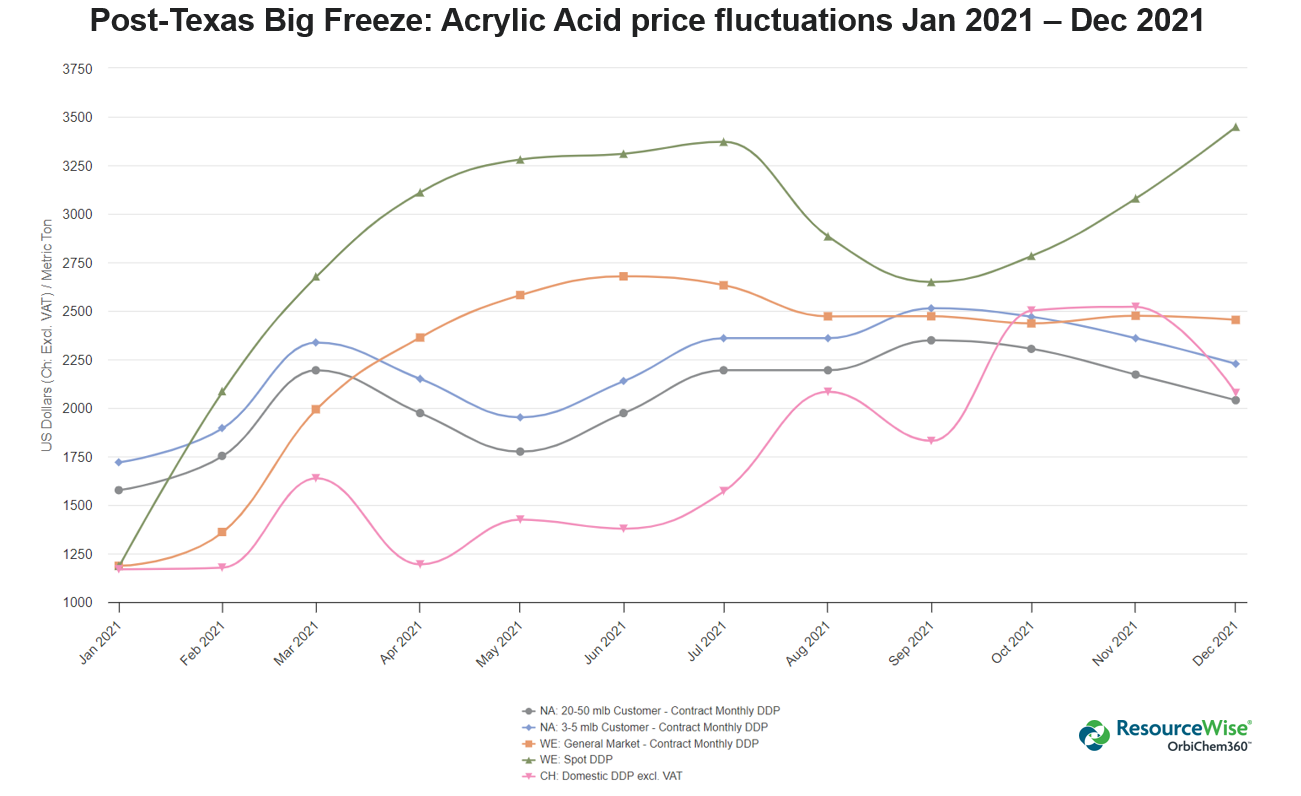

Knock-on effects ripped through the acrylic acid and acrylates chemicals subsector, for example. There was a rapid shift from a buyers’ to a sellers’ market. As shown in the historical graph downloaded from our chemical intelligence platform OrbiChem360 below, this dynamic dominated the 2021 acrylic acid and acrylates markets.

Source: Tecnon OrbiChem

The aromatics sector faltered due to a scarcity of styrene as several production facilities struggled to return online. While some reluctantly remained in force majeure, others scaled back production. At one point, just one styrene plant was said to be onstream—namely American Styrenic’s 500-plus ktpa styrene operation in St James, Louisiana. Key producers LyondellBasell, CosMar, and Ineos were forced to remain idle, according to market sources. As a result, styrene values jumped by more than $500/ton in the aftermath of the Big Freeze.

Problems of Concentrated Supply Hubs

Almost one fifth of global acetic acid production capacity is US-based. And of that, 90% of production happens in Texas. Such was the situation in February 2021. So when Texas froze, most of the region’s acetic acid sites went into ‘hard shutdown’. This meant the outages happened immediately, leaving little time for controlled measure planning.

Similarly, at that time Celanese, Ineos, LyondellBasell and Japanese firm Kuraray accounted for roughly a quarter of the world’s total vinyl acetate monomer (VAM) production capacity. (Today, M&A activity has replaced Ineos with Dow, and the US capacity share is nearly 1.9 million metric tons versus a global capacity of 9.1 million metric tons)

However, when all four erstwhile owners went off-stream, global supply balances—unsurprisingly—suffered. In fact, it was VAM prices in West Europe that were most impacted.

Climate Calamity Is on the Horizon

The Center for Climate and Energy Solutions says the frequency of major hurricanes increased in the US between 1979 and 2017. Furthermore, the National Oceanic and Atmospheric Administration predicts an increase in the highest category hurricanes, with increased wind speed too. And, contrary to climate change’s ‘warming temperatures’ offering a silver lining, their disruption of the polar vortex will push cold air into non-traditional areas.

So, whilst interruptions to operations across the chemical supply chain are commonplace—and becoming increasingly so—operators’ abilities to cushion them are improving too. Mainly because they have to.

Take Hurricane Sally for example. Though she made landfall in August 2020, Lake Charles, Louisiana-based production facilities did not return to normal operation until many months later. Unsurprising then that—with those recent memories in mind—early January’s snowfall across parts of the US roused relatively quiet markets.

Procurement professionals—both buyers and sellers—and analysts will surely be in intense monitor mode until the weather settles. Whether the conditions initiate a stockpile mentality – or traders exploiting arbitrage opportunity – is yet to be seen.

An Academic View: Cambridge University Study

A University of Cambridge paper, Climate Change and Economic Activity: Evidence from US States, explores 48 US states from 1963 to 2016. The research team highlights its contrast to most prior literature which it says, claimed that climate change impact on economic activity was ‘negligible’ for advanced countries and even ‘beneficial in cold climates’. Further, it pointed to the immediate impact of lower disposable incomes due to increased utility costs for end consumers when extreme cold weather hits.

According to the team, mining, construction, transport, retail trade, wholesale trade, services, and government sectors tend to be most negatively affected by unusually cold snaps. In prolonged periods of extreme cold, it is hard to imagine any other outcome than the same—but exacerbated.

The Inevitability of Supply Chain Volatility

The mid-twenties markets are now subject to a severe El Niño. That weather-based phenomenon has disrupted shipping via the Panama Canal since June 2023. However, freezing conditions have delayed shipments out of the US in January 2024.

After Putin's invasion of Ukraine, shipping firms were crippled by safety and insurance issues – vessels increasingly port-bound. Shifts in supply enforced by sanctions against the war-mongering Russian leadership prompted the value chain to adapt. And now, since October 2023, the Gaza-Israel conflict has turned the Middle East into a tinderbox of geopolitical tension.

Houthi terrorists continue to disrupt the passage of container ships through the Red Sea. And the logistic sector’s Panama woes are set to drag on for some time. As if that was not enough, more disruptive influences factors were explored in our blog post, Barge, Truck or Train? Panama Ships and Supply Chains.

As market participants look to put a blueprint for 2024 in place, many will wonder when respite will be ours.

The truth is, while relief from one or other of these particular issues may emerge in time, they will doubtless be replaced by a whole heap of new ones to navigate.