Epoxy resins producers in China have been making good profits since Q4 2017 after a number of producers were shut down following environmental inspections. The last five years saw a limited number of new epoxy resins capacities but demand has been growing off the back of a buoyant wind energy sector.

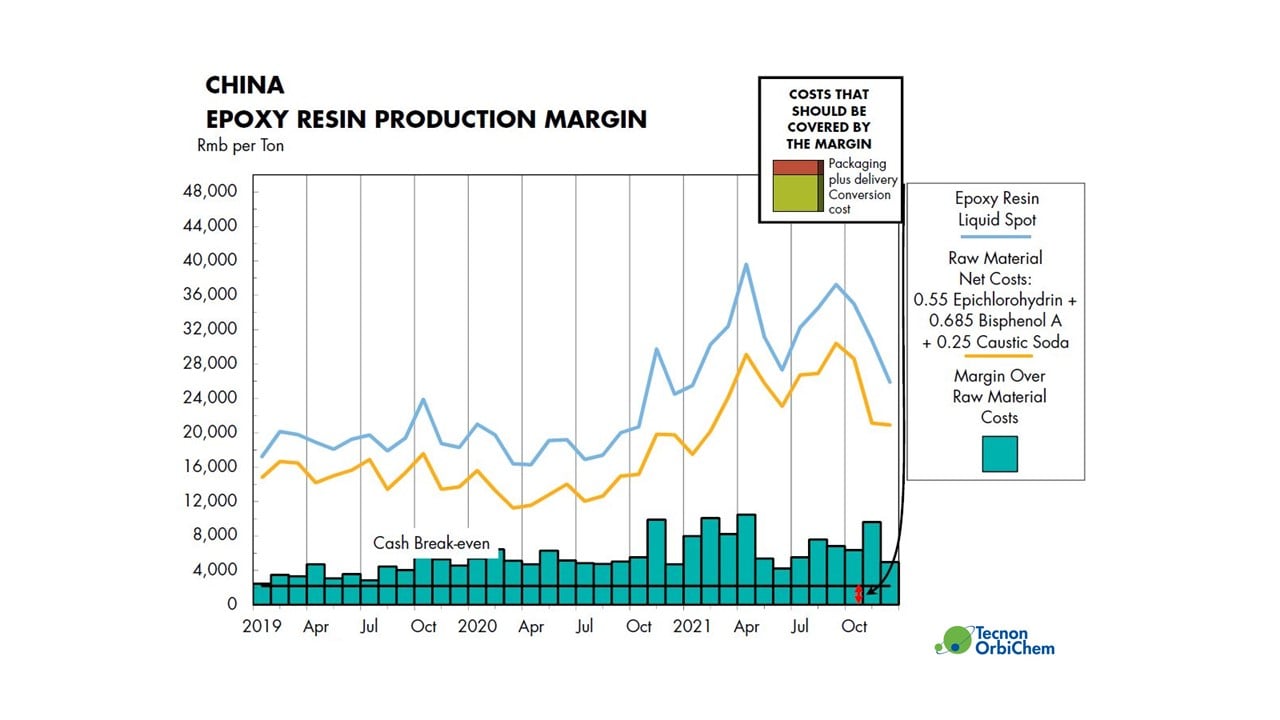

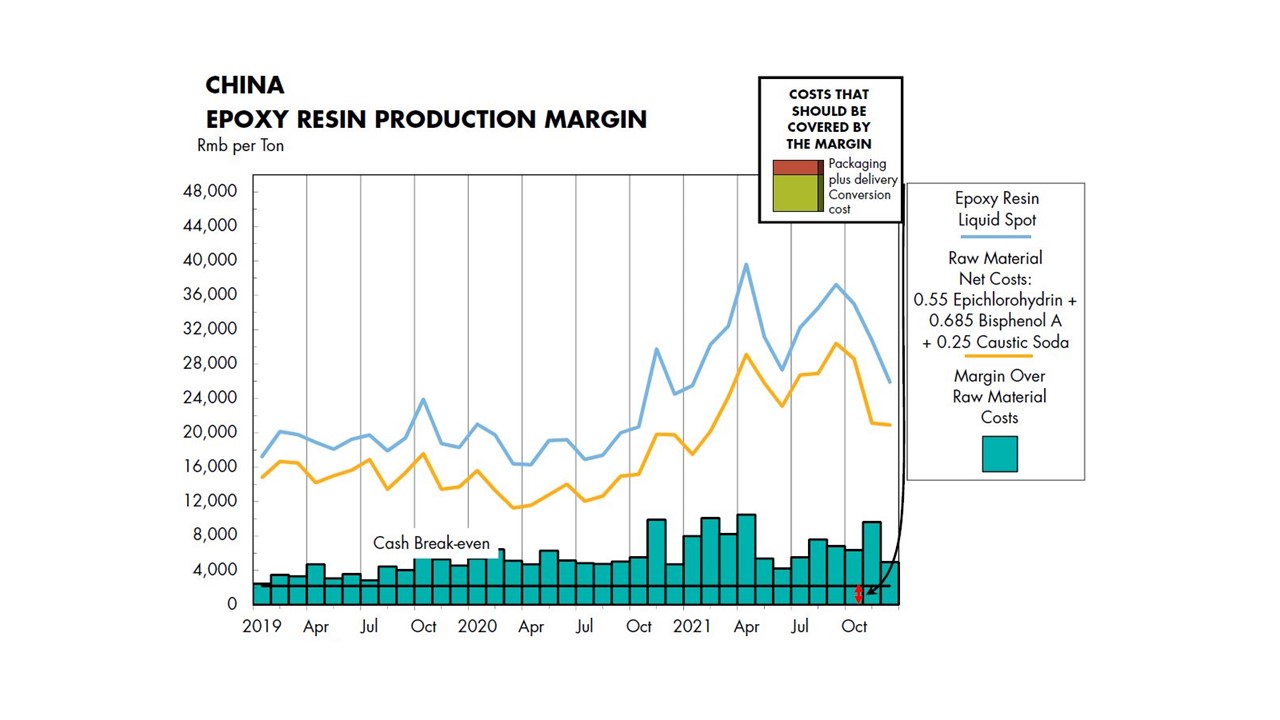

Chinese producers’ margins are thought to have hit Rmb4000/ton levels at the height of the market in April 2021. The figure represents a 40% rise on 2020 margins. Profits of these levels are beginning to attract more companies to invest in epoxy resins with new capacities expected in the coming two years.

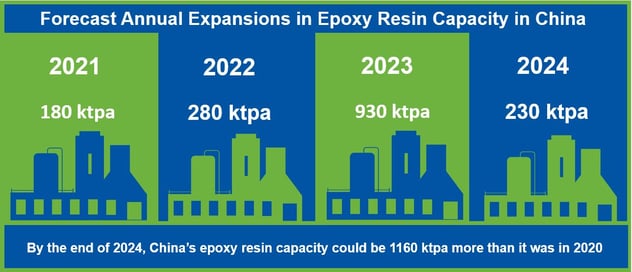

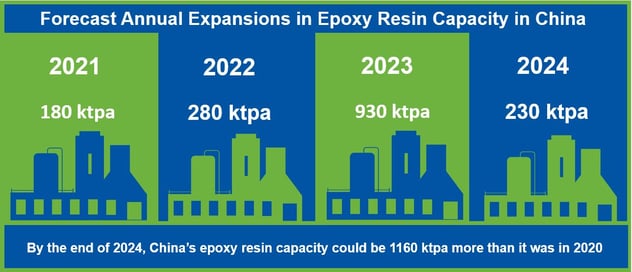

Although 2021 brought new capacities within China, overall supply and demand remained unimpacted because supply was tight globally. This prompted a rise in Chinese export volumes. However, this is expected to change next year as new plants come on line. According to a company announcement, Yangnong was scheduled to start a new 180 ktpa epoxy resin plant in December 2021. Though not designated for full operation immediately, it is set to increase supply to the market early in 2022. A further 280 ktpa capacity is planned to come on line in 2022, followed by an extra 1,160 ktpa epoxy resins capacity in the next two to three years.

Oversupply risk

If all the new capacities do go ahead as planned over the coming years, this will create an oversupply as demand is unlikely to increase to the same extent. Over the last two years, the wind energy sector has been the star of epoxy resins consumption, particularly in 2020 when the industry enjoyed government subsidies. As a result, this helped to push epoxy resins prices up until mid-2021. Demand in other applications has not grown as much over the last several years and in some cases, high epoxy resins prices have forced some downstream users to switch to alternative, cheaper materials.

The energy control policy in September and October had a positive impact on the Chinese epoxy resins market, as this pushed plants to invest in wind energy in order to save their energy quota. Wind blade demand, however, will not be enough to absorb all the new capacity that is due to come on line in the next two years.

Source: Tecnon OrbiChem

Source: Tecnon OrbiChem

The graph above represents the typical Chinese epoxy resin production margin. The blue line shows epoxy resin prices since 2019, whilst the yellow line shows feedstock cost based on the formula of 55% epichlorohydrin, 6% Bisphenol A and 25% caustic soda. The black line represents costs in addition to the three key raw materials.

Buoyant export market

Export volumes of epoxy resin from China increased significantly in 2021 because of global tight supply. In January to October 2021, China exported 84,626 tons of epoxy resins, representing an increase of 119.0% year on year. Will a rise in export business help to consume any new Chinese production? It might help to some extent but it won’t be enough – export volumes have been falling over the last several months as global supply has loosened.

The new capacities will not all come on line at the same time, so they will have a gradual impact on the epoxy resins market. But eventually, if the industry does see a supply glut, then this will undoubtedly create fierce competition, drive prices down and possibly encourage a rise in exports. However, lower growth in demand in other sectors may prompt producers to reduce operating rates if margins start to suffer. This means that producers integrated both upstream and downstream will find that they have an advantage in the market.

Windfarm windfall

A Tecnon OrbiChem white paper Epoxy resins market facing further headwinds in Q4 2021? published in September 2021 contains insight into China's windfarm markets from the state's National Energy Administration.