The global maleic anhydride market continues to be under downward pressure in 2023 amid the economic slowdown.

Like many other products in the chemical industry, the maleic anhydride market started to see demand softening from the second half of 2022 as the Russia-Ukraine war started to impact the European economy.

By Q4 last year, business had become extremely slow as buyers adopted a heavy destocking strategy amid the uncertain economic outlook.

In the US, maleic demand remained robust throughout most of 2022, but December too saw a significant slowdown following a drop in downstream UPR demand. Although January 2023 saw somewhat of an uptick, volumes remained well below levels seen in 2022.

A lot of hope was on China bouncing back after it abandoned its zero-Covid policy in December last year. However, China’s rebound has been slower than expected, mainly due to underperforming of the housing sector as well as weak export demand.

"...More maleic anhydride capacities are due to come on stream during this year..."

Tecnon OrbiChem Consultant Kaiyin Hu

Meanwhile, China’s MA capacity continues to grow. Binzhou Dayou started up its 60 ktpa MA plant in May 2023. There are more MA capacities scheduled to come on stream this year, including Puyang Shengyuan, Hengli Petrochemical and Wanhua Chemical which have plans to start up in the second half of this year.

Source: Tecnon OrbiChem

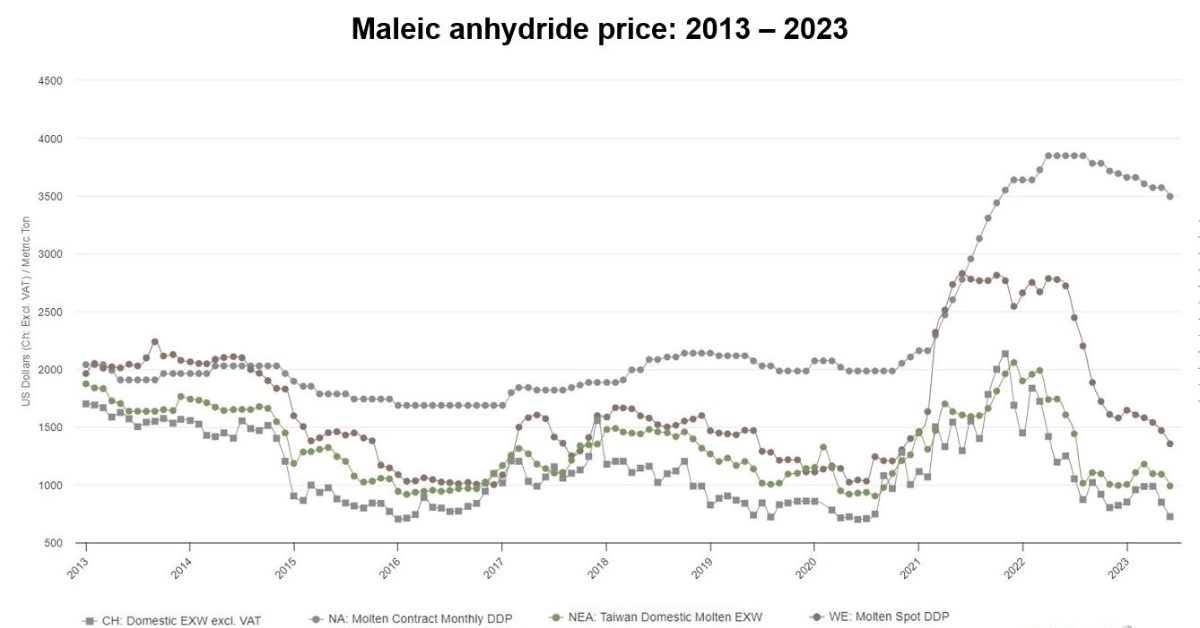

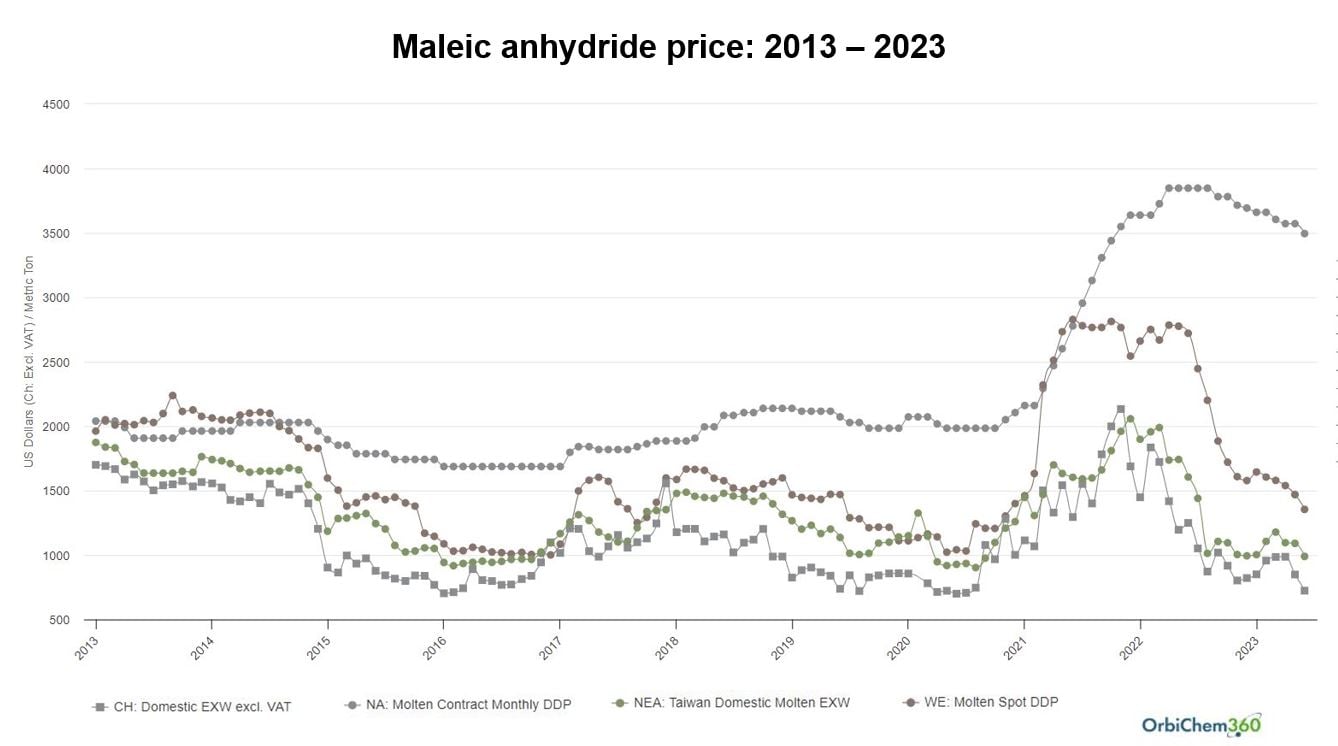

Prices Trend Downwards

As a result, maleic prices have been trending downwards, with Asia starting the trend in Q2 2022; European MA prices also started falling from the second half of last year as demand dropped; while in the US, prices have been much more stable but have also generally entered a softening trend this year.

The graph above is from Tecnon OrbiChem's subscriber-based business intelligence platform OrbiChem360. This particular graph shows only four of the 12 distinct prices series our consultants cover for maleic anhydride globally. All prices cover a mix of types - whether contract or spot - across the world.

After a terrible Q4 last year, demand in Europe was better-than-expected in Q1 2023; however, despite hopes for a gradual improving trend in 2023, Q2 performance has been disappointing as most sellers reported demand in Q2 was slightly softer than Q1. Looking ahead, MA demand in July and August is usually lower due to the summer holiday season. Faced with cheap imports and low demand, MA producers in Europe will be under increasing pressure to reduce prices or even further lower their output. In the US, the maleic market remained quiet in Q2 as demand failed to take off as normal during the typical peak season. Extended bad winter conditions in some areas of the US have also prevented infrastructure projects from starting. However, as the weather improves, market participants are hoping that demand will gradually pick up.

Hope Dwindles For 2023

As the year progresses, the hope for a strong recovery in demand in 2023 is vanishing fast. There is still a lot of uncertainty among industry players about whether demand will pick up at all this year. According to the China’s official preliminary data released on 7 June, its total exports in May dropped by 7.5% year on year to around $283.5bn. On the other hand, the recent depreciation of Rmb is expected to help the export business in China. Meanwhile, according to the latest release from Eurostat, the Euro zone is now in recession as GDP in the first quarter fell by 0.1% compared with the previous quarter.

"...Unless demand sees further significant erosions, prices are likely to stay relatively stable..."

Kaiyin Hu

Looking ahead, global maleic anhydride prices could face further downward pressure in the remainder of 2023, as demand is not likely to see a substantial improvement before next year while new capacities in China will only add to the supply glut. The US market is usually less affected by imports; prices have already seen some softening so far this year, but unless demand sees further significant erosions, prices are likely to stay relatively stable.

The one-minute video above outlines the benefits of a subscription to our business intelligence platform OrbiChem360. For a demonstration of how Tecnon OrbiChem's insights into global chemicals markets can inform your business, hit the button below.

Kaiyin Hu

Kaiyin Hu