1 min read

Post-Covid-19 Changes in Caustic Soda Trade Flows in the US

Hira Saeed

:

Oct 12, 2020 12:00:00 AM

Hira Saeed

:

Oct 12, 2020 12:00:00 AM

Before the COVID-19 outbreak, demand for caustic soda was firm, with most sectors showing steady growth over the past few years. However, when the COVID-19 pandemic hit the US in March 2020, the market shifted quickly, going from plentiful supply and higher stocks to a considerably tighter market as operating rates were cut due to poor chlorine demand. Many industries were impacted by the COVID-19 pandemic, particularly in Q2 of 2020, where demand destruction was significant in the construction industry, where PVC became particularly weak, pushing down chlor-alkali operating rates.

Demand is now beginning to rebound back to normal pre-COVID-19 levels. Though the pulp and paper market is slow, organic and inorganic chemical demand is strong. Due to some units being offline in the past few months, supply is tightening, and export volumes have been lower. The offline units have offset reduced US export demand in the past month as Alunorte reduces its alumina plant operating rate to between 35% and 45% for the next two months due to operational and maintenance issues at its pipeline that transports bauxite to the alumina plant affecting approximately 30,000 tons of caustic soda.

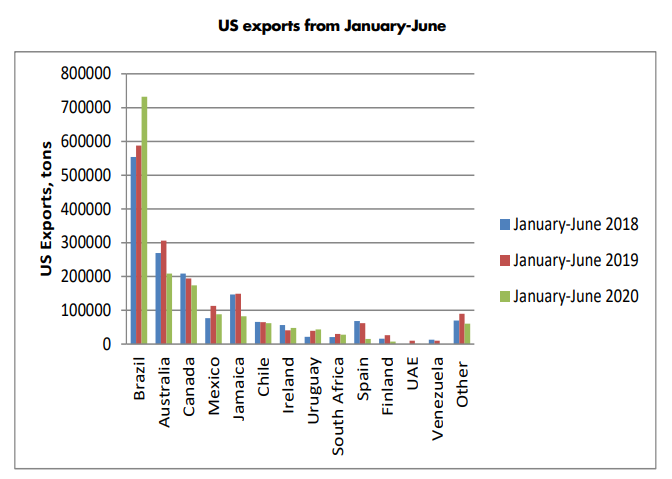

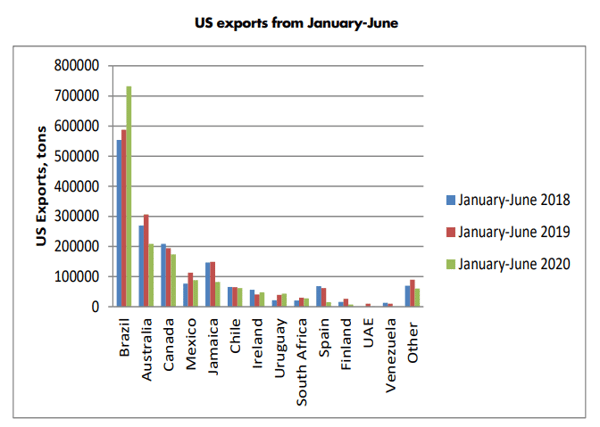

There has been a change in trade flows since the beginning of the pandemic. The main change has been a notable increase in exports to Brazil compared to previous years. In the past two years, demand from Brazil has reduced due to lower operating rates at Alunorte. Still, in May 2019, Alunorte was permitted to ramp up production to normal levels after running at half capacity for over a year. The increased demand for caustic soda for Alunorte has offset the decline in demand caused by South America’s depressed economy.

US exports to Australia also reduced in 2020 due to competitive prices in Asia, making exports from the US less favorable. While alumina is a minor end-use in the US domestic market, high volumes of caustic soda are shipped from the US Gulf to the alumina market, particularly in South America.

There is potential for the US to become oversupplied as units come back online while Alunorte is still operating at reduced rates. This situation will ease when Alunorte ramps up to full production at the end of October. US production volumes of caustic soda in August were still over 20% lower than in August 2019.

Learn more about how OrbiChem360, our online chemicals intelligence platform, can help your business in the global chemicals market.