Chemicals captured in the tax

The measure distinguishes between 'Taxable Chemicals' and 'Taxable Substances'.

To qualify as a taxable chemical, it must be imported into the US or produced in the country. The hydrocarbon chemicals: acetylene, benzene, butane, butylene, butadiene, ethylene, naphthalene, propylene, toluene and xylenes are currently listed and will be charged at the same rate of $9.74/ton. Methane, however, will be charged at a lesser rate of $6.88/ton.

Note that 'ton' in the legislation refers to the short ton (s.ton) of 2000 pounds, not the metric ton of 1000 kilograms.

Besides the 11 key organic chemicals just listed, also 31 inorganic chemicals are included, and are taxable at varying levels. We are not covering the inorganic chemicals in this article, but note that chlorine and ammonia are included, which has implications for some organic chemical derivatives.

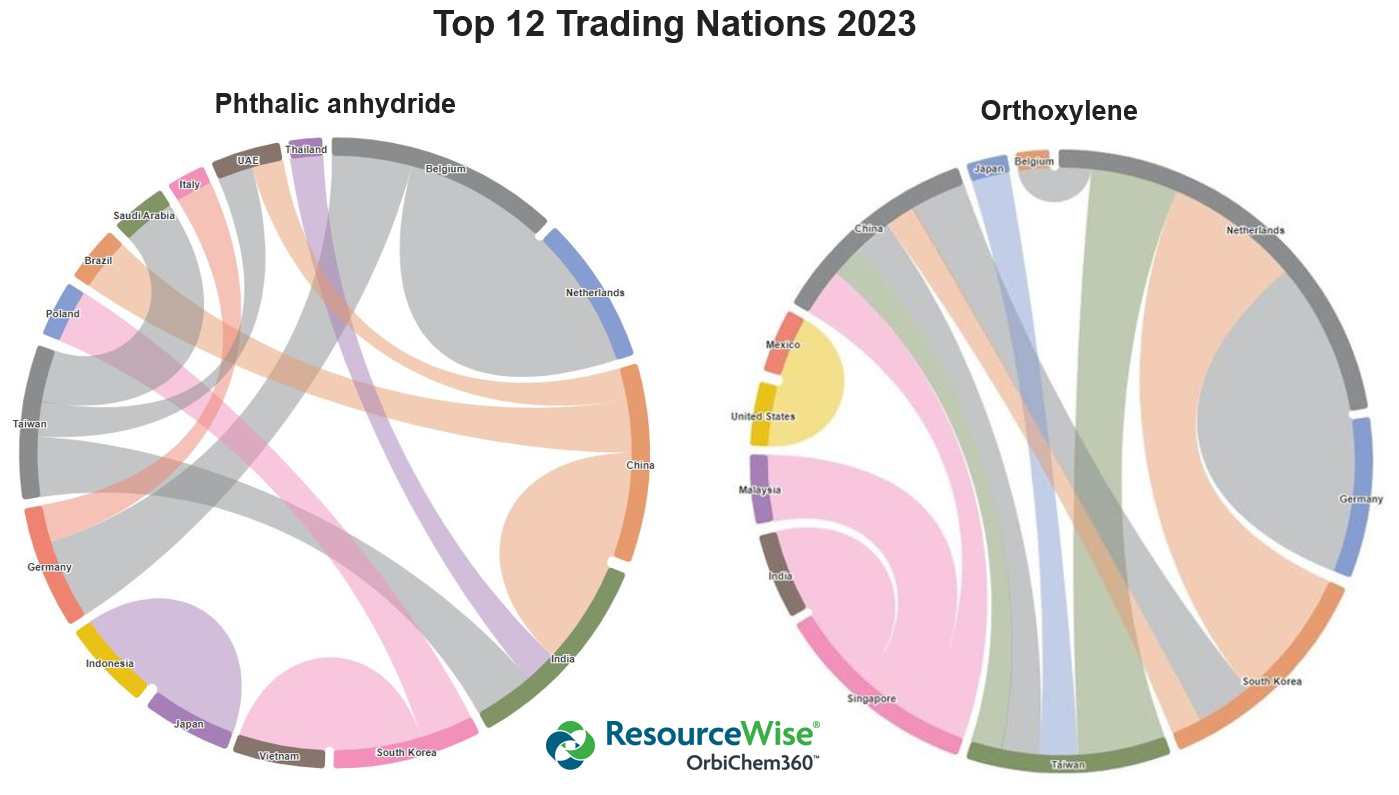

It appears that paraxylene (PX) and orthoxylene have been included in the list of taxable chemicals, being caught under the general name xylenes.

The olefin product butadiene – used to make rubber, and from it goods like car tyres and other auto applications – is categorised as a petroleum gas with other gaseous hydrocarbons which are often commercialised in liquid form by refrigeration or compression, such as liquified ethylene, propylene, butylene and butane.

Taxable substances

The category called Taxable Substance was introduced to ensure that the levy is applied also on imports of derivatives of the taxable chemicals.

To qualify as a Taxable Substance, the product must be imported into the US and specifically listed – of which there are currently around 150. It is a compound comprising at least 20% – either by weight or value – of a taxable chemical. The levy on Taxable Substances – Internal Revenue Code § 4671 and 4672 – is applicable to importers, and it is due upon the first sale or use after import. Link to Notice 2021-66

The reinstated infrastructure act’s Taxable Substances strand is a companion excise tax to the Taxable Chemicals element. As companion to the main tax, it closes a loophole which could facilitate avoidance. While it will not prevent the production of taxable chemicals offshore and subsequent importation into the US, it will thwart any attempts to circumnavigate the tax on a technicality.

Still this month '...the process for handling the new tax was not fully understood,

even within large companies used to dealing with complex financial issues...'

William Bann, Tecnon OrbiChem lead business manager

Under the new legislation for example, butadiene is a taxable chemical that cannot be imported to the US without payment of the infrastructure tax levy. Importing polybutadiene in the hope of avoiding the tax by asserting it as a different chemical will not be possible. In this way, the Taxable Substances excise tax establishes a backstop.

Calculating composition

Chemical substances in question – so stipulated in the original superfund tax – had to be comprised of over half a taxable chemical to qualify. In its reinstatement however, that ratio has been reduced to a qualifying threshold of 20%.

The Taxable Substance monoethylene glycol (MEG) will require consideration of composition on an ongoing basis to be fully confident of adherence to the new legislation.

The quantity of ethylene to make one ton of MEG is 0.452 tons stoichiometrically, but 0.60 tons in practice, due to losses in production. We do not know which of these two figures will be accepted by the IRS, but let us suppose that the practical figure will be taken. (The figure of 0.60 tons is an average, modern plants and newer processes can achieve a lower figure.)

In that case each short ton of MEG imported will be subjected to a levy of $9.74 x 0.60 = $5.84. Imports are measured in metric tons, equivalent to 2204.6 lbs, so the levy per metric ton will be $5.84 x 2204.6/2000 = $6.44.

The position with regard to by-products is uncertain. Production of one ton of MEG entails the co-production of about 0.10 tons of higher glycols (DEG, TEG, etc.). So, to produce one ton of MEG a total of 0.64 tons of ethylene has to be fed to the plant. The IRS may insist, in order to maximise the tax take, that it is the feed of ethylene that counts, irrespective of what by-products emerge (especially since DEG and TEG are not on the taxable substances list). The levy per metric ton of MEG in that case comes to $6.87.

But things go further. On the 'follow up list by the IRS we find that PET resin is included as a Taxable Substance. One ton of PET needs 0.33 tons of MEG for its production. This mean that imported PET is subject to a levy of $5.84 x 0.33 = $1.93 per short ton or $2.13 per metric ton on account of its MEG content (rising to $2.26 per metric ton taking account of the by-product effect). In addition, PET needs 0.87 s.tons of PTA for manufacture of one s.ton, and one s.ton of PTA in turn needs 0.67 s.tons of PX. This means that imports of PET have an additional levy of 0.87 x 0.67 x $9.74 = $5.68 per s.ton or $6.26 per metric ton coming from its PTA content. Taking MEG and PTA together, one metric ton of imported PET will be subjected to a superfund levy of $2.13 + $6.26 = $8.39.

But another complication emerges. Making one ton of PX needs the consumption of 1.25 tons of mixed xylenes (a variable figure depending on the process). If the IRS insists that the feed of xylenes is the relevant factor, the levy per metric ton of PET due to the total xylenes input goes up to $7.83.

Taking both of the higher figures for MEG and PTA and combining them, one metric ton of imported PET will be subjected to a superfund levy of $2.26 + $7.83 = $10.09.

The calculation has been made referring to a levy on imports of PET. But the same calculation applies to the domestic US producer of PET, as a result of use of the taxable chemicals ethylene and PX in the MEG and PTA used.

US producers that export products that have incurred a superfund levy can reclaim that tax on documenting the levy applicable to the quantity that has been exported. This is to ensure that US producers are not disadvantaged on the international market.

Clarification from the IRS will be needed on whether the total feed of taxable chemical should be used in the calculation, or alternatively a pro-rata amount that is specific to the quantity of feedstock used in the production of the end-product. Maybe there are some precedents already established from the 1980s.

Overcoming complications

With just a week before the tax's commencement, one US market participant described the tax as 'really complicated'. Tecnon OrbiChem's lead business manager William Bann says 'my contact raised a valid question 'How do you tax side-streams or by-products?' and referred to 'credits for exporting. They see it as a work-in-progress,' Bann adds.

He said some US market participants were advising customers that the superfund tax will start appearing as additional line items in invoices beginning in July.

'Other US market participants said in June that the process for handling the new tax was not fully understood, even within large companies that are used to dealing with complex financial issues,' Bann adds.

A self-fulfilling system

Under the reinstated tax, importers must accurately detail the composition of dual or multi-composite supplies, for example bisphenol A. It is wholly incumbent upon the importer to provide the Internal Revenue Service (IRS) with substance composition detail that allows the federal body to confirm the accuracy of the importer's calculations stated tax rate calculations.

Failure to comply will incur a default rate penalty of 10% of the appraised value of the substance. Taking recent domestic and import US prices of PET, failure to report to the IRS would result in a penalty charge of approaching $200 on a metric ton basis (rather than $10.09 (worst case) in our example above for compliance). That is quite an incentive to producers and importers to provide satisfactory inventory analysis to the IRS for this purpose.

The IRS has the authority to calculate and decide how it would determine the tax rate on these substances based on its calculation or information it obtains on the chemical composition of these substances.

PET predicament

Raw materials used in the production of PET and its precursor PTA, namely paraxylene and ethylene glycol derived from ethylene, are taxable chemicals included in the revived tax. PET and PTA will be taxable items on which the levy will have to be paid by the importer. Many other imported substances will be caught up in this excise levy.

US-based operators using monoethylene glycol (MEG) and PX-converted PTA to produce PET have been notifying customers of surcharges this month. Set at roughly the $9 - $10/metric ton mark it represents a relatively small cost base compared to the products’ price/ton.

Ten dollars though, is further dwarfed by brunt the of fees for research and consultancy fees, not to mention man hours invested in unravelling the changes to ensure compliance. One North American source told Tecnon OrbiChem that they were aware of huge sums being invested in consultancy services as companies large and small try to navigate the changes. Representing a medium-sized chemicals manufacturing enterprise, the source said in May it was still very much 'misunderstood within the chemical industry'.

Another producer advised customers in writing of a new ‘separate line item reflecting the tax’ that will be added to invoices issued from 1 July 2022 onwards. ‘PET resin is identified as a Taxable Substance,’ its correspondence said. ‘However, the IRS has not yet provided guidance on the applicable tax rate’ echoing the prevailing confusion around a tax that will apply within weeks and be the subject of detailed inventory reporting and filing within a matter of months. Reporting to the IRS will be required on a quarterly basis once it commences. That makes October the first month for reporting to the IRS.

Elsewhere the message communicated to customers focused not just on the tax’s impact on PTA and MEG in PET production but highlighted its impact on ‘most catalysts’ in use too. Stressing its record of absorption of increases in costs including freight, energy, additives and labour throughout 2022, the company limits its surcharge 'request to this excise tax adjustment’.

Exemptions

Use of methane or butane to produce motor fuel and/or using particular chemicals to make fertilisers are among those excluded. Similarly, releasing sulfuric acid as a by-product of air pollution control equipment as well as certain chemicals with ‘transitory presence’ during smelting or refining processes, and substances derived from coal, can be disregarded for inventory as these carry no levy.

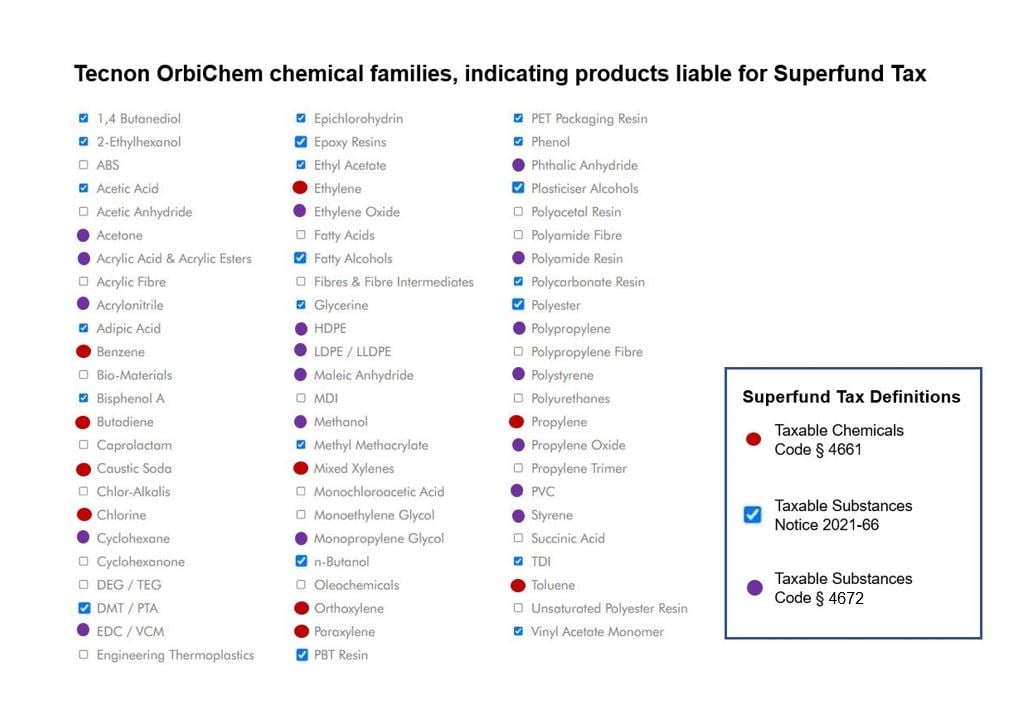

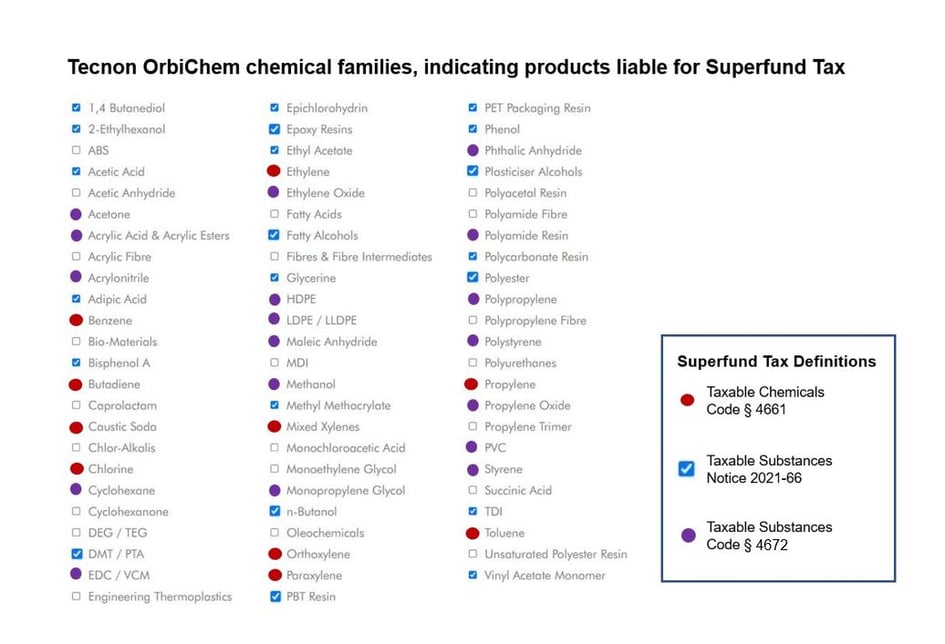

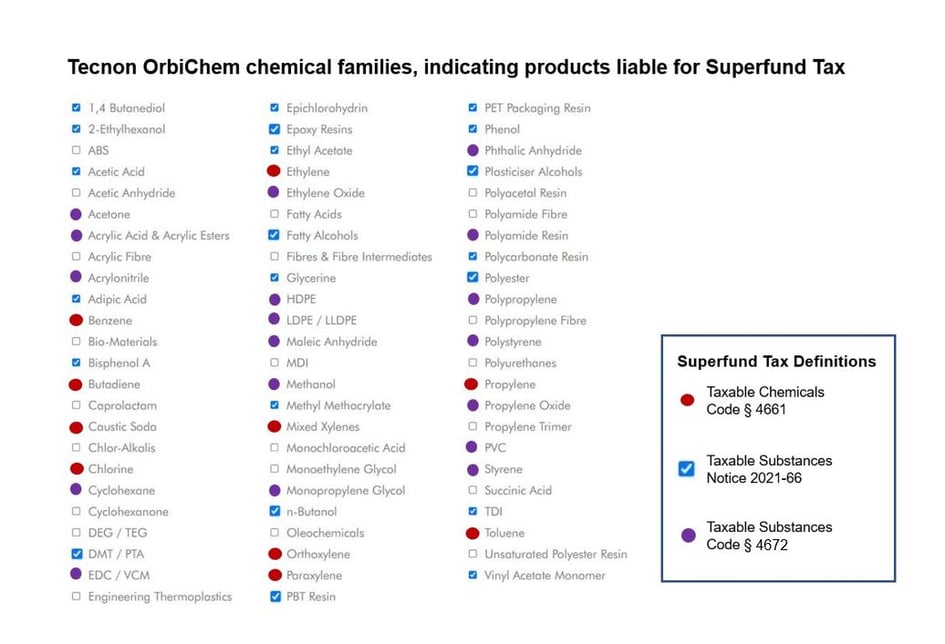

Below is a partial list of the chemical families researched by Tecnon OrbiChem (click image to open in a new page). We have tagged those that come under one of the categories liable to Superfund Tax.

Source: Tecnon OrbiChem

Clarifying the unclear

Leanne Sobel, director of motor fuels and excise tax services at Houston, Texas-based, US accounting and advisory firm Weaver said the IRS had informally informed her that 'substances not included in § 4672 or Notice 2021-66 are exempt'.

Sobel adds 'The IRS said the Taxable Substances are only those on the lists or added to the lists.'

This means that importers of MDI and caprolactam will not have to pay the superfund tax. On the other hand, US producers of MDI and caprolactam will have to pay a levy related to the benzene content of these products. This is somewhat surprising seeing that some of the products in the lists are of quite small volume.

Based on that, it may be unwise to completely rule out that substances like MDI and caprolactam may appear on what would be the IRS's third iteration of the Taxable Substances list.

Reactions

The reinstated tax has come under fire from lobby groups and associations since its re-emergence. The American Chemistry Council (ACC) report Analysis of reinstating Superfund Taxes on chemicals estimates that the excise will impose an annual cost in excess of $1.2 billion on American chemistry.

That could, the ACC expanded, lead to shutdowns for plants producing certain industrial chemicals, fostering 'further supply-chain challenges for these chemistries that are the basic building blocks for American manufacturing'.

The burden of the reinstated Superfund chemical excise tax would primarily fall on the building block chemicals ethylene, propylene, benzene, chlorine and xylenes.

And it creates an unfair advantage to foreign producers not affected by the tax, the ACC claims.