4 min read

Renewables, Low Carbon-Intensity Chemicals and ESG at EPCA '23

Tecnon OrbiChem

:

Oct 16, 2023 12:25:53 PM

Discussions on low carbon or sustainable feedstocks at European Petrochemical Association gatherings – even ten years ago – were rare.

Back then, inquiries for products meeting Environmental, Social, and Governance (ESG) expectations would signify a delegate had stumbled into the wrong event… That's how exotic such concepts were among some petrochemicals market participants.

This year however talk of routes to low carbon-intensity raw materials resonated in Tecnon OrbiChem’s bustling meeting suite.

Terms like renewable, biomass and circularity preceded questions around cost curves, product pricing, supply chain security, technology, and government policy.

Inside our Grand Hotel Wien meeting suite, delegates representing multi-billion-dollar-making corporates using fossil fuel-based feedstocks passed by peers from a renewables enterprise with a US$10 billion-plus turnover like ships in the night.

Our new biomaterials business manager Dwight Lynch and the company’s global sales manager Matteo Baldi engaged in hours of discussions, which are reviewed below.

...The 'Louis Vuitton price model' is about targeting companies willing to pay higher prices for greener – or more circular – materials

- Biomaterials business manager Dwight Lynch

"It is well understood that goods with a strong sustainability profile come with higher price tags," says Lynch.

"With the cost of biobased chemicals and polymers up to three times their petrochemical equivalent, companies face the critical question: Which of my existing, or potential, customers can, or are willing, to pay that?"

“It’s a strategy one delegate dubbed the ‘Louis Vuitton’ price model," says Lynch.

'Louis Vuitton’ Price Model Explainer

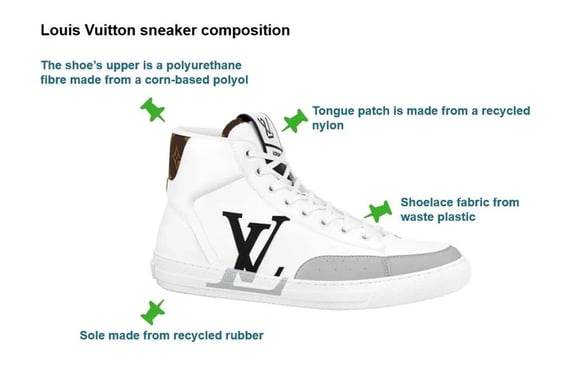

French fashion house Louis Vuitton (LVMH), for example, sells no ladies' handbags under the US$1000 mark. Widely considered the world's most expensive luxury brand, it launched a 90% sustainable materials-based US$1000 sneaker in 2022.

Of course, the ROI (return on investment) thanks to the sneaker's price tag justifies the cost of the recycled and renewable raw materials used to produce it. In this way, LVMH is a hot target for producers of low-yield high-cost recyclable or biobased materials because its end customers can afford to pay the premium.

Source: LVMH/Tecnon OrbiChem

Want to Know More About Footwear Feedstocks?

We dissected the raw materials supply chains for LVMH's Charlie Sneaker in our blog post Recycled Synthetics vs Renewable Fibres.

Find out about the petrochemicals used in traditional shoemaking – which underpin the majority of footwear sector output – in our blog post, Footwear Feedstocks Price Forecast: A Chemicals Cost Comparison.

The blog post includes a free-to-download eBook with datasets indicating pricing for the raw materials that make up EVA foam in midsoles – ethylene and vinyl acetate monomer. Also explored are propylene oxide and other chemicals used in polyurethane-based shoe components.

Edging on Commercialization

Tecnon OrbiChem's global sales manager Matteo Baldi recognizes the glass ceiling... Scale-up and cost of production processes are the biggest limitations, together with the supply and traceability of sustainable feedstocks.

"So far, like most new technologies, these raw materials remain prohibitively costly until they are commoditized. Endless startups with new, disruptive products and processes are unable to scale up. Often, commercialization fails due to the very high costs."

"Creating sustainable materials is costly because, so far, neither the yield nor properties of the materials obtained – in biochemical plants at least – have reached a scale-up level necessary to underpin a good selling proposition."

Stabilizing Cost?

The Louis Vuitton pricing strategy, Lynch interjects "has the advantage of being free of petrochemical price fluctuations. The perceived benefit lies in the potential for more constant pricing, even if it is much higher."

"However, petrochemicals market fundamentals remain very important," adds Lynch. "Because they set a 'floor price', which sets the expectation for the premium price."

"However, petrochemicals market fundamentals remain very important," adds Lynch. "Because they set a 'floor price', which sets the expectation for the premium price."

Having explored biobased and recycled opportunities, one household name brand Tecnon OrbiChem consultants met with at EPCA, is hedging its bets on CO2.

"The company's experts have calculated an internal carbon cost and are prioritizing sustainable suppliers. Those able to provide goods with a reduced emission profile are given the CO2 cost credit against the selling price," he adds.

Mapping Sustainable Pathways

In general, companies applying strategy at this level have fully surveyed internal operations. They’re cutting in-house emissions already, so their expert teams probe supply chains to identify Scope 3 emissions. Once identified, they devise a reduction strategy with the supplier.

"Lowering environmental impact involves the entire value chain. From the raw material and its production to transportation, energy, and product manufacturing processes. It can take optimization of a whole supply chain to make a sustainable product," adds Baldi.

In fact, that's exactly the approach taken by Hempel – as explored in our blog post Putting Sustainability at the Heart of the Chemicals Sector. The strategy is also explored in our, Sustainable Trade Europe: Internal Carbon Price Raw Materials, blog post.

Recycling Technology R&D

According to Lynch, the leisure product brand's strategy also includes both mechanical recycling and chemical recycling, with the latter reflecting the lion's share.

Multiple partners are collaborating to realize dissolution technology – a purification process through which the polymer present in mixed plastic waste is selectively dissolved in a solvent. "My contacts even talked of a demonstration plant," adds Lynch.

This brand believes that chemical recycling's purity surpasses that of mechanical recycling. "That's vital for consumer peace of mind," they said. "But chemical recycling also has the potential to enhance supply chain security by utilizing hard-to-recycle post-consumer mixed plastic waste streams," Lynch adds.

To Conclude

While companies are keen to develop sustainability profiles in chemicals and consumer markets, many market participants have a way to go before such initiatives can be hardwired into strategy.

"Some companies and brands are willing to pay a premium for eco-alternatives," says Baldi. "But we must remember that final products will cost more which many consumers won't always be willing to pay," he adds.

Subscribe to our blog to stay up to date on issues and market insights in the chemical industry.

This is the second blog in a two-part series. Check out part I, Key takeaways from a premier petrochemicals event: EPCA, Vienna 2023, for a detailed discussion from our chemical expert team on market outlooks for the chemical sector, from epoxy resins, PET & polyester, to plasticizers and methyl methacrylate.