Recycled rubber and Nylon, and renewable wood-based resources underpin sustainability initiatives from key apparel brands adidas and Louis Vuitton (LV) this summer.

The latter’s footwear comes hot on the heels of its parent company LVMH’s commitment to use biobased packaging and materials – namely polyethylene furanoate (PEF) – developed in partnership with US-based carbon negative materials company Origin.

And German sports brand adidas launched its first knitted wood-based product – the Terrex HS1 Hoodie – which costs around £130. Its fabric – says adidas – is 30% wood-based and 70% organic cotton.

While these may be bold sustainability moves by a high-profile pair, the apparel market overall has been woefully slow to implement sustainable practice within supply chains. Compared to conventional production, so-called ‘preferred fibres’ – says global non-profit organisation Textile Exchange – improve environmental and/or social sustainability outcomes and impacts. However – as of 2021 – less than a fifth of global fibre market products are this positive type, the organisation’s report shows.

In-sector circularity paints a bleaker picture. The Textile Exchange report gauged pre- and post-consumer recycled textile use in 2020 at under 0.5% of the global fibre market. Besides the obvious challenge of collection and sorting of consumers' used garments, they generally demonstrate deteriorated properties compared to virgin fibres.

'...continuous demand for new products accompanies population growth,

which necessitates production using raw materials, not just waste...'

Sustainable textile company Aquafil

In some cases however, monomers or other starting materials can be regenerated to allow fresh polymer production and virgin fibre manufacture. Polyamide 6 (PA 6) is the fibre that best lends itself to this approach, since the monomer from which it is made – namely caprolactam – is easily regenerated from the polymer.

Less easy to recycle is Polyamide 66 (PA 66), which can be reprocessed only once or twice due to the increase in crystallinity each time. PA 66 is not easily depolymerised back to the monomers, although some claim to be able to recover adipic acid. For the rest, it is similar to PA 6 with regard poor sustainability but is also more expensive.

Source: Louis Vuitton

Component accounting

LV's Charlie sneaker – with its £780 price tag – comprises 90% sustainable materials says the retailer’s website. The shoe’s upper mixes recycled and biobased materials. Potentially, says Tecnon OrbiChem's biomaterials expert Doris de Guzman, the biobased element of the upper is made with material from DuPont's Sorona range.

Recycled rubber is used in its outsole and the recycled polyamide that makes up the sneaker's tongue patch is Econyl – a material made by Italian firm Aquafil. Though established in 1965, Aquafil has been using post-consumer waste Nylon 6 – including fishing nets recovered from the sea – as a fibre starting material for over a decade.

In Aquafil's process, Nylon 6 waste streams are depolymerised, purified, and regenerated into fresh polymer. The polyamide filament it yields is spun into new materials and products.

Depolymerisation doubts

Evolving beyond the circular model on which its business was built, Aquafil is turning its attention to biobased options. This is because, it says, depolymerisation methodologies alone will not allow the Nylon industry to be 'completely independent of fossil-based raw materials'.

'World population growth is accompanied by a continuous demand for new products that must necessarily be produced from raw materials, not just from waste,' the firm indicates.

Last week, Genomatica and Aquafil jointly announced their first several ton yield of the Nylon 6 building block monomer caprolactam from plant-based sources. Having successfully converted the yield to Nylon 6 at a new Aquafil Slovenia-located demonstration plant – said a joint press release – they now plan to evaluate the feedstock in applications such as yarns for textile and carpet, and engineering plastics.

Another Italian company Fulgar turns old car tires into new materials. Additionally, the company launched what it says was the first 100% biobased polyamide – designated Evo – in 2015. More recently, the firm leveraged the chemicals giant BASF’s ChemCycling recycling project to create PA 66 Q-Cycle.

The project demonstrated the feasibility of fossil raw material re-use at its end of life. Vitally, using initial component forms delivered new feedstock streams exhibiting the same properties as their virgin counterparts.

Organic carbon

To bring its 30% cellulose fibre-based hoodie to market, adidas worked with Finnish sustainable material startup Spinnova. Founded in 2014, Spinnova developed technology for making textile fibre out of wood or waste such as leather, textile and even food waste.

The company claims to achieve this without the use of harmful chemicals, using very little water and producing no waste. Brazilian pulp and paper company Suzano and Spinnova are currently building €31 million plant in Jyväskylä, Finland. It is due for completion by the end of 2022.

Water-saving

That the adidas/Spinnova hoodie's cotton component is organic is important given that non-organic cotton production – though still technically using natural fibres – relies on a great deal of water and chemical input. A 60% shrinkage of the surface area of the Aral Sea – located between Kazakhstan and Uzbekistan – over four decades prior to the millennium is linked to over-intensive cotton farming.

It was announced in June that Sweden's textile recycling firm Renewcell had partnered Swiss textile technology company HeiQ Aeoniq to manufacture circular cellulose filament yarn from pulp. Renewcell positions its branded Circulose material as a direct substitute for virgin cotton, wood, and oil in high tenacity performance fabrics.

The partnership is looking to develop a 100% textile-to-textile recycled, biobased, biodegradable yarn with the physical performance of polyester and Nylon. Adding to sustainable credentials, the process's water consumption will be 99% less than that of cotton yarn production.

Evolving strategy

Austria's specialty fibres manufacturer Lenzing refined its production processes by incorporating water-saving innovation and closed loop technology that recovers 99% of the chemicals and water used.

Lenzing Group global textiles business vice president Florian Heubrandner defines the company's vision for its flagship fibre Tencel as pushing the boundaries of comfort and sustainability. And, he adds, to 'define the best we can do in terms of carbon footprint [and] recycling share.'

Speaking in May 2022, Heubrandner pinpointed realisations around recycling and circularity as significant past year developments. ‘We finally realise that our linear business model is no longer valid and we need to turn it circular,’ he added.

By adding cotton scraps at roughly 30% capacity to wood pulp-derived cellulosic polymers, the company now produces a Lyocell fibre branded Refibra. The textile industry’s carbon footprint and the importance of traceability within the textile industry have also been key realisations, Heubrandner said.

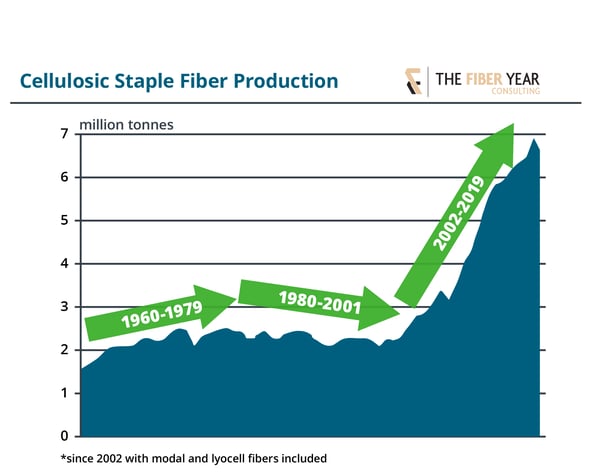

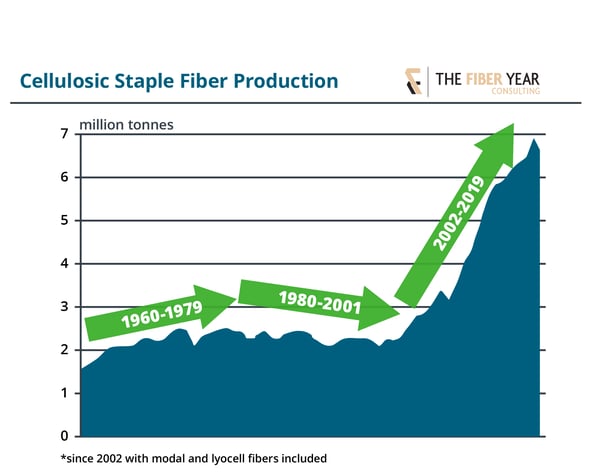

Cellulosics on the up

Source: The Fiber Year

As explored in our prior blog post Cellulosics - A world of opportunity fibres derived from natural cellulose – a non-petrochemical source – are gaining interest. German research and consultancy enterprise nova Institute found cellulose fibres to be the bioeconomy’s largest investment sector in 2019.

People, opinion, plastics

Increasingly, the public wants consumer goods that can legitimately claim to be protecting the planet. And, it appears, consumers are progressively factoring the environmental-friendliness of goods into their retail decision-making.

70% of respondents to a survey carried out by US-based industry association the Plant Based Products Council and published in July 2022 said they consciously think about products and packaging made from plant-based materials when shopping. That figure represents a 5% increase on 2021 and, says the association, is rebounding to pre-pandemic numbers.

With that level of consumer engagement, now is the time for brands to embrace the Environmental, Social and Governance values that mirror the zeitgeist.