A challenge for chlor-alkali producers is balancing offtake for its two products streams – caustic soda and chlorine. The distinct demands of their different downstream markets, which react differently to changing economic circumstances, can trigger specific pain points in this chemical subsector.

Caustic soda is used in paper and pulp, food industries, soap & detergent, metal industry, textile, pharmaceutical and rubber industries. While chlorine is used in manufacturing of PVC and many chemical syntheses, and in water treatment.

In fact, this product pairings’ price fluctuations tend to move in contrary directions. And the result is that the chlor-alkali business operates in cycles, with markets moving from caustic-strong/chlorine-weak to caustic-weak/chlorine-strong and back again.

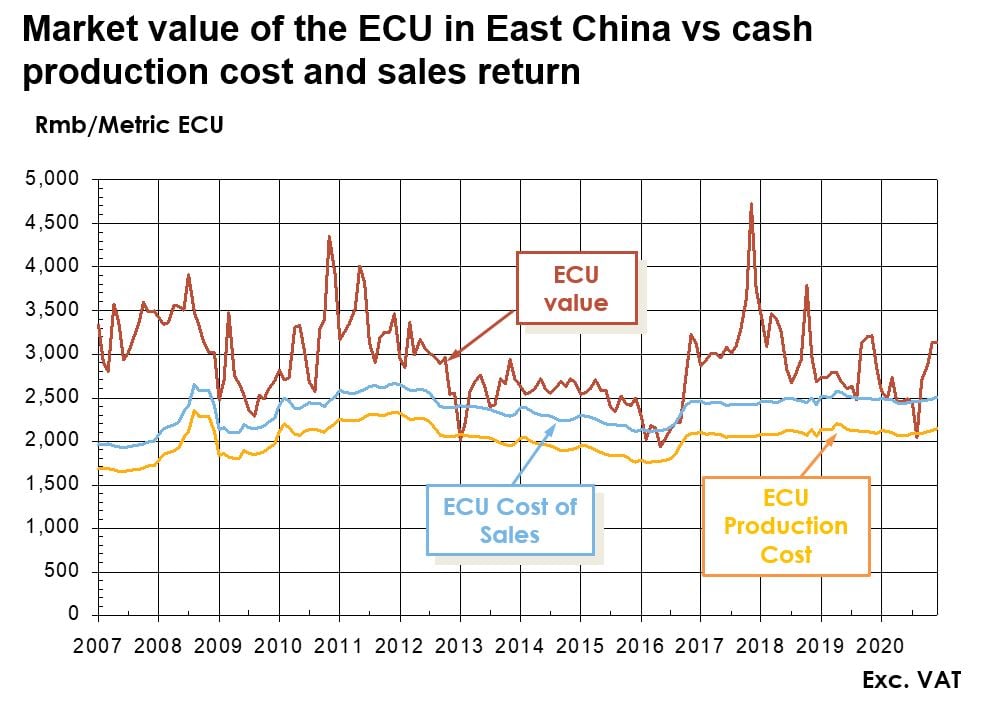

Working with the Lantau Group – a Hong Kong-based consultancy which benchmarks power consumption/intensity – Tecnon OrbiChem investigated the cost of production of the electrochemical unit (ECU) of China's largest chlor-alkali plants. Each of the 70 plants investigated have an annual caustic soda capacity of 300 kt, or more. The results are presented in a study, which benchmarks the plants according to their cost of production of the ECU.

The study shows that China accounts for about 80% of the total new capacity expected to come on stream worldwide over the next few years. Around 3 million tons of caustic soda could come on stream over the next two years in China, of course there is a possibility that some of these projects will be delayed (or even cancelled) depending on how demand evolves.

From rock bottom upwards

In the summer of 2020, the chlor-alkali business was on its knees. As Tecnon OrbiChem founder and senior advisor Charles Fryer explains in the video, the point at which prices hit rock bottom is a good place to start when charting a chlor-alkali business cycle.

'As the economy starts to emerge from a recession, builders merchants rush to stock up on materials like PVC pipes, rainwater goods and sidings resulting in a boom in chlorine offtake'

Charles Fryer, Tecnon OrbiChem Founder and Senior Advisor

Pointing to the emergence of certain trends and behaviours when a recession nears its end, Fryer verbalises exactly what we've been seeing as economies have clawed back into growth following Covid-19 lockdowns and restrictions.

‘People start to think about buying a new house – or repairing their current house – having made savings during the downturn, helped also by interest rates that are likely to be still low,' Fryer says.

Watch Charles Fryer in this video on chlor-alkali industry cycles below

‘Builders realise that their inventory of building materials is too low and rush to stock up on such materials as PVC pipes, rainwater goods, sidings etc. PVC producers see a surge in orders, resulting in a boom in chlorine offtake.’

This has been the scenario for much of 2021, Fryer adds but caustic soda will be the strong performer in 2022 – 2023.

Pendulum effect economies

And yet, by 2024, the chlor-alkali business’ current cycle will come to a close, Fryer predicts – largely because every economic boom’s tendency is – with the passage of time – to wane. Interest rates rose in countries including the UK, South Korea, New Zealand and Brazil in 2021. And in the US, the Fed raised rates a quarter point this month, with more slated to come as 2022 progresses, which could eventually cause a slowdown in economic growth.

What Fryer predicts is capital goods and housing sales slowing. And eventually, chlorine prices will return to the low prices seen in 2020, with caustic soda prices later deescalating too.

Benchmarking chlor-alkali plants in China

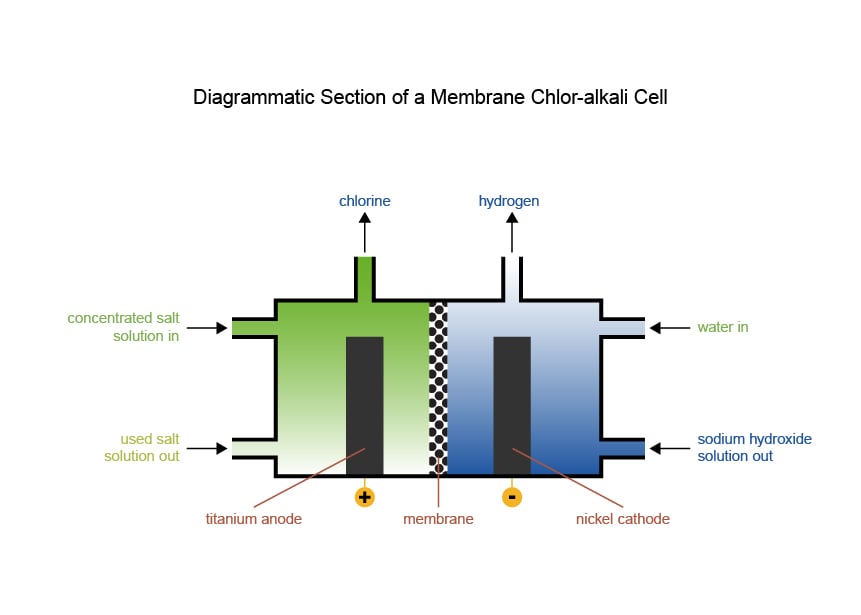

The cost of electricity accounts for at least 50% of the total cost of production of the ECU. Chlor-alkali plants using membrane cells – the leading technology in China – can enjoy the lowest production costs, while diaphragm technology carries the highest cost.

In our study Benchmarking of the Chlor-Alkali Plants in China – which we referenced in a previous blog Chlor-alkali: 2021 review and outlook for 2022 – various contributions to the costs of production of the ECU are compared plant by plant across the country.

Energy cost variables – such as those of the Chinese companies that were subjected to China’s ‘dual control’ policy of 2021 – impacted production and trade flows significantly last year. It’s a subject our consultants probed extensively with regard to their respective chemical families in a white paper published last year.

In fact, Chinese chlor-alkali producers lowered operating rates from early September 2021, affected by the environment inspection and the control of energy consumption of the Chinese government. The average operating rates of chlor-alkali producers in China dropped 10-20%, which tightened supply substantially.

And the operating rates of Jiangsu producers decreased from 90% or so in early September to 20-30% in late September as many producers shut down or reduced operating rates amid the severe situation of environmental inspection of Jiangsu province. Producers continued to raise prices based on substantially tightened supply.

Source: Tecnon OrbiChem

Source: Tecnon OrbiChem

Coming full circle

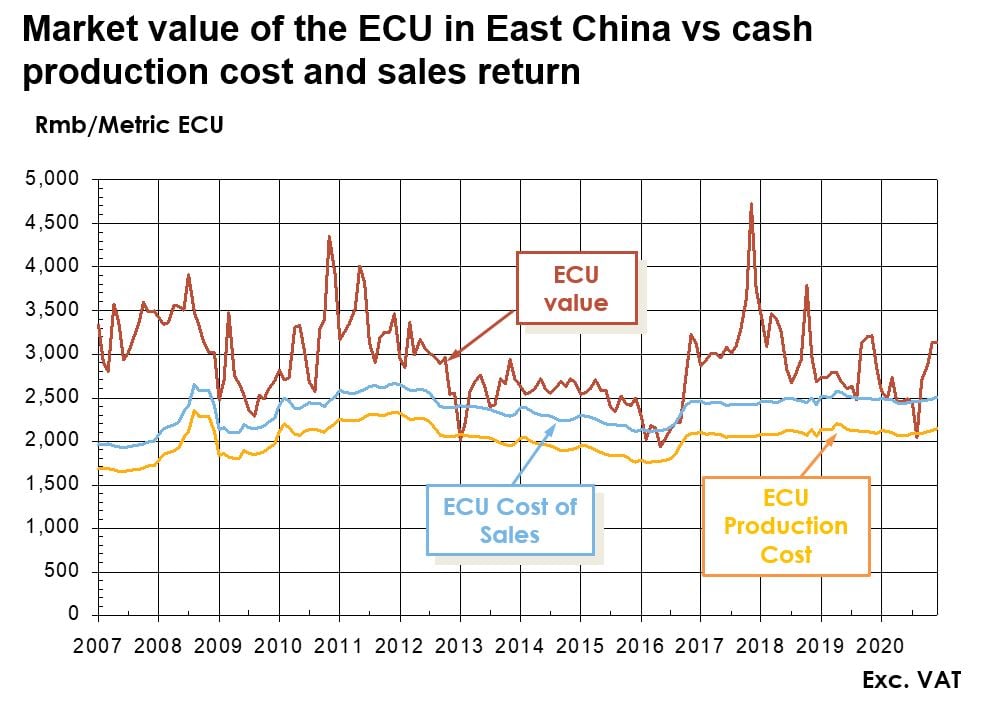

The cyclicality of profitability is clearly seen in the graph above, with points of zero profitability coming up at intervals of a few years.

The ‘relative competitivity of chlor-alkali producers over the wide extension of territory and huge diversity of operating conditions that China reveals’ present distinct challenges. This collaborative study provides an overview of the factors shaping the cost structure of the industry, and compares the costs of production of the ECU throughout China.

And as Fryer says, it is vital that any business looking to trade with China's chlor-alkali producers or consumers has access to this unique insight. To access the graphs and infographics shown in the video, fill out the form below and we will send it straight to your inbox.

Source

Source