What has happened since early February?

During February, China has been slowly returning to work after an extended time away from offices and factories as the Lunar New Year holiday was extended from 30 January to 2 February --- and then in many places to 10 February and beyond -- in an attempt to contain the COVID-19 corona virus that first manifest in humans in December 2019 in Wuhan, Hubei. As the government struggles to contain the virus, transportation and travel are restricted across the country. Transport of goods across cities and provinces are more challenging in some regions; only trucks with a local registration and local resident drivers are allowed to drive through. This has led to delayed traffic and shortages of trucks and drivers, and thus prompted freight rates to increase significantly. The impact on international shipping has also been marked with a significant slowdown in all activity and a shortage of containers is also reported due to the lack of vessels moving out of China.

The news about the virus was updated on 18 February by the head of the World Health Organization (WHO). As of 6 am Geneva time on 18 February, China had reported 72,528 cases to the WHO, including 1,870 deaths. In the previous 24 hours, China reported 1,891 new cases, including both clinically- and lab-confirmed cases. Outside China, there were 804 cases in 25 countries, with three deaths. In the 24-hour period preceding that update, there were 110 new cases outside China, including 99 on the Diamond Princess cruise ship. So far there are 92 cases in 12 countries outside China of human-to-human transmission. The WHO said it does not yet have enough data on cases outside China to make a meaningful comparison on the severity of disease or the case fatality rate.

Update on the impact on the Economy

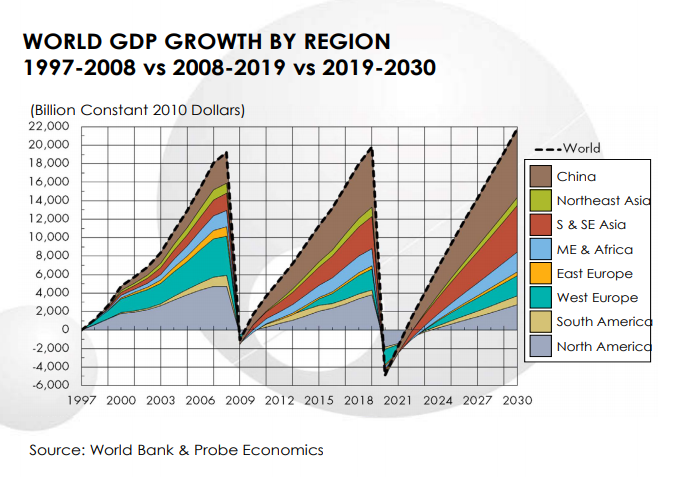

The scale of disruption caused by the COVID-19 outbreak is forcing economists to re-think forecasts for economic growth in 2020. It remains difficult to predict the ultimate impact on the global economy and on people’s livelihoods although the impact of the epidemic is clearly focussed more on China and the knock-on effect on other regions has not yet been established. Reduced production of almost all end-products from electronics to auto-parts to textiles means an economic slow-down not just in China but across the globe. The spread of the virus has been well contained so far and one of the biggest worries is that when the virus hits fragile and vulnerable countries, for instance some countries in the Middle East and Africa, the effects could be devastating. As previously reported, on 3 February, the first trading day after the Lunar New Year holiday, the China stock market plummeted by around 8% amid virus fears, the worst day in over four years. The Chinese government already expects that GDP growth will drop from the expected 6% to 5% this quarter, while Q2 will see 6% restored. Many observers think this is optimistic and indeed Morgan Stanley is reported predicting a drop to 3.5% this quarter with recovery heavily dependent on when the epidemic is finally contained, and when the number of new cases stops going up. There will be repercussions throughout Asia, and the coronavirus outbreak has spread to more than a dozen other countries, causing stock markets around the world to weaken. The global economy has felt the reverberations with the drop in crude oil prices one of the notable signs of weakening. The worry is that the economic impact could exceed that of the SARs epidemic in 2003 as the scale of this outbreak has already exceeded that of SARs in numbers of people who have diagnosed with the disease. The total estimated cost of the SARs epidemic was $40 billion, according to a report published in 2004 by the Institute of Medicine (US) Forum on Microbial Threats.