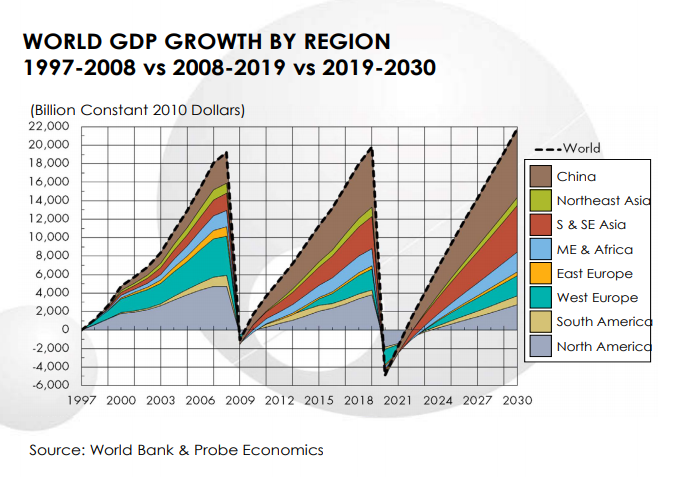

Engineering thermoplastics markets have not been spared during the ongoing COVID-19 coronavirus pandemic which is creating massive challenges for the global economy. With whole populations told to remain in “lockdown” for weeks at a time, normal routines have been disrupted and many businesses of all kinds have been shut. While some petrochemical markets remained buoyant in late March – particularly those market sectors deemed essential to ongoing operations of food supply lines, hygiene products and medical supplies -- others were straining under the loss of demand and companies were lowering operating rates in anticipation of weak conditions in April. There had been hope that demand for engineering thermoplastics would increase in Q2 2020, but this is no longer the case.

For many engineering thermoplastics markets, there was a further shock as the major automobile manufacturers in key production centres across Europe and in countries including the United States, Mexico and Brazil, shut factories amid widespread travel restrictions, border closures and slumping demand. The shutdowns originally were expected to last until the end of March, but most automobile manufacturing plants will remain closed well into April. There also have shutdowns affecting a range of consumer goods, including home appliances. The production base for home appliances in Europe is located in northern Italy which was an epicentre of the COVID-19 outbreak in the region.

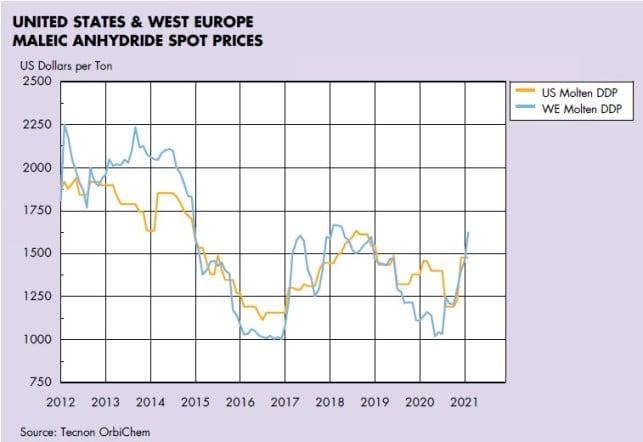

Amid the turmoil in the markets over the political and practical responses to the COVID-19 crisis, markets around the world were hit with a stunning development in the crude oil prices. Crude oil levels had been under downward pressure in February and early March due to decreased demand from China as transportation systems and logistics networks were under were closed or severely restricted.

The situation was exacerbated in early March as OPEC members and non-OPEC producers could not agree on further production cuts scheduled to start in April, which led to a row between Saudi Arabia and Russia over crude oil production limits. Saudi Arabia responded by cutting its Official Selling Price for April, triggering a steep decline in global crude oil prices beginning on 6 March when ICE front-month Brent prices fell $14.25 in open trading to $31.02/bbl. On 9 March, Brent was selling at $36.50/bbl in early trading, while WTI was pegged at $32.90/bbl, but prices continued to fall sharply as the impact of COVID-19 virus gripped global markets. At the end of March, Brent crude prices briefly dropped below $18/bbl before recovering to around $25/bbl. Crude oil prices continued to look vulnerable as stock levels were threatening to overwhelm storage capacity in early April.

The unprecedented decline in crude oil demand and the subsequent price collapse sent shockwaves through the petrochemical markets. Values for key feedstock for engineering thermoplastics including ethylene, propylene, benzene, paraxylene and methanol all decreased substantially. Those decreases in turn have impacted key intermediates such as styrene monomer for ABS; caprolactam for PA 6; bisphenol-A for polycarbonate; and purified terephthalic acid for PBT. Engineering thermoplastics producers may not see the benefit of lower raw materials and production costs due to the questions about demand levels during the second quarter. In China, the COVID-19 outbreak was at its worst in January and February, and by March most industrial activity was restarted.

However, market participants in China are dealing with over-supply as some downstream businesses have not yet resumed normal operations. This has put additional downward pressure on Chinese market prices heading into Q2.

Most producers and consumers active in the key engineering thermoplastics markets covered by Tecnon OrbiChem – polyamide 6 & 66 resin, polycarbonate, polyacetal, PBT and ABS – were operating normally in early March. Heading into April, however, companies throughout the various value chains were making critical decisions regarding operations of major plants based on quickly changing demand patterns and order book levels. It would not be surprising to see reduced operating rates or even some shutdowns if demand worsens in April.

The lack of clarity over supply is a daunting prospect for the engineering thermoplastics sector. Many advanced materials companies are working to provide items of personal protective equipment (PPE) to healthcare workers involved in efforts to help victims of COVID-19 and stop the spread of the pandemic. Polycarbonate sheet, for example, is needed to produce visors. It is unlikely, however, that this application can replace the volumes lost due to the shutdown of the auto industry and other major end-use markets.