World supply chain security may hang in the balance of the Chinese government’s zero-covid policies... The potential for ongoing lockdown measures to gridlock the country’s ports is a matter of concern to both internal and external markets.

Since movement control measures were introduced in Shanghai’s eastern region at the end of March, the terminals of Shanghai International Port Group have become a storage site for containers destined for the municipality.

As the restrictions widened, yards within the port areas filled up – including spaces allocated for dangerous goods – and remained so throughout much of April.

Yard costs cut

To mitigate costs for goods owners caught up in the issues, the port group announced 50% discounted yard costs on import containers (including abroad and local) from April 22 to the end of the month. It was noted that refrigeration costs were not included in the discounts.

April’s end brought some relief as containers destined for locations outside Shanghai had already been dispatched – freeing up yard space for more. However, in light of the Chinese government’s extension of Shanghai’s full lockdown yesterday (4 May 2022), Shanghai-based supply recipients could face a wait for their goods. The prospect of congested ports looms large again.

Keep calm and carry on

Operating rates at Shanghai-based manufacturing facilities are low despite options to bypass stringent lockdown rules by, for example, provisions for staff to live on site and the isolation of operatives within facilities.

That continuance of operations cannot however overcome the limits on the movement of goods and transportation. Where supply has become available for shipping, there’s no guarantee it can reach a Shanghai port for export. A source told Tecnon OrbiChem that delays in the arrival of cargo from Shanghai rendered port areas relatively quiet. Export activity has been subdued by usual standards too.

'Polyester operation in China took a hit, cut from 93% capacity in mid-March to less than 80% by early April'

Terry Li, Tecnon OrbiChem consultant

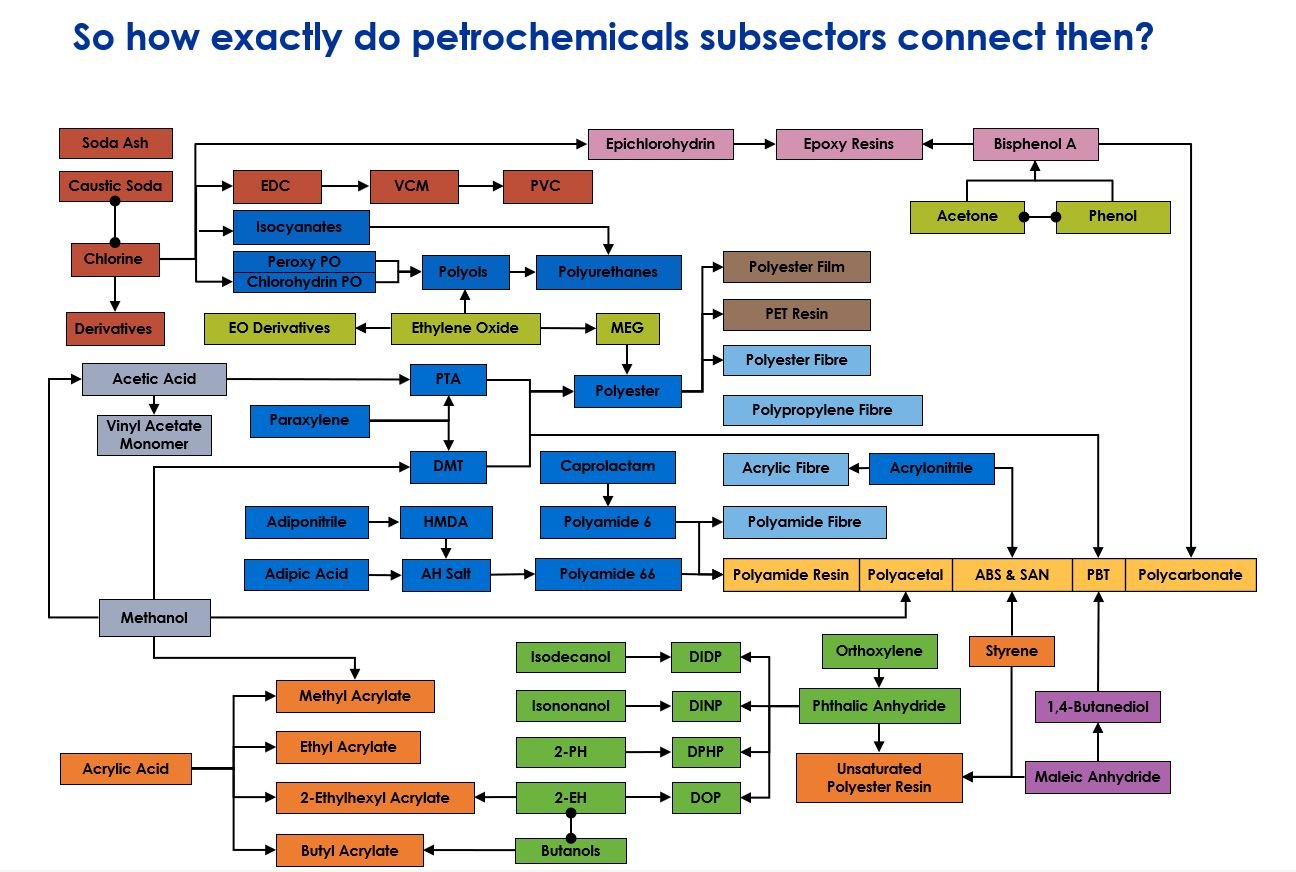

Ethylene Glycol, Ethylene Oxide & Derivatives, Olefins, Polyolefins

Polyester plus feedstocks ethylene oxide, and glycol

Polyester operations in China took a hit, cut from 93% capacity in mid-March to less than 80% by early April. While the shipping vessel to tank procedure in raw material transportation is experiencing no delays, the lags in transportation from port terminal tanks to the polyester producer plants are problematic.

The costs of transporting monoethylene glycol (MEG) from northwest China to east China have risen since March. Overall production capacity and product availability to demand ratios for MEG were largely unaffected, logistics were impacted.

Restrictions are such that trucks that have been inside outbreak cities are subject to stoppages, meaning costs have increased due to a hike in demand on a pool of fewer vehicles. Drivers are being required to test and confirm a Covid-19 status more frequently.

Import processes however, slowed due to delays in the release of relevant documents. International trade processes require a ‘letter of credit’ the transfer for issuance of a bill of lading – essentially, a cargo inventory, or receipt. While lockdown measures are impacting that part of the process, telex messaging has been possible. All the while though, containers continue to stack up at China’s ports, gridlocking the entire logistics process. In response, shipping company Evergreen Marine has cut some container-over-rent costs in Shanghai.

Acrylic and acrylates

Northern China-based Qingdao port picked up some of the slack caused by Shanghai’s port’s inability to fully operate. Reported to have been a hub of activity in April, the port was able to provide service to north China businesses still in operation due to no serious Covid-19 outbreaks locally. Still, cargo earmarked for Shanghai will not export through Shanghai port.

With some orders shipped to north China for export, the northern China-based Qingdao port was busy in April. Shipping by bulk along the Yangtze River was found to be unaffected. While this opened up the possibility of transport via ports located along Asia’s longest river, the inland transportation both to and from those ports inland remained an issue.

Knock-on effects

A reduction in producer operating rates for acrylonitrile butadiene styrene (ABS) led to weaker demand. Currently, there is ample ABS supply despite some plant shutdowns. Home appliances and car makers however, are experiencing delays in domestic deliveries and arrivals of imported components.

Downstream users even end consumers hold the orders due to the uncertainties of lockdown so that demand for ABS weakens. It is also heard that oversea buyers of end products such as home appliance hesitate on order placement. ABS inventories are piled up and ABS producers continue offering competitive prices.

In response to slow domestic demand for maleic anhydride, Chinese suppliers of the chemical are shifting their volumes to the export market and dragging down prices in Asia.

Caprolactam

Logistics issues have forced some caprolactam producers to cut operating rates, or even shut down units during the lockdown period. The decreased operating rate of some downstream producers in east China means orders are being redirected to other areas. Some polymer producers in other areas have been increasing the operating rate because of an increase in orders.

Export market is not bad. Although Shanghai Ports cannot fully operate, other ports in east China have not been influenced by the Covid-19 outbreak.

Some polyoxymethylene (POM) producers decreased operating rates or shutdown units as inventories increased. Food supply problems caused by the Covid-19 outbreak triggered an optimistic outlook... Many consumers are looking to buy bigger refrigerators, freezers and other home appliances to mitigate predicted issues. In response, downstream buyers are increasing POM inventories to take advantage of an anticipated engineering plastic market boom once the outbreak is under control.

This blog post was created with contributions from members of our China-based team of consultants.