As Russia continues its invasion of Ukraine, aspects of the chemicals value chain are shifting – with signs of rebounding Ukrainian demand and a return to day-to-day business activity.

Yuriy Shafran is the marketing director and co-founder of Ukraine-headquartered OSV, a polyurethane (PU) processing machinery maker and raw materials supplier. He, along with OSV’s senior engineer and two other colleagues, relocated – and now operate from – the company’s satellite site in Poland.

Shafran told Tecnon OrbiChem that he believes – as of mid-April – around 50% of OSV’s Ukrainian customer base were operating within the country, some having relocated to its western frontier. ‘A month ago the situation was different. People were shocked by the war and unable to proceed with their lives. After almost two months, people are seeing how to make the next steps. We understand that if we stop, we will not be able to recover.’

Dramatic changes in phenol markets

The European phenol market has gone through a dramatic change in just a few weeks. Over the last few years, market participants have mooted the idea of moving from quarterly to monthly adders (above benzene contract), but in the past both buyers and suppliers have been reluctant to be drawn into lengthy monthly discussions.

With the recent extreme volatility in the energy and feedstock markets, however, adder negotiations will take place on a monthly basis from Q2 onwards. Manufacturers believe this will continue while the Russian-Ukrainian conflict persists and all markets remain susceptible to further price shocks.

Rising energy costs had already pushed production costs up and prompted European epoxy resins producers to announce energy surcharges for April business. Huntsman, Westlake Epoxy and Olin introduced €300-350/ton energy surcharges from 1 April.

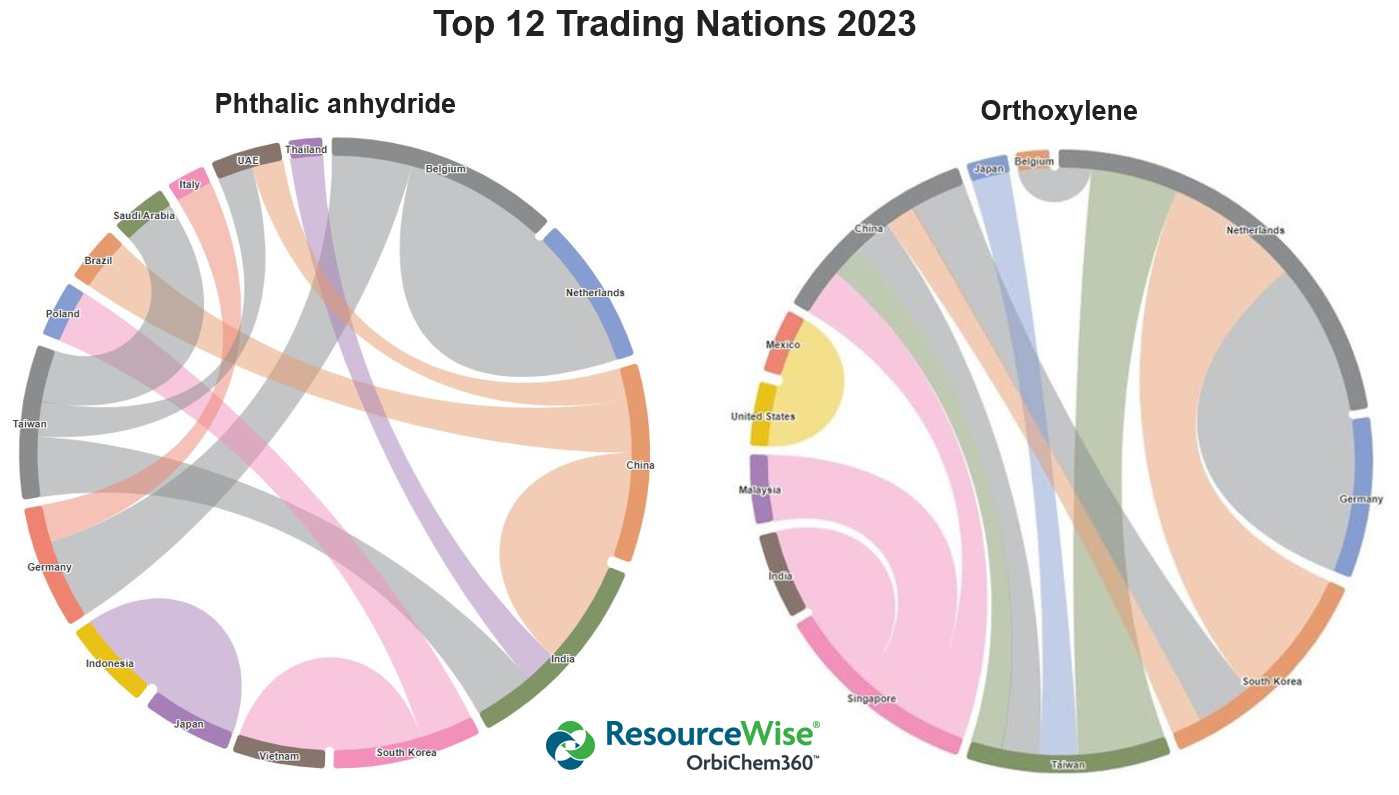

Orthoxylene and phthalic anhydride

Suppliers and producers in neighbouring countries – and even the US – have received enquiries for both orthoxylene (OX) and phthalic anhydride (PA) from within the invaded nation.

US markets however, are said to be ‘sold out’ due to continued high domestic demand and therefore unable to assist countries in mitigating the supply chain disruption caused by the war. Even before factoring in the additional high freight costs and uncertain transit times associated with general international trade, US market participants appear uneasy with the uncertainty of stability in this sector.

Neighbouring European producers that previously supplied the Ukrainian market are capitalising, benefitting from the close proximity and consequent cost effectiveness of meeting the demand.

Western Europe is experiencing negative effects as some Central/Eastern European producers no longer divert as much, if any, material to tightening western markets. The most notable impact is in West European spot markets, described as having ‘nothing available’ The few spot deals happening do so at extraordinarily high prices, while those operating under contracted supply arrangements still appear to find supply somewhat manageable.

OX supply may slightly improve in the short term amid Q2’s multiple PA maintenance stoppages. PA markets, however, will likely endure tightened supply until regular operations resume. Only then can producers assure not just regular contracted supply volumes, but also release excess material held for inventory to supply the spot market.

In this tightened market, Northeast Asian suppliers are receiving OX enquiries from Europe. With China experiencing its worst Covid-19 wave since 2020 – and in view of the limited spot availability from other Asian suppliers – it’s unlikely any excess volume there will mitigate the worsening supply situation in Europe.

Caustic soda

Chinese caustic soda export volumes will hit a record high in 2022, with European buyer demand a key factor. China and northeast Asia saw unprecedented requests for large quantities of caustic soda from European buyers after February. Spot product from northeast Asia producers has been limited however, so China met most of the European buyers’ need.

China’s total export volume of caustic soda was around 1.09 million dry metric tons in 2021. One major international caustic soda trader has bought 370,000 dry metric tons of caustic soda from China since 1 January, 2022.

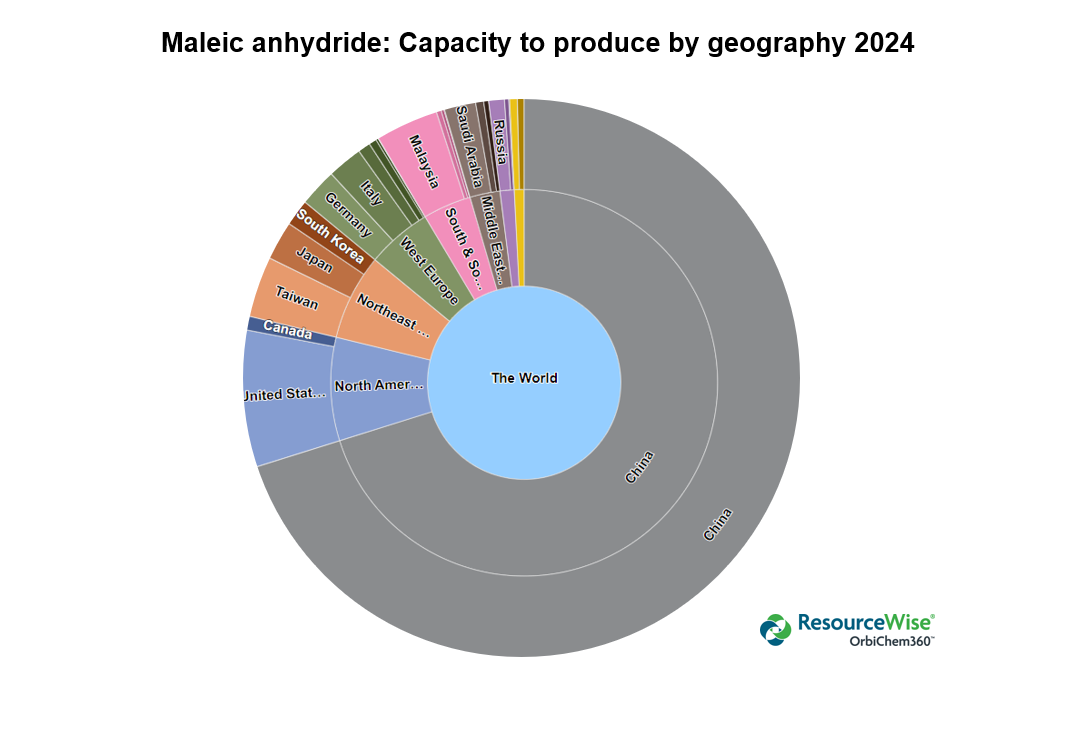

Russia’s European maleic aspiration on hold

There is no update on the production status of Sibur’s new 45 ktpa maleic anhydride (MA) plant in Russia which was supposed to start up in March. It is unlikely that Sibur’s material will be entering Europe this year, given the current political climate. Alternative export options such as the Middle East and Turkey have been proposed, but it remains to be seen what options the company will decide to take as it tries to reposition itself in the market.

In Europe, supply of MA appears normal with no evidence of production issues so far. Great uncertainty and volatility will keep market participants wary.

European maleic producers may be trying to diversify their raw material supply in a bid to minimise any potential production problems, but no doubt there will be challenges in the process and the threat to feedstock availability due to a possible ban of Russian gas imports into Europe still remains. Meanwhile, elevated prices and costs could start to cause some demand rationing down the road.

...But Russian supplies rumoured to circumnavigate sanctions

An unspecified volume butyl acrylate (BA) from Russia may still be entering the market via Finland and finding its way to European traders/consumers. Although some major companies have distanced themselves from Russian product, this is not universal and prices for these imports are rumoured to be below European spot prices. Turkey and India are both reported to be actively purchasing Russian BA.

Meanwhile, the methyl methacrylate (MMA) market is suffering on two fronts due to the war in Ukraine. Firstly, the run up in natural gas costs has put pressure on the industry, leading to soaring costs.

And secondly, feedstock ammonia supply has become very tight. Ammonia is a big user of natural gas and some plants have cut rates or closed due to the high costs, including producer Yara. Also supply of ammonia from the Black Sea has been impacted by the war in Ukraine, as a major pipeline from Russia to Yuzhny was closed.

With the high cost of production and the tight supply of ammonia, European MMA producers have cut operating rates further. This has tightened the balance of domestic supply in Europe, and customers face higher contract prices in Q2. However, there remains interest to import into Europe from Asia, and this could compensate to an extent for the short supply.

Isocyanates price increases

After the invasion in Ukraine the most significant changes for MDI and TDI so far are the high increases in natural gas as Europe depends on Russia for its supply. This has led to huge increases in energy costs and energy surcharges are being introduced into contracts.

So far, only Huntsman has announced a surcharge but all the other European MDI producers are expected to follow. BASF has not announced surcharges, but the company has warned that if Russia cuts its gas to Germany by 50% it will have to reduce or close production at Ludwigshafen, which would be disastrous for the chemical industry.

Prices for isocyanates are now seeing significant increases and filtering down into polyurethanes.

One polyols buyer said producers tried to increase prices of some raw materials by up to €600/ton but this was declined as they would have no choice but to shut the plant if suppliers insisted the €600/ton increases went through.

China’s PET resin exports

With Russia and Ukraine important PET resin export destinations from China, a certain level of impact should be expected in 2022. In 2021, Russia accounted for around 7% of total PET resin exports from China while Ukraine was its sixth largest export destination. With an expectation among major Chinese PET resin suppliers that sales to Ukraine will drop significantly in 2022, they will sell PET resin more aggressively to other regions in 2022.

Already some local South Korean PET resin producers are concerned over increasing PET resin imports from China, a trend that is likely to accelerate as Russia continues its invasion of Ukraine.

Acetyls

Demand in the acetic acid and vinyl acetate monomer markets remained healthy during April, but market participants are not sure how much longer high levels of demand will be sustained due to high production costs.

Transportation delays and high freight costs are expected to continue throughout 2022 and possibly into 2023, which is problematic for European consumers who rely on regular large shipments of acetic acid and vinyl acetate monomer to maintain operations.