All eyes are on China this month as markets reopen after the Lunar New Year holiday. It is the Year of the Rabbit which, says Asian folklore, is a zodiac signifier of hope, resilience and a sense of cautious optimism. That's a good metaphor for where global markets find themselves today after the appalling financial performance of Q4 2022, with some businesses also bracing themselves for a worse Q1 2023.

But the general consensus is that most markets are coming close to rock bottom, which means only one thing: The only way is up from now on.

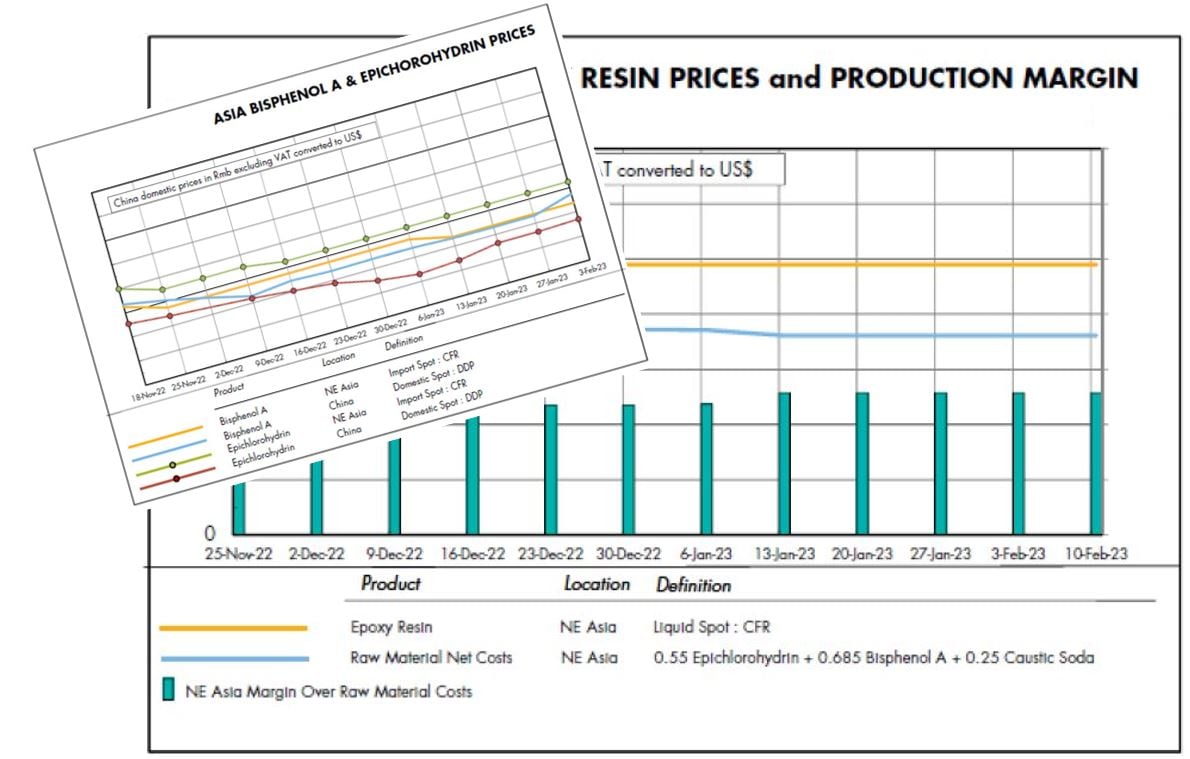

Tecnon OrbiChem launches Epoxy Resins Bisphenol A & Epichlorohydrin Weekly Report

Upgrade to 12-week price history charts & production margins for China/Asia output

Source: Tecnon OrbiChem

Spotlight on China

China always draws keen interest from the rest of the world at this time of year. A strong post-holiday rebound usually gives a boost to confidence and morale to the global markets. Optimism is sorely needed as major economies teeter on the brink of a recession; a pick up in China would be a glimmer of light at the end of the tunnel for Western markets.

In the first week of February, epoxy resins, bisphenol A and epichlorohydrin values increased slightly, but the uptrend ran out of steam very quickly and stabilised before the week was over.

Why is China is key to European/US markets?

Why is China is key to European/US markets?

Since Tecnon OrbiChem launched the epoxy resins monthly reporting service in 2016, China has always had an overwhelming influence on the global epoxy resins and its feedstocks markets. For example, in 2017 epichlorohydrin became very tight in China following a governmental crackdown on the disposal of waste water. A number of plants were forced to close down to make modifications, causing epichlorohydrin prices to shoot up.

This prompted Asian suppliers to divert both epoxy resins and epichlorohydrin imports away from Europe and the US to China so they could take advantage of attractive arbitrage opportunities. Supply in the US and Europe then became extremely tight, causing values to also soar in their domestic markets. (Asian imports on average make up 20-25% of the market in both regions - if volumes start to slip below these levels, supply becomes tight.)

Covid complications

Again in 2021, a combination of strong post-Covid demand and disrupted deep-sea transportation saw Asian suppliers once again favour the Chinese market. Buyers in both Europe and Asia were left scrambling for material, with some downstream factories being forced to close as they were unable to get all the raw materials they needed to run their plants. On the flipside, when demand sank to almost non-existence amid China’s zero-Covid policy from Q2 to Q4 2022, Asian suppliers, burdened with expensive stock, started to send imports to Europe and US by the droves. It was not long before a supply glut caused values to plummet in Asia, China and Europe. Prices in the US also faced downward pressure, but to a lesser extent thanks to a resilient economy, combined with reduced run rates at Olin’s Freeport site and a less fragmented market. European producers, however, facing high energy costs following the Russian invasion of Ukraine, struggled to compete against much cheaper Asian material. As a result, the market share of Asian and Chinese imports increased to 40-45% in Europe, causing values to drop by almost 30% in eight months.

From January to November 2022, imports from China to the EU27 rose 60%

compared to the same period in 2021

Tecnon OrbiChem business manager Jennifer Hawkins

Trade flows that shift significantly

Over the last couple of years there has been a significant shift in trade flows that will keep China a force to be reckoned with. Trade data shows that from January to November 2022, imports from China by the EU27 were up by 60% compared to the same period in 2021, and also up by 850-900% compared to the same period in 2020 and 2019. The surge of import volumes has meant that China has now started to compete with other traditional Asian suppliers in the European market. Total imports from South Korea, Taiwan and India by the EU27 in January to November 2022 were up by 9% compared to the same period in 2021. The strong increase in imports to Europe has pushed many suppliers into other regions; the US saw a 25% jump in import volumes during January to November last year.

It is possible that improved demand in China will put a stop to the influx of imported material. However, market participants doubt that Chinese import volumes will completely disappear from Europe this year, therefore keeping competition intense in the Western markets. It is too early to say if there will be a recovery in China. In theory, it should be a good one; citizens were subjected to lengthy lockdowns for more than six months last year and it is thought that they hoarded money in case it would be needed during periods of ill health.

A question of consumer confidence

Economists believe consumers will be keen to spend their savings once they feel confident of their personal circumstances. It is possible that some will feel this year will be a good time to purchase a new car, replace a washing machine or a TV, or other goods they could not afford during times of uncertainty. This would certainly give a struggling global coatings sector a shot in the arm and help to improve epoxy resins consumption. China has promised to increase production of renewable energy; the wind blade sector consumes a lot of epoxy resins, so this would also be a boon for the sector. However, there is one blot on the landscape.

Construction has been a driving engine in the world economy and a huge consumer in the epoxy resins sector for the last 10-15 years. But this sector has been in poor shape. However, measures were announced in November 2022 to give the industry a boost this year. State-owned commercial banks have been instructed to ramp up lending to the real estate sector, which will enable the stronger realtor developers to acquire finished housing projects. In early February, Wuhan, announced plans to ease housing purchases restrictions and allow households to buy an additional home in the city, a move expected to be rolled out in other cities too.

At the same time, all markets will be watching the Two Sessions - China’s annual parliamentary meetings, due to take place in Beijing in early March - with interest. The meetings include two main political bodies of China - the National People's Congress (NPC) and the National Committee of the Chinese People's Political Consultative Conference (CPPCC) and it is expected that they will reveal plans for China's policies involving the economy, military, trade, diplomacy and the environment.

It is too early to say what impact this will have on the epoxy resins market in China. But it is expected to remain volatile, with the effects expected to ripple into Asia, Europe and finally ending up in the US.

New epoxy resins capacity was brought online last year, but will there be enough domestic demand to consume the additional volumes? Also, several Chinese polycarbonate producers brought on new captive bisphenol A capacities late last year, which saw several of them step out of the bisphenol A purchase market.

An oversupply of bisphenol A means that epoxy resins producers in China could have access to cheaper feedstocks, which is bad news for the Western manufacturers. At the same time, epichlorohydrin values are thought to have hit bottom levels in January, but this market is subject to glycerine and propylene market trends, neither of which have been particularly steady in the last 12 months, while chlorine remains in gross oversupply.

'Unstable demand amid volatile feedstocks markets

will keep the epoxy resins market in China & Asia erratic.'

Jennifer Hawkins

New weekly reports

Tecnon OrbiChem has launched a weekly reporting service of covering epoxy resins, bisphenol A and epichlorohydrin for China and Asia, because it believes the Chinese epoxy market will continue to exert its influence on the rest of the world for the foreseeable future regardless if demand picks up or not. We also believe that unstable demand amid volatile feedstocks markets will keep the epoxy resins market in China and Asia erratic.

The new service will be made available for viewing on the OrbiChem360 platform every Thursday. The weekly report will give a brief summary of the Chinese epoxy resins, bisphenol A and epichlorohydrin markets together with pricing for all three products for both China and Northeast Asia.

The new service will also include three graphs; one will chart 12-month price history for all three materials while the other two will include production margins for Northeast Asia and China.

Why is China is key to European/US markets?

Why is China is key to European/US markets?