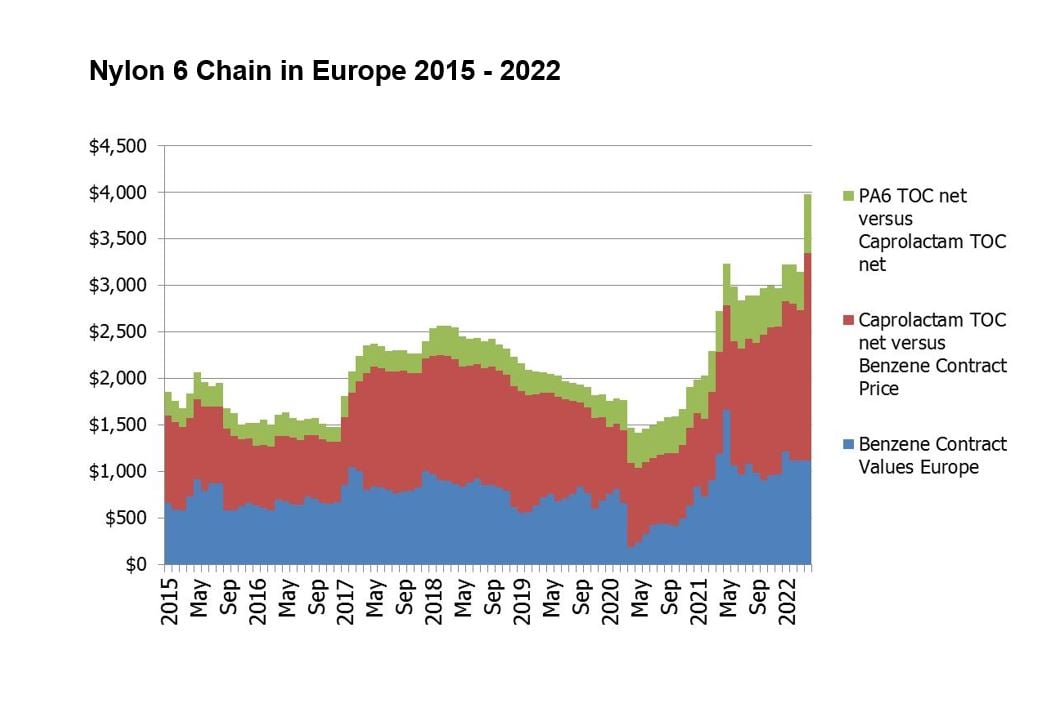

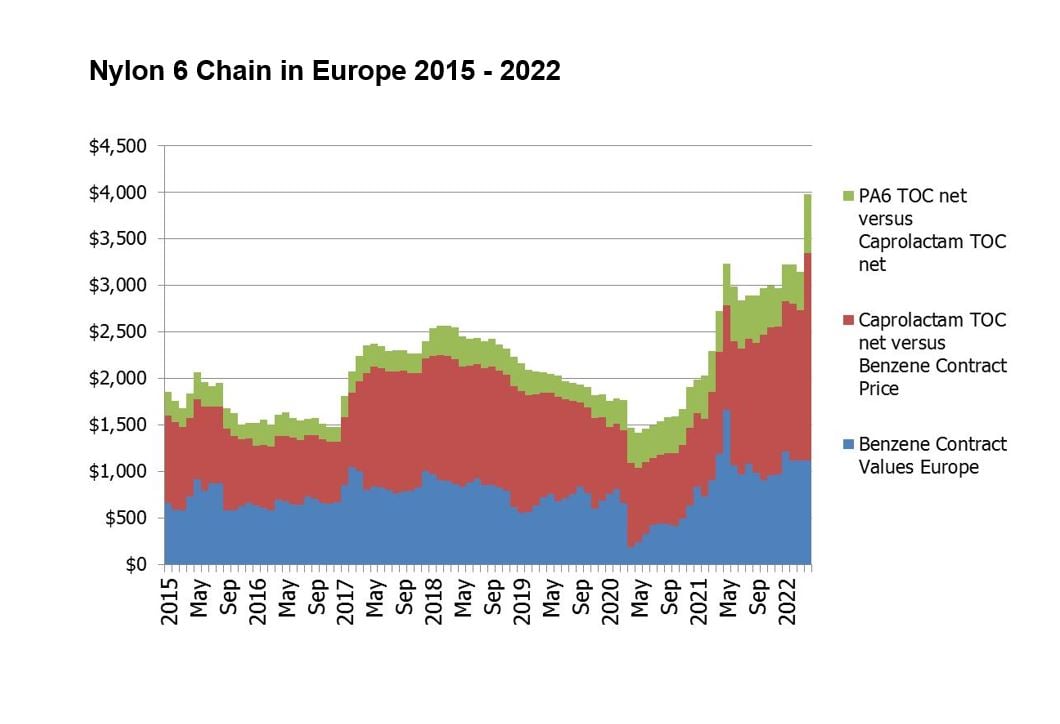

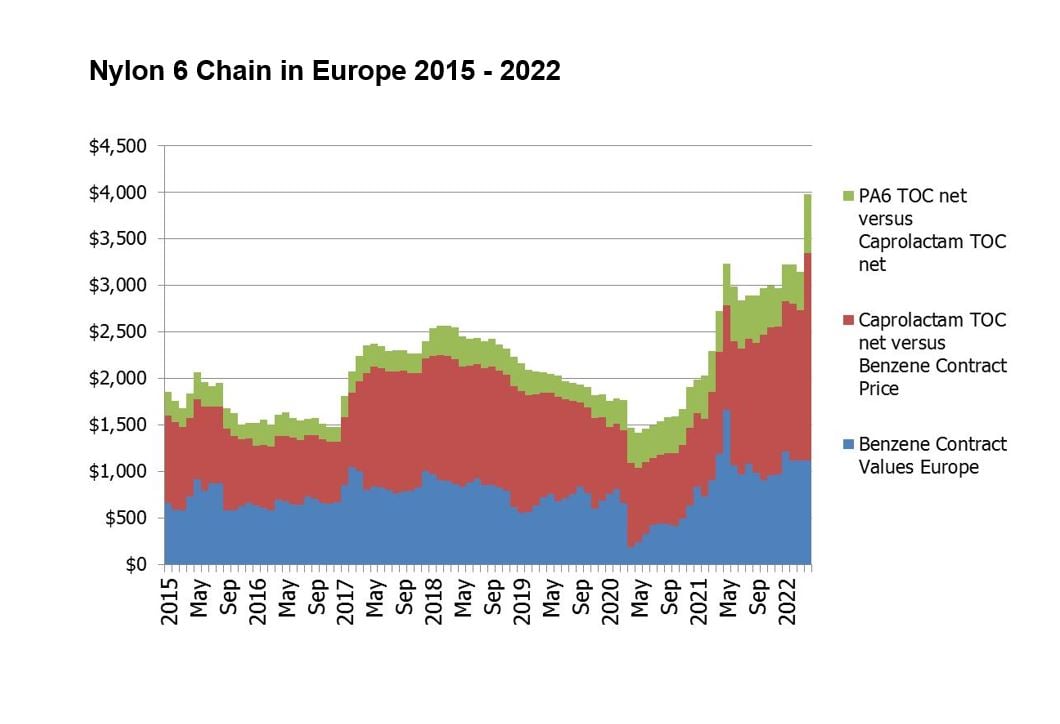

Extreme volatility and instability has impacted all petrochemicals, and nylon (polyamide) chain products are no exception. The nylon 6 chain was used to the volatility of benzene, but the rising cost of other raw materials needed to produce caprolactam - and the cost of energy - have disrupted negotiations schemes since Q4 2021.

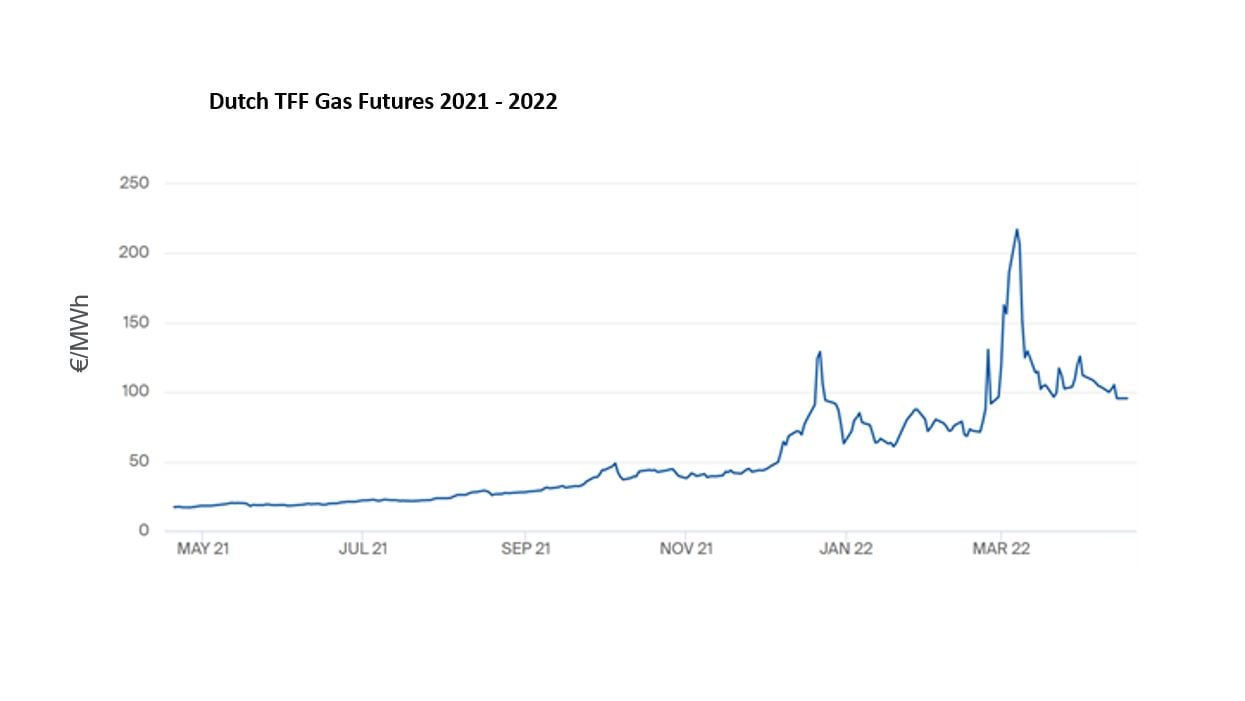

The impact of Russia's invasion of Ukraine on energy prices created chaos in the nylon 6 chain in March, with the final effect on prices to be seen in April. The increase in energy values in Europe brought an unprecedented scenario, including high uncertainty and limited visibility.

The impact on the cost structure of caprolactam producers has changed the pricing mechanism, the commercial-purchasing strategies and operating rates of companies throughout the nylon chain. Negotiations that did not include energy-clauses for 2022, have been or will be renegotiated to implement energy clauses, surcharges or price increases to cope with the high cost.

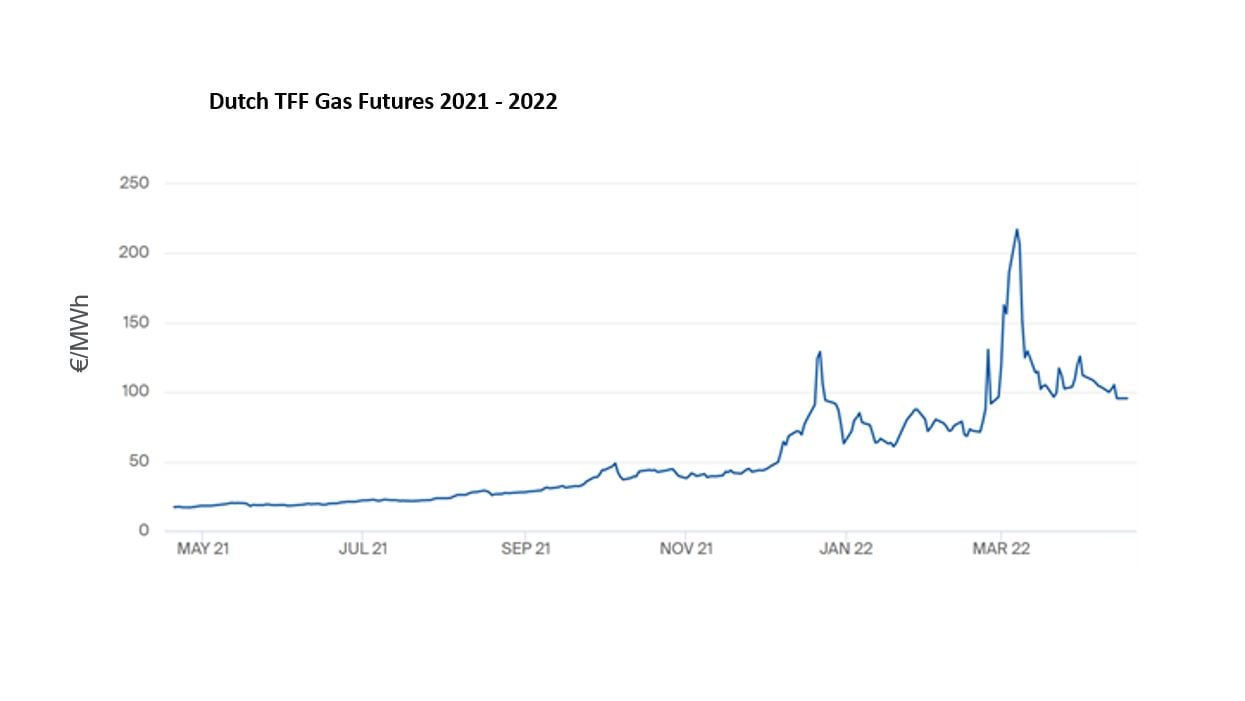

Caprolactam production is energy intensive with a variation of one euro per MWh impacting between 8-10 times the cost structure of producers. TTF Dutch futures can be taken as a representative reference of energy prices for the petrochemical industry in Europe. The chart shows the evolution of the MWh prices in recent years. The upward trend of TTF values in Q4 2021 accelerated since mid-February.

Source: Dutch TTF Gas Futures

The trend during the first half of March forced producers of caprolactam and polymer to announce price increases of between €1000-1300/ton for deliveries in April, representing increases above 35% on the current price.

The pressure was therefore transferred to downstream industries, which have more difficulties to pass it through the higher cost. Although the final number has been adjusted following the decline in TTF values during the second half of March, the high energy cost and volatility are expected to remain, impacting demand for nylon 6 products.

Short-medium-long term impact on demand

Rising cost has led to historically high prices for nylon 6 product, which together with current uncertainty has reduced requirements for short-term deliveries and questioning medium-term demand for some applications.

All producers (mainly caprolactam and polyamide 6 producers) have adjusted operating rates in line with confirmed orders accepting increases to cover the additional cost, and avoiding creating inventories. Market participants were expecting a decline of between 20-30% of polymer demand could be seen in April.

The end demand for nylon 6 products remain strong with only the automotive industry clearly below average and expectations. The lack of semiconductors has been amplified as some microchip producers rely on a supply of neon gas, palladium and others from Russia and Ukraine. Many car producers have paused production in factories across Europe as a result of parts shortages such as electrical cables, wiring components and others resulting from Russia’s invasion of Ukraine.

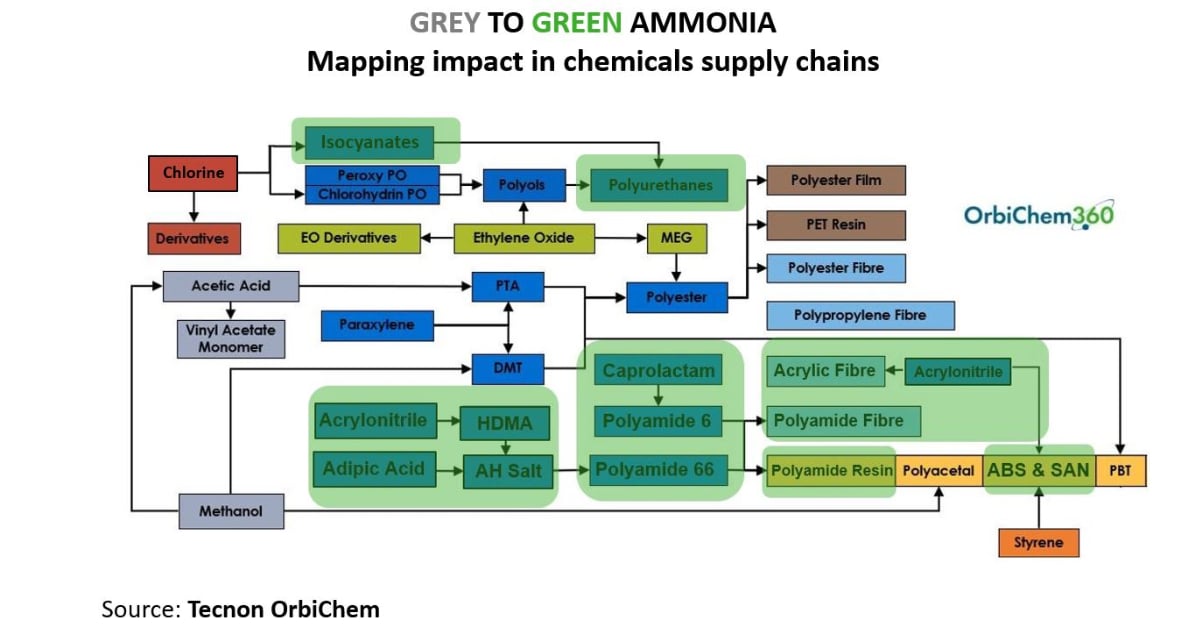

Source: Tecnon OrbiChem

Chain reaction

This is happening at the same time that high energy prices threaten the already weak growth of the European economy, impeding or questioning the medium-term future demand for products in the chains.

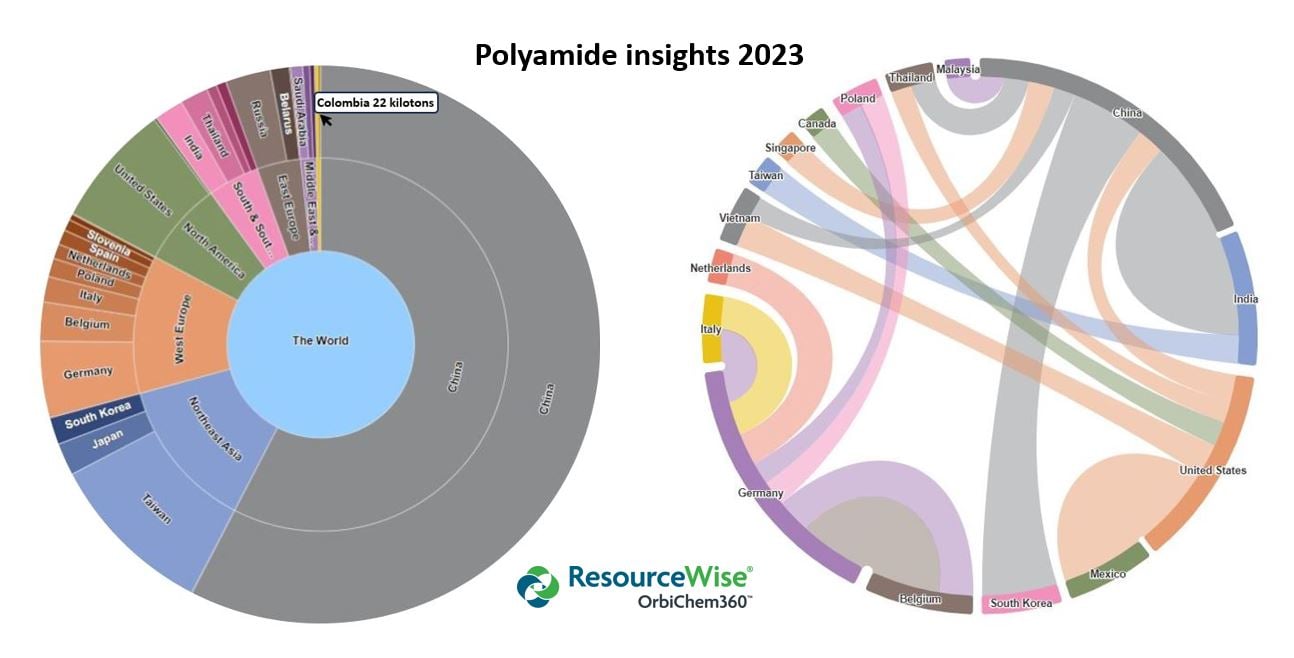

Europe has been additionally and particularly affected by increasing natural gas prices – the main source of energy for the industry – compared to cheaper energy values in North America and more diversified and cheaper energy sources in Asia (coal and fuel oil).

High prices in Europe have encouraged exports from other regions, which could impact the market share of European producers in the coming months.