- Expertise

- Solutions

- CHEMICAL PORTFOLIO

- Acetic Acid • Vinyl Acetate

- Acrylic Acid & Acrylate Esters

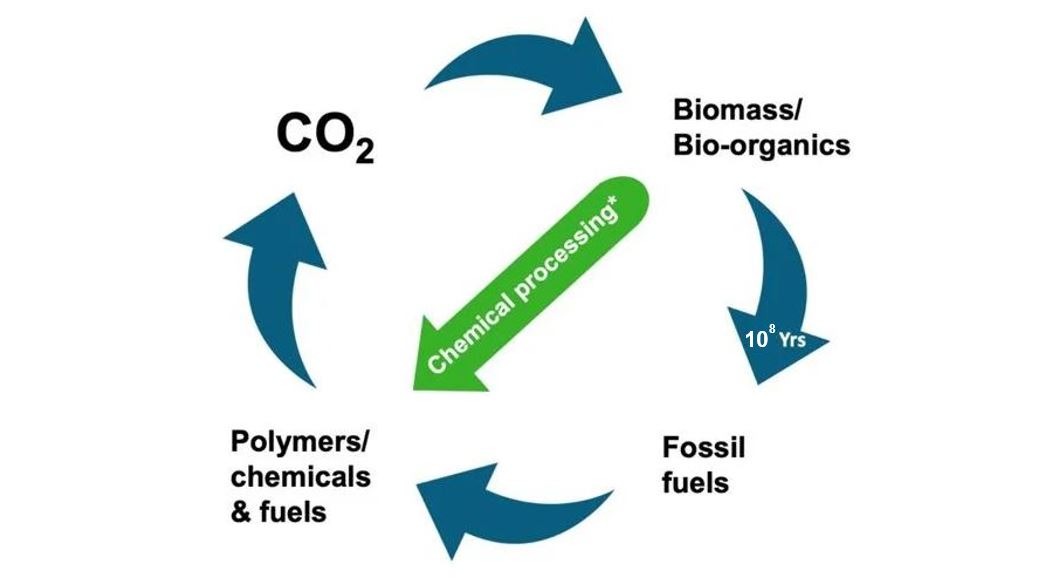

- Bio-Materials & Intermediates

- Chlor-Alkali & Derivatives

- Engineering Thermoplastics

- Epoxy Resins & Co-Reactants

- Ethylene Glycols • EO & EODS

- Fibres & Intermediates

- Maleic Anhydride • 1,4-Butanediol & Derivatives

- Orthoxylene • Phthalic Anhydride

- Phenol • Acetone & Derivatives

- Plasticisers • Oxo Alcohols

- Polyamide & Intermediates

- Polyester & Intermediates

- Polyurethanes & Intermediates

- Unsaturated Polyester Resin

- Aromatics

- Olefins

- Polyolefins

- RESOURCES

- COMPANY

- Contact

INDUSTRIES

OrbiChem360

OrbiChem360 provides comprehensive chemical business intelligence to assist business managers in their strategic planning and business performance optimisation.

MARKET DATA, INSIGHTS & INTELLIGENCE

CONSULTING SERVICES

Specialist and Strategic Advisory Services

OrbiChem360

OrbiChem360 provides comprehensive chemical business intelligence to assist business managers in their strategic planning and business performance optimisation.

Main Menu

- MAIN MENU

- Expertise

- Service & Solutions

- Chemical Portfolio

- Acetic Acid • Vinyl Acetate

- Acrylic Acid & Acrylate Esters

- Bio-Materials & Intermediates

- Chlor Alkali & Derivatives

- Engineering Thermoplastics

- Epoxy Resins & Co-Reactants

- Ethylene Glycols • EO & EODS

- Fibres & Intermediates

- Maleic Anhydride • 1,4-Butanediol & Derivatives

- Orthoxylene • Phthalic Anhydride

- Phenol • Acetone & Derivatives

- Plasticisers • Oxo Alcohols

- Polyamide & Intermediates

- Polyester & Intermediates

- Polyurethanes & Intermediates

- Unsaturated Polyester Resin

- Aromatics

- Olefins

- Polyolefins

- Resources

- Company

- Events

- LOGIN

- CONTACT