Unsaturated polyester resins market participants will be crossing their fingers for a repeat of H1 2022 this year. It was one sector that remained largely immune to the catastrophic effects of the Russia-Ukraine war.

US unsaturated polyester resin producers started 2022 well. Demand levels were at crazy high levels, with producers inundated with orders and even forced to turn away potential customers. All end use sectors were performing very well, especially construction, infrastructure and marine.

Entirely unaffected by the outbreak of war in Ukraine, this sustained high demand showed no sign of slowdown throughout Q1 and Q2 of 2022.

The primary problem that unsaturated polyester resin (UPR) producers faced in H1 2022 logistics. A shortage of qualified truck drivers throughout the region, combined with rail disruptions, proved to be a major bottleneck throughout the supply chain.

Raw material prices were on a steady increase throughout the year, as high demand and logistical constraints lead to a very tight market. Maleic anhydride prices saw a 6% increase from January to June 2022. See our January blog post Maleic anhydride markets: Where are they headed in 2023?. And styrene saw a near 10% increase in that timeframe.

UPR average contract prices increased 20% in H1 2022

& Q3 2022 was also strong

Tecnon OrbiChem consultant Sam Uctas

As a result, UPR average contract prices saw a 20% increase from January to June 2022. Q3 2022 was also strong for UPR producers with demand still outstripping supply and prices continuing to rise.

Q4 2022 started to show some changes to market fundamentals. Economic uncertainties started to affect consumer activity, resulting in UP resin demand falling progressively. December was a poor month for all UPR producers, with the market shifting from a sellers' to a buyers' market. End use sectors such as automobile and construction have taken a big hit, with demand down on 2021.

Outlooks for 2023 are somewhat muted, with most producers expecting Q1 volumes to be considerably down compared to Q1 2022. UP resin prices are expected to decrease steadily throughout the first half of the year, as demand remains weak.

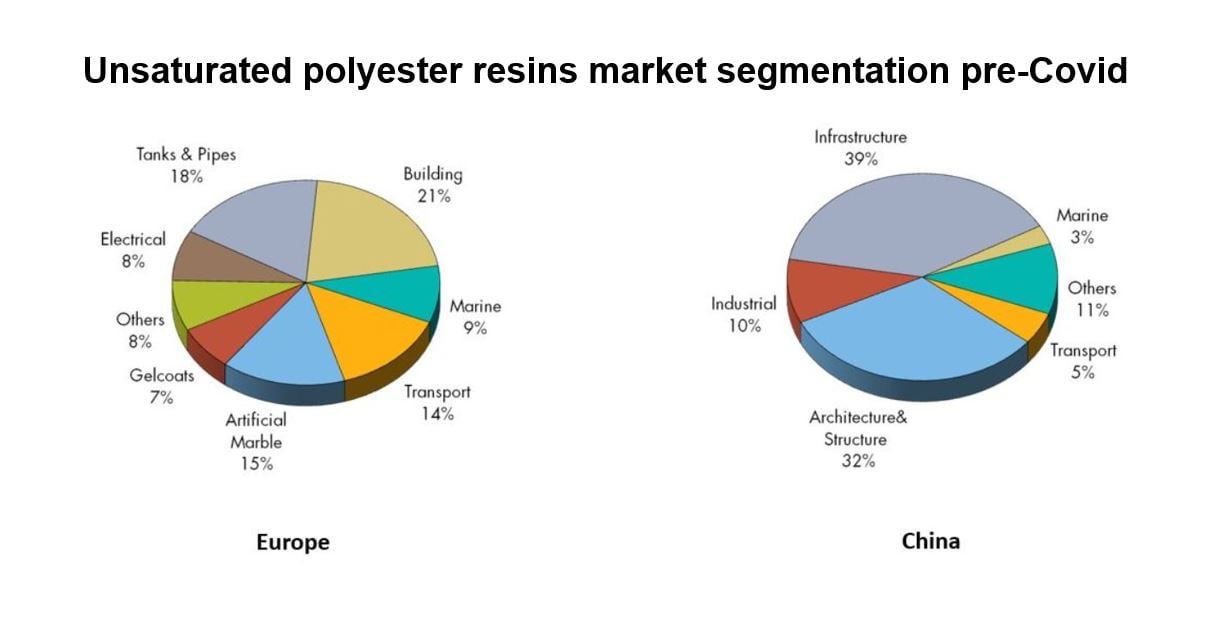

Europe

Similar to the US, European UPR producers had a very strong start to 2022. Volumes were healthy in all sectors, and demand far outweighed supply. UPR margins were high, and most producers expected 2022 to follow the same trends as 2021, which saw a whole year of sustained high demand.

However, in March, after the outbreak of war in Ukraine, the market started to experience some turmoil. Skyrocketing oil and gas prices cut into UP resin margins, as did increasing raw material costs. Styrene contract prices jumped a substantial €584 (33%) between March and June. UPR prices increased by 11% in this timeframe.

Increasing costs, as well as the resulting economic uncertainty caused by the war, lead to a noticeable decrease in volumes at the beginning of Q3 2022. Whilst the cost of production remained at record highs, softening demand and cheap UP resins coming from Turkey, forced producers to cut into margins further.

This trend of cutting into margins, continued in to Q4 2022. This can be illustrated by looking at styrene contract price movements between September and December 2022. They softened by 5% over that period, whilst UPR prices softened by 7%. It is important to note that plant running costs also increased dramatically over this period, as energy prices saw up to a five-fold increase, further increasing the production costs.

Volumes in Q4 continued to show significant softening in all downstream sectors. Total December volumes were down around 30-35% year on year, and January 2023 volumes saw little recovery.

Outlook

Market sentiment for Q1 2023 is pessimistic, with recovery unlikely to begin until the latter stages of Q2. Prices are expected to continue to soften, as supply outweighs demand.

Outlooks for 2023 in he US are somewhat muted, with most producers expecting Q1 volumes to be considerably down compared to Q1 2022. The infrastructure sector is expected to remain strong throughout the whole year, showing continued growth. However construction is expected to remain slow well in to Q2 2023 - though it will likely show some increase in demand. H1 2023 will be more challenging for UPR resin producers, with a more competitive environment as overall demand remains slow. Market sentiments for H2 2023 are more optimistic, as the US economy is expected to strengthen amid increases in overall market activity.

Europe

Market sentiment for Q1 2023 is pessimistic, with recovery unlikely to begin until the latter stages of Q2. The recovery of the Chinese market, which is anticipated to show signs of improvement in late February- early March 2023, is likely to result in a greater amount of cheap raw materials entering the market. This will help European producers to rebuild margins, or to make prices more competitive with Turkish UP resins. The second half of 2023 is likely to show continued growth in most downstream sectors, as the rate of inflation across Europe drops, and economic prospects remain positive.

Unsaturated polyester resins production draws from a number of petrochemical supply chains.

Among them are maleic anhydride, monoethylene glycol, triethylene glycol (TEG), diethylene glycol (DEG) and phthalic anhydride - all of which are monitored globally by Tecnon OrbiChem's global team of consultants. For more insight into the market for UPR feedstock phthalic anhydride, read our January 2023 blog post Orthoxylene-phthalic anhydride: Outlook for 2023, 2022 review.