Textile markets weakened substantially in 2022 as retail sales dropped due to tightening consumer budgets. In this landscape, new construction projects were few and far between.

While there was uptick in the automotive sector during the year, it was far too slow to offset the year’s overall trajectory. These negative factors compounded acrylic and polypropylene fibres’ downward price trend.

The western hemisphere saw polyamide and polyester fibre prices gradually firm as the year progressed. However, this outcome was driven by rising feedstock and energy costs more than demand. In fact, in common with the wider economy, orders in these markets were not considerable.

Polyamide fibre

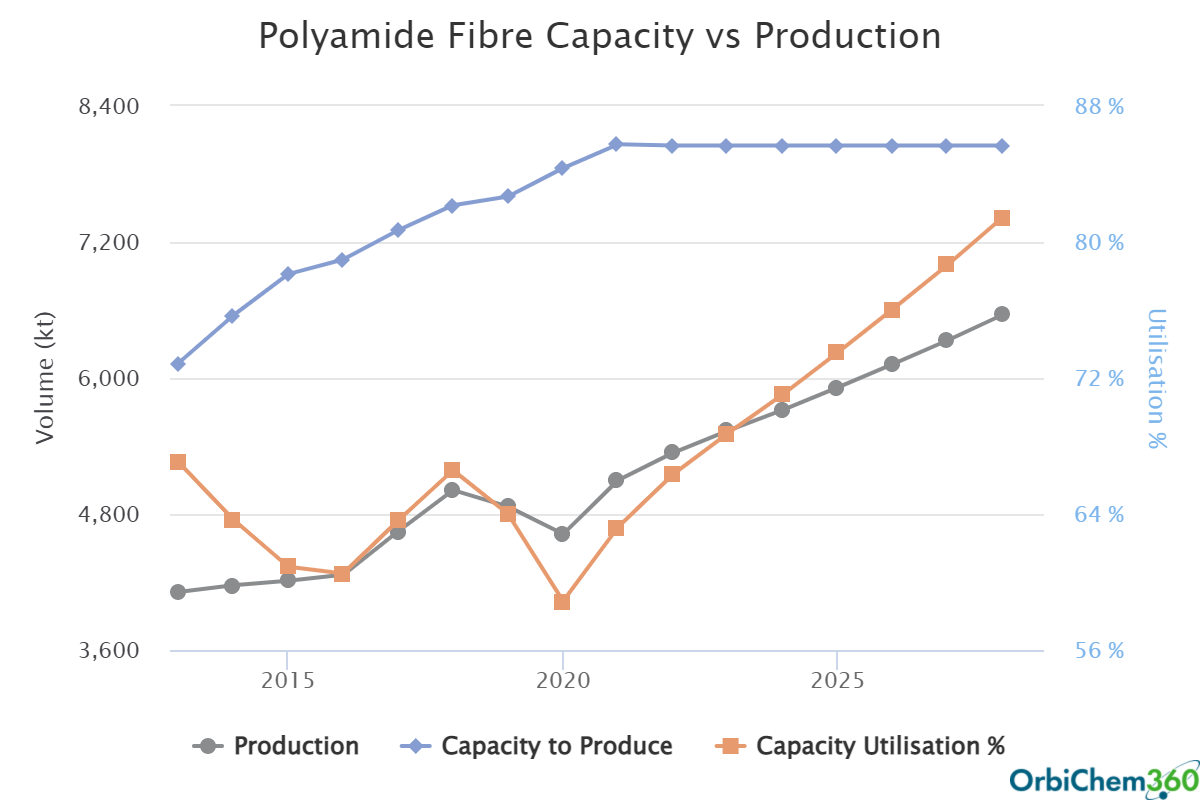

Polyamide fibre markets came under extreme pressure from sluggish demand and surging feedstock costs during 2022. Record-high energy prices impacted production economics for polyamide 6 & 66 fibre in all regions, particularly during Q3.

European producers took the brunt of the energy cost increase and reduced operations in H2. Meanwhile, China’s limited consumer spending and stunted overall economic growth due to zero-covid measures reduced polyamide fibre demand.

The US PA fibre sector was more resilient for most of the year, but higher interest rates dampened consumer sentiment in Q4.

Polyamide fibre prices increased in all regions during Q2/Q3, primarily supported by sharply higher feedstock values. Chinese market prices started slipping lower during Q3 in reaction to weaker demand. And a weak automotive market weighed heavily on polyamide tyrecord materials markets in Asia.

European/US polyamide fibre prices remained elevated in late 2022,

but decreases are expected to take hold in the first half of 2023

Tecnon OrbiChem consultant Jaroslaw Cienkosz

Polyamide fibre prices in Europe and the US remained elevated in late 2022, but decreases are expected to take hold in the first half of 2023 due to poor demand and softer feedstock prices.

There is not much optimism for polyamide fibre markets during Q1 2023 due to lingering economic stresses caused by lockdowns in China. Demand has not improved there to any great extent, and with supply remaining at high levels, there is not much room for prices to increase.

Any potential changes will be associated with raw materials costs, which will not rise substantially for the foreseeable future amid more than sufficient supply. Europe's economy is forecast to slip further into recession during Q1. The picture for the US economy is less bleak than Europe, with limited recovery possible, but growth is expected to slow.

Polyester fibre

Polyester fibres' use in consumer-facing applications apparel, automotive interiors and home textiles renders them vulnerable to consumer economics and the current cost of living crisis. Demand is likely to be weak, at least in the short term.

With potential for European fibre producers to close plants or – in the case of polyester staple producer Advansa Manufacturing, filing for insolvency – and the region’s sole dimethyl terephthalate DMT producer Oxxynova shutting down its German plant in December 2022, regional polyester fibre cost pressures will likely increase.

This, in turn, will intensify European producers’ lack of competitiveness with other regions, particularly Asia.

Cienkosz explains Europe losing a local framework for polyester fibre industry, with all the consequences that entails. 'This is why associations in the sector keep warning the public, authorities and market participants.

'There may be many instances of this kind of SME quitting in the entire value chain, also further in the textile sector itself. I would say the insolvency was an example, and I would not specifically point at European fibre producers closing since we have limited evidence of spectacular shutdowns. It all appears to be more complex,' adds Cienkosz.

India is attempting to actively size up its textile industry starting several initiatives and programs to draw in investment. link

The Chinese market was sluggish in 2022 but now that the Spring Festival is behind us, perhaps an anticipated growth in consumer spending will materialise. The end of the government’s zero-covid policy suggests there will be an improvement in business throughout 2023.

Blendstock disruption

Finally, the European and North American upstream markets, paraxylene (PX), PTA and DMT, historically were benchmarked against Asian prices, but due to disruptions in gasoline markets in the latter half of last year, producers had to compete against gasoline blenders to secure mixed xylenes, so Asia lost its relevance as the benchmark and prices soared.

A higher import parity with Asia due to more expensive logistics also contributed. Much of it disappeared in Q4 2022. So, if the crude oil and gasoline markets normalise, these trends should follow suit for stability and balanced competitiveness between regions to return.

The decline in PX could impact prices because it will continue in Q1-Q2 2023. A lowered freight cost (which makes imports more competitive) and muted demand are expected globally. Go to PET & its raw materials: outlook 2023, 2022 review for a more in-depth analysis of PX and PTA markets from Tecnon OrbiChem consultant Javier Rivera. The blog post from Rivera also includes a free-to-download eBook.

Polypropylene fibre

US polypropylene prices will likely remain low as the market is not expected to recover significantly in Q1 of 2023. Producers are expected to keep run rates down to help balance the need and in Europe, demand will probably remain weak.

2023 global growth prediction is 2.9% this year, before rebounding to 3.1% in 2024

International Monetary Fund

From the raw material perspective, the fibre marginality looks promising. Unfortunately, demand-wise, economic recovery remains largely outside eyeshot. The latest growth rate prediction from the International Monetary Fund (IMF) is 2.9% this year, before rebounding to 3.1% in 2024. The institution's forecast rose slightly from its October 2022 estimate of 2.7% 2023 growth rate, as the IMF now sees far fewer countries facing recession this year. It is still however, significantly down on the 6% seen in 2021.

Geopolitical tensions, inflation remaining high for longer than expected, and the energy crisis are weighing heavily on the world economy. Chips shortage will continue to affect the automotive industry to some extent. Outsized fibre demand in the recent two years for home improvement projects was inspired by working from home and spending much more time at home. Sentiment in the property sector began deteriorating a while ago, and increasing interest rates will not stimulate home textile demand. Finally, lower disposable income will cut back on fashion and apparel sales. Crisis-proof hygiene applications will continue to tend upward but at a weaker than normal pace. Textile recovery will again be postponed for the time being.

Acrylic fibre

Generally stable North American acrylic fibre industry saw demand decrease towards the end of 2022 due to the recession. In Europe, the acrylic fibre market has remained relatively stable for several months. Volumes and quotations are expected to stay steady in the near term, with a potential rebound as buyers may look to restock inventories. Acrylic fibre prices in Asia registered gradual reductions throughout 2022, losing what they re-gained in post-Covid recovery.

Growing inventories forced Far Eastern acrylic fibre producers to welcome 2023 with much reduced operating rates. Meanwhile, in China, the acrylic fibre sector remains lukewarm.

Acrylonitrile raw material supply is expected to be good or ample in all regions.

A blog post and white paper by Cienkosz in collaboration with our China-based consultant Jane Zhu published earlier this year explores the acrylates landscape in greater detail. Follow the link to read Global acrylates market outlook 2023, and 2022 rewiew.

However, economic woes will keep limiting demand in 2023.