'Many innovations are targeting next-gen leather applications,

leaving silk, wool, down, fur and exotic skins with limited innovation efforts'

Tecnon OrbiChem biomaterials expert Doris de Guzman

Fruit by-product fibres

Italy's Orange Fiber produces fibres and fabrics from fruit by-products. The company constructed a plant in Sicily in 2020, producing its first ton of cellulosic fibre thereafter. Previous brand partners include high street brand H&M and luxury goods sellers. However, in 2021 the firm partnered with Austria's wood-based specialty fibres producer Lenzing Group.

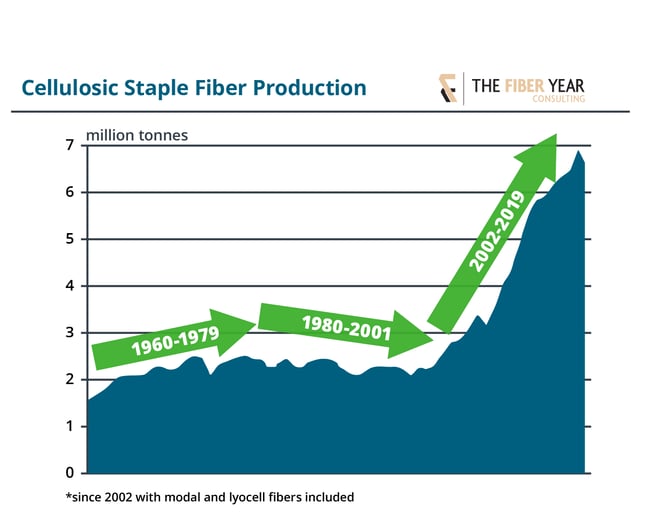

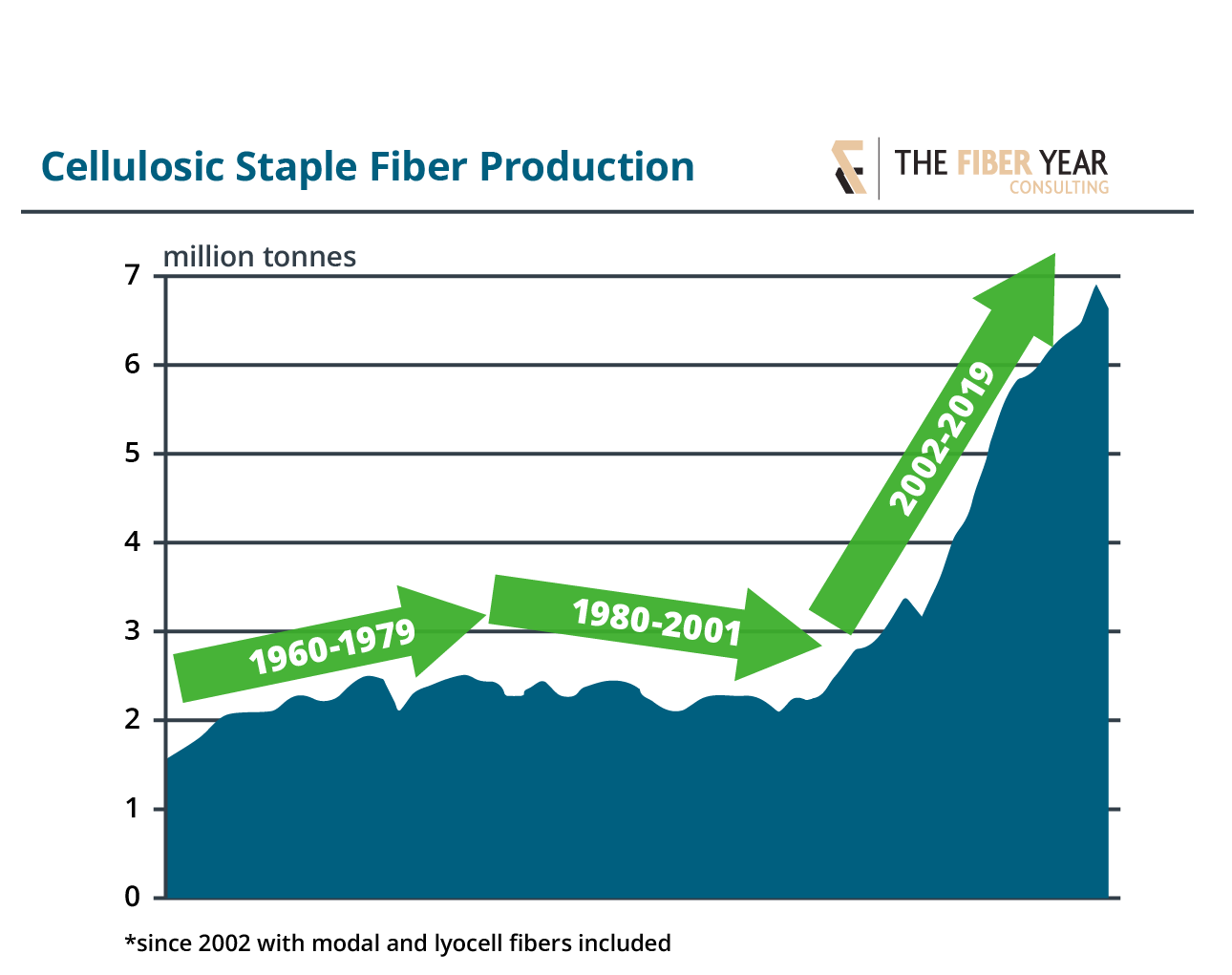

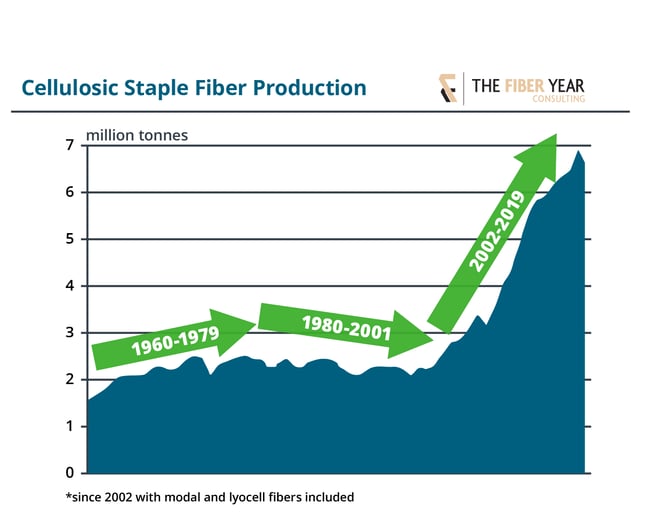

Their shared aim was to realise a lyocell fibre made of orange and wood pulp in a limited edition offering. Lyocell is a semi-synthetic fabric which commonly substitutes cotton or silk. In fact, it is a type of cellulose-based fibre that has grown exponentially in the new millennium.

And in the textile industry overall, cellulose is the fastest growing fibre group. Analysts at German research and consultancy enterprise the nova Institute identify cellulose fibres as the bioeconomy’s largest investment sector.

Our blog post Cellulosics: A world of opportunity explores the cellulose value chain in depth.

Manufacturing ambition

Manufacturing ambition

‘Most next-gen material companies go to market with a minimum viable product while continuing to refine and improve the performance, aesthetic and environmental impact of their material,’ de Guzman adds. This is because ‘the majority are in the early concept stage, conducting research and development, in prototype production or building production facilities’. It is an output level that provides the perfect match for a collaborative capsule collection approach.

Of the 102 companies that MII focused on in its report, more than almost two thirds are targeting next-gen leather. This, de Guzman explains, leaves categories such as silk, wool, down, fur and exotic skins with limited innovation efforts.

Untapped potential

Tecnon OrbiChem’s chemicals data intelligence platform OrbiChem360 puts the current price of North American polyester filament at around $3-4/kg. Raw silk, meanwhile, reportedly averages around $55/kg.

‘These underserved product categories mean a lack of competition in the biomaterials space, which may be attractive to innovators and investors.’

Not only does raw silk’s substantially higher price point makes it an attractive proposition for investment, the potential environmental benefit from its redevelopment as a sustainable, renewable or so-called ‘green’ material is significant. With the MII estimating silk production at around 160ktpa, it is currently responsible for a hefty environmental footprint.

As well as using an exorbitant amount of water – cocoon cooking and silk spinning combined use over 150 litres per kilogram output – up to 20 kg of firewood is said to be burned in its production process. Source

Source: Silk production Quang Nguyen/Pexels

Source: Silk production Quang Nguyen/Pexels

Silk substitutes

A biobased b-silk protein from US-based materials solutions company Bolt Threads is processed using sugar, water and yeast. This mid-sized enterprise was founded in 2009 and is targeting a myriad of applications in beauty, textiles and biomedicine with the innovation.

It has partnered biotechnology research company Ginkgo Bioworks – based in Boston, US and founded in the same year – which specialises in novel functional protein synthesis. The latter's protein strain engineering expertise is being leveraged to improve sustainability, efficiency and cost-effectiveness throughout b-silk's manufacturing process.

Bolt Threads' cellulose blended yarn fibre – designated Microsilk – featured in a collaborative concept offering from British designer Stella McCartney and sports brand adidas. The biofabric replicates spider silk fibres sustainably at a large scale through bioengineering and, like real spider silk, biodegrades at the end of its life, according to Bolt Threads.

In a separate innovation, synthetic spider silk from Japan-based Spiber was used by outdoor apparel brand the North Face. Spiber's brewed protein platform – which ferments plant-based ingredients – is suitable for manufacturing fibres, films and other types of materials.

Microbial cell factories

Microbial cell factories are engineered microorganisms that manifest biosynthetic pathways streamlined to produce chemicals from renewable carbon sources. While bacteria are indeed microbes, it does not follow that all microbes are bacteria. However, a process patented by German biotech company AMSilk to deliver a spider silk biopolymer from genetically-engineered microbes is underpinned by bacterial specimens. The proteins it yields can be processed into gel or powder for consumer goods or spun into textile fibres. The material is said to be 15% lighter than conventional synthetic fibres, and fully biodegradable.

Early in 2023, the firm partnered with Evonik to scale up production at the German specialty chemicals company's contract development and manufacturing precision fermentation site in Slovakia.

Leather-like materials mushroom

Another Bolt Threads innovation – designated Mylo – is a vegan material made from mycelium, the root-like system of a mushroom. Platformed within Italian fashion accessories manufacturer Vivolo's green alternative materials, it is used by a diverse range of brands from high end Chanel and Armani to high street fashion outlet Zara.

Having engineered a process to grow mycelium stacked in vertical farming facilities, the cells' diet of sawdust and other organic materials facilitate its delivery of a supple-like leather alternative material. The first Mylo material products became available in 2022 through its consortium with adidas, Kering, lululemon and Stella McCartney.

An eBook Tecnon OrbiChem published in 2022 explores the economic potential in sustainable chemicals production. Read the blog post Bioeconomy poised at a historic crossroads and download the eBook.

Doris de Guzman's special report Luxury brands & next-gen biomaterials is available to subscribers via our OrbiChem360 platform.

Manufacturing ambition

Manufacturing ambition